Doc876 robbins tapp cobb & assoc accountants_work done_final comp

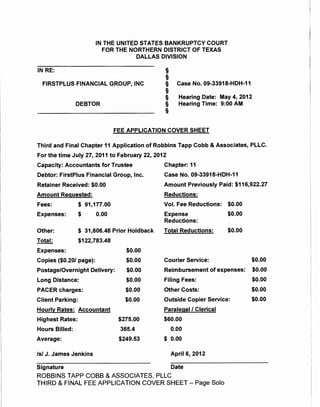

- 1. IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION IN RE: § § FIRSTPLUS FINANCIAL GROUP, INC § Case No. 09-33918-HDH-11 § § Hearing Date: May 4, 2012 DEBTOR § Hearing Time: 9:00 AM § FEE APPLICATION COVER SHEET Third and Final Chapter 11 Application of Robbins Tapp Cobb & Associates, PLLC. For the time July 27, 2011 to February 22, 2012 Capacity: Accountants for Trustee Chapter: 11 Debtor: FirstPius Financial Group, Inc. Case No. 09-33918-HDH-11 Retainer Received: $0.00 Amount Previously Paid: $116,922.27 Amount Requested: Reductions: Fees: $ 91,177.00 Vol. Fee Reductions: $0.00 Expenses: $ 0.00 Expense $0.00 Reductions: Other: $ 31,606.48 Prior Holdback Total Reductions: $0.00 Total: $122,783.48 Expenses: $0.00 Copies ($0.20/ page): $0.00 Courier Service: $0.00 Postage/Overnight Delivery: $0.00 Reimbursement of expenses: $0.00 Long Distance: $0.00 Filing Fees: $0.00 PACER charges: $0.00 Other Costs: $0.00 Client Parking: $0.00 Outside Copier Service: $0.00 Hourly Rates: Accountant Paralegal/ Clerical Highest Rates: $275.00 $60.00 Hours Billed: 365.4 0.00 Average: $249.53 $ 0.00 Is/ J. James Jenkins April 6, 2012 Signature Date ROBBINS TAPP COBB & ASSOCIATES, PLLC THIRD & FINAL FEE APPLICATION COVER SHEET- Page Solo

- 2. J.JamesJen~ns,CPA Robbins Tapp Cobb & Associates, PLLC 600 N. Pearl, L.B. 146 Dallas, Texas 75201 (214) 979-2323 (214) 979-2423 Fax ACCOUNTANTFORTHETRUSTEE IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION IN RE: § § FIRSTPLUS FINANCIAL GROUP, INC. § Case No. 09-33918-HDH-11 § DEBTOR § § § Hearing Date: May 4, 2012 § Hearing Time: 9:00 AM THIRD AND FINAL CHAPTER 11 APPLICATION OF ROBBINS TAPP COBB & ASSOCIATES, PLLC, FOR ALLOWANCE OF ACCOUNTING FEES AND REIMBURSEMENT OF EXPENSES TO: ALL CREDITORS AND OTHER PARTIES IN INTEREST: NO HEARING WILL BE CONDUCTED HEREON UNLESS A WRITTEN RESPONSE IS FILED WITH THE CLERK OF THE UNITED STATES BANKRUPTCY COURT AT 1100 COMMERCE STREET, ROOM 1254, DALLAS, TX 75242-1496 BEFORE THE CLOSE OF BUSINESS ON APRIL 30,2012 WHICH IS TWENTY (24) DAYS OR MORE FROM THE DATE OF SERVICE HEREOF. ANY RESPONSE MUST BE IN WRITING AND FILED WITH THE CLERK, AND A COPY MUST BE SERVED UPON THE APPLICANT PRIOR TO THE DATE AND TIME SET FORTH ABOVE. IF A RESPONSE IS FILED A HEARING WILL BE HELD WITH NOTICE ONLY TO THE OBJECTING PARTY. IF NO HEARING ON SUCH NOTICE OR APPLICATION IS TIMELY REQUESTED, THE RELIEF REQUESTED SHALL BE DEEMED TO BE UNOPPOSED, AND THE COURT MAY ENTER AN ORDER GRANTING THE RELIEF SOUGHT OR THE NOTICED ACTION MAY BE TAKEN. THIRD AND FINAL APPLICATION OF ROBBINS TAPP COBB & ASSOC. FOR ALLOWANCE OF ACCOUNTING FEES AND EXPENSES Page 1

- 3. TO THE HONORABLE HARLIN D. HALE UNITED STATES BANKRUPTCY JUDGE: COMES NOW ROBBINS TAPP COBB & ASSOCIATES, PLLC ("Applicant"), Accountants for the Trustee and makes this Third and Final Chapter 11 Application for Allowance of Fees and Reimbursement of Expenses and represents to the Court as follows: 1. On June 23, 2009, a voluntary petition was filed by the Debtor seeking relief under Chapter 11 of Title 11 of the United States Code (the "Bankruptcy Code"). 2. On July 24, 2009, Matthew D Orwig was appointed as Chapter 11 Trustee, accepted his appointment and continues to serve. 3. Applicant was employed by Order Authorizing The Retention Of Robbins Tapp Cobb & Associates, PLLC As Accountant To Chapter 11 Trustee Nunc Pro Tunc to August 17, 2009 entered on November 12, 2009 .. 4 Applicant has been employed by the Trustee in connection with this bankruptcy case. All services covered by the Application were performed on behalf of the Trustees and not on behalf of any other person or entity. 5. Applicant filed its First Interim Application on November 23, 2010 requesting accounting fees in the amount of $110,514.25 and expenses of $0.00. Hearing was held on December 17, 2010 and on or about December 21, 2010, an Order approving fees of $110,514.25, less a 20% Holdback of $22,102.85, was entered by the Court. Applicant received $88,411.40 in compensation. 6. Applicant filed its Second Application on September 2, 2011 requesting accounting fees in the amount of $38,014.50 for the period November 1, 2010 through July 25, 2011, less a 25% Holdback of $9,503.63. Hearing was held on September 27, 2011 and on or about September 29, 2011, an Order approving fees of $28,510.87 was entered by the Court. Applicant received $28,510.87 in compensation and has received $116,922.27 in total compensation, to date. THIRD AND FINAL APPLICATION OF ROBBINS TAPP COBB & ASSOC. FOR ALLOWANCE OF ACCOUNTING FEES AND EXPENSES Page 2

- 4. 7. The services rendered in this "Application Period", from July 27, 2011 to February 22, 2012, totaling $91,117.00, listed by date services rendered, description of the services rendered, the professional providing the service and the amount of time spent by each professional in providing the service is attached as Exhibit A. 8. Applicant has neither shared or agreed to share its compensation for services rendered in connection with this case with any other person. 9. In connection with its employment by the Trustee in this case, Applicant has incurred out-of-pocket expenses in the amount of $0.00. 10. Section 330 of the Code authorizes the Court to award a professional, retained by a Trustee, reasonable compensation for services and reimbursement of expenses. Section 330 sets forth a number of parameters for use by Courts in determining whether to allow compensation. See also Johnson v. Georgia Highway Express. Inc .. 488 F. 2d 714 (5th Cir. 1974); In re First Colonial Corp. of America, 544 F2d, 1291, 1299 (5th Cir. 1977, cert denied, 431 U.S. 904 ( 1977) established a set of twelve factors for use by lower courts when setting reasonable professional fees. 11. The parameters set forth in Section 330 of the Code are addressed below: a. Time and Labor Required: Exhibit A is a listing of services rendered, listed by date of services rendered, description of the services rendered, the professional providing the service and the amount of time and the amount spent by each professional in providing the service. b. The Novelty and Difficulty of the Questions: The case did not involve novel or difficult questions. c. The Skill Required to Perform the Services Properly: The services THIRD AND FINAL APPLICATION OF ROBBINS TAPP COBB & ASSOC. FOR ALLOWANCE OF ACCOUNTING FEES AND EXPENSES Page 3

- 5. required knowledge of accounting and tax practice, accounting and tax practice in a case under the Bankruptcy Code, the Internal Revenue Code and IRS Regulations. d. The Preclusion of Other Employment by Applicant Due to the Acceptance of the Case: Applicant was not precluded from accepting other employment due to the acceptance of this case. e. The Customary Fee Charged by Applicant: Applicant's hourly charges for services rendered to the Trustee are computed at the same rates as Applicant regularly charges other clients. f. Whether the Fee is Fixed or Contingent: The fee in this case is subject to the Court's approval as necessary and reasonable. g. Time Limitations: No specific time limitations were imposed by this case. h. Results Obtained: Applicant assisted the Trustee and the Trustee's counsel with analysis of pre-petition transactions, property of the Debtor, evaluation and analysis of tax matters, reporting required by the Bankruptcy Code and Rules and by the Office of the U.S. Trustee, administration of the Debtor estate and preparation of the Trustee's amended plan of liquidation, liquidation trust and disclosure statement. Pursuant to Local Rules for the Northern District of Texas, Dallas Division, a breakdown of the projects and services performed in this Application Period and the costs of those services is attached as Exhibit B. i. The Experience, Reputation and Ability of Applicant: Applicant is experienced in all aspects of accounting and tax matters as relating to the issues arising in bankruptcy cases. i. The Desirability of the Case: This case was not in any way "Undesirable". k. The Nature and Length of Applicant's Professional relationship with the THIRD AND FINAL APPLICATION OF ROBBINS TAPP COBB & ASSOC. FOR ALLOWANCE OF ACCOUNTING FEES AND EXPENSES Page4

- 6. Client: Applicant had no prior relationship with the Debtor. I. Awards in Similar Cases : The compensation requested by Applicant is consistent with the compensation awarded in other cases of similar size and complexity. Applicant respectfully requests that they be allowed compensation of $91,177.00 in connection with their employment by the Trustee during the Application Period. This amount consists of $91,177.00 for professional fees and $0.00 for out-of-pocket expenses. The compensation requested in this Application represents the product of a reasonable number of hours for the work done, multiplied by a reasonable hourly rate for work on this case. Applicant respectfully requests that the total compensation requested during the administration of this Chapter 11 in the amount of $239,705.75 be finally allowed and approved as reasonable, necessary and beneficial to the Chapter 11 Debtor and that the Trustee be authorized to pay the $91,177.00 of accounting fees of this Application Period and the prior holdbacks of $31,606.48, a total of $122,783.48, at this time, from the general funds of the Liquidating Trust, as provided in the Amended Plan of Liquidation and Liquidating Trust Agreement. WHEREFORE, Applicant prays that the Court award and authorize the payment to Applicant the total sum of $122,783.48, representing $91,177.00 as accounting fees for the period July 27, 2011 through February 22, 2012, and $0.00 for reimbursement of out-of-pocket expenses during such period, and prior fee hold backs of $31,606.48, as final compensation from the Chapter 11 Debtor Estate. Respectfully submitted, Is/ J. James Jenkins J. James Jenkins, CPA Robbins Tapp Cobb & Associates, PLLC 600 N. Pearl, LB. 146 Dallas, TX. 75201 ACCOUNTANTSFORTHETRUSTEE THIRD AND FINAL APPLICATION OF ROBBINS TAPP COBB & ASSOC. FOR ALLOWANCE OF ACCOUNTING FEES AND EXPENSES Page 5

- 7. CERTIFICATE OF SERVICE This is to certify that a true and correct copy of the Third and Final Application of Robbins Tapp Cobb & Associates, PLLC, has been served on the parties listed below by First Class U.S. Mail or by email transmission of digital media on this 6th day of April2012. Erin Marie Schmidt Matthew D Orwig, Trustee Office of United States Trustee Jones Day 11 00 Commerce Street, Room 976 2727 N Harwood Street, 5th Floor Dallas, Texas 75242 Dallas, Texas 75201 George H Tarpley Basheer Ghorayeb Aaron Michael Kaufman Jones Day Cox Smith Matthews, Inc. 2727 N Harwood Street, 5th Floor 1201 Elm Street, Suite 3300 Dallas, Texas 75201 Dallas, Texas 75270 Peter A Franklin, Ill Doug D Skierski Franklin Skierski Lovall Hayward, LLP 10501 N Central Expwy, Suite 106 Dallas, Texas 75231 Is/ J. James Jenkins J. James Jenkins, CPA THIRD AND FINAL APPLICATION OF ROBBINS TAPP COBB & ASSOC. FOR ALLOWANCE OF ACCOUNTING FEES AND EXPENSES Page 6

- 8. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Emglo~ee Descrigtion Rate at ion Amount Meeting with J Jenkins & A DiFrancesco re handling filing of 07/27/11 KCobb 235.00 0.60 141.00 delinquent tax returns 07/27/11 J Jenkins Assist K Cobb with 201 0 and earlier tax return issues 275.00 0.30 82.50 Review of balance sheets for periods beginning with 2007 and A. 08/08/11 activity in accounts involving payments to other related 225.00 1.90 427.50 DiFrancesco companies. Prep for and telcon with Doug Skierski and meeting with Peter 08/09/11 J Jenkins Franklin re tax elements of plan and definition of trust; followup 275.00 3.50 962.50 research Researching tax issues for plan and trust and disclosure 08/10/11 J Jenkins 275.00 3.00 825.00 statement presentation 08/15/11 J Jenkins Assisting in drafting Plan & Trust Agreement 275.00 6.00 1,650.00 A. Meeting with Jim Jenkins relating to amounts relating to FPFI 08/16/11 225.00 1.40 315.00 DiFrancesco trust payments to FPFG and supporting schedules 08/16/11 J Jenkins Assisted in drafting Plan & Trust Agreement and Disclosure Stmt 275.00 5.50 1,512.50 A. Researching the various cash accounts of FPFG relating to 08/17/11 225.00 2.30 517.50 DiFrancesco transactions involving FPFI Trust. Prepare MOR; Update cash summary for preparation of estimated trustee compensation; telcon with M Orwig, trustee, 08/17/11 J Jenkins and P Franklin re estimated trustee compensation; prepare 275.00 5.50 1,512.50 memo toP Franklin re question on Nevada and Texas franchise tax filings and payments review e-mails from various parties, inculding PLR's and revised 08/18/11 KCobb 235.00 2.00 470.00 Disclosure Statement A. Completed reseaarch of FPFG bank account activity and noted 08/18/11 225.00 2.10 472.50 DiFrancesco several items of further interest. Prep of fee application; upload July MOR; lunch meeting with M Orwig & P Franklin re implementation of liquidating trust and 08/18/11 J Jenkins 275.00 6.00 1,650.00 related issues; Telcons with R Richard and J Santoli re: tax issues and considerations in creating FPFG liquidating trust research on tax issues for plan; cont. call replan of reorg.; 08/19/11 KCobb 235.00 5.50 1,292.50 discuss w/ JJ changes to be made to trust Completed research of bank accounts for FirstPies Enterprises; A. 08/19/11 FirstPius Acquisition and FirstPius Development relating to 225.00 2.50 562.50 DiFrancesco possible transactions involving FPFI Page 1 EXHIBIT A

- 9. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Em~lo~ee Descri~tion Rate ation Amount Reading private letter ruling, field advisory memo and related documents; prepare memo in preparation for conference call 08/19/11 J Jenkins 275.00 6.00 1,650.00 with tustee and case professionals; followup on instructions from conference call review of changes made by JJ to Trust Agreement & Plan of 08/20/11 KCobb 235.00 3.30 775.50 Reorg.; discuss changes w/ JJ Suggested wording changes to Liquidating Trust Agreement and 08/20/11 J Jenkins 1st Amended Plan; discussions with K Cobb re adjusting 275.00 7.50 2,062.50 Quickbooks general ledger records to facilitate tax return prep Suggested wording changes to FPFG Disclosure Stmt to 08/21/11 J Jenkins 275.00 2.00 550.00 conform with changes in Plan and Liquidating Trust Agreement review of changes made by JJ to Disclosure Stmt.; forward to 08/22/11 KCobb Peter & Doug; draft lang. on equity interests continuation in Plan 235.00 5.70 1,339.50 and Trust Agreement Completed research of bank accounts for FirstPius Facility A. 08/22/11 Services; FirstPius Restoration and FirstPius Restoration and 225.00 2.40 540.00 DiFrancesco Facility Services. Complete suggested changes to Disclosure Stmt, transmit to 08/22/11 J Jenkins 275.00 2.50 687.50 and telcon with Kirk Cobb draft lang. on equity interest continuation and Federal tax 08/23/11 KCobb 235.00 3.40 799.00 provisons in Disclosure Stmt. A. Completed research of bank accounts for Rutgers Investment 08/23/11 225.00 2.10 472.50 DiFrancesco and The Premier Group review revised draft of the Liquidating Trust Agreement and 08/25/11 KCobb discuss same w/ JJ; review & research suggested changes 235.00 1.10 258.50 made by Tim Santoli 08/25/11 J Jenkins Telcons w K Cobb re changes suggested by SNR 275.00 0.30 82.50 review new draft of Trust Agreement; respond by e-mail; call to 08/26/11 KCobb Doug S. to discuss various use of PLR on tax aspects of Trust 235.00 1.20 282.00 Agreement review new draft of Plan of Reorg. And e-mails from others as to changes; reply re changes; exchange emails w P Franklin re 08/29/11 KCobb 235.00 2.80 658.00 SEC issues and revising Plan and Trust; telcons with J Jenkins re SEC and equity issues under Plan multiple calls to/from P. Franklin, D. Skierski, & J. Jenkins re 08/30/11 KCobb proposed changes in Plan and Trust Agreement; review multiple 235.00 2.20 517.00 e-mails on same and reply Page 2 EXHIBIT A

- 10. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Dur- $ Date Emj2loyee Description Rate ation Amount Prepare Project Breakdown exhibit for fee application; telcons with K Cobb, P Franklin and D Skierski re questions raised by 08/30/11 J Jenkins 275.00 2.60 715.00 SNR Re shareholder treatment, liquidating trust and relationship to Debtor after confirmation call to Keith Enger to discuss his contact w/IRS spec. 08/31/11 KCobb procedures; draft e-mails toP. Franklin; telcons with J Jenkins re 235.00 0.60 141.00 update on proposed changes to plan and trust A. Began researching back-up for selected receipts possibly 08/31/11 225.00 1.10 247.50 DiFrancesco involving FPFI Trust 09/01/11 K Cobb review revised Disclosure Statement 235.00 0.70 164.50 Continued researching general ledgers for FPFG for years 2002 A. 09/01/11 through 2009 for transactions and support for entries involving 225.00 3.40 765.00 DiFrancesco the FPFI Trust 09/01/11 J Jenkins Complete fee application and notices 275.00 4.00 1,100.00 review comments ofT. Santoli on Dis. St.; research and draft changes; research issue on discharge & respond to T S, confcall 09/02/11 KCobb 235.00 7.20 1,692.00 w D Skierski & P Franklin re issues on discharge; prepare & mail notices of fee application 09/02/11 J Jenkins Upload Fee Application to ECF 275.00 1.00 275.00 A. Continued review of selected bank accounts relating to 09/05/11 225.00 3.00 675.00 DiFrancesco transactions with FPFI Trust. review e-mails on remaining issues; search for Vectrix Plan doc.; 09/06/11 KCobb send email w copies of Vectrix documents to D Skierski & P 235.00 0.70 164.50 Franklin A. Continued review of selected bank accounts relating to 09/06/11 225.00 1.70 382.50 DiFrancesco transactions with FPFI Trust. 09/06/11 J Jenkins Review reorg documents; TC D Skierski re changes 275.00 1.20 330.00 Finalized research and review and began tracing entries to A. 09/07/11 documents prepared from FPFI records to try to reconcile 225.00 3.60 810.00 DiFrancesco amounts reflected in both entities. review of FPFI plan of reorg; 2005 - 2006 tax returns & other 09/08/11 KCobb docs for informaton on tax status to Debtor; meeting w J Jenkins 235.00 6.50 1,527.50 to discuss Analysis of payments received from FPFI, 2000 - 2009 general 09/08/11 J Jenkins ledger trial balances; FPFI plan provisions relating to FPFG 275.00 4.50 1,237.50 claim Page 3 EXHIBIT A

- 11. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time .Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Emglo)lee Descrigtion Rate ation Amount discuss possible tax positions for 2010 w/ RR & JJ; confcall w K Enger re FPFI disclosure statement and settlement agreement; 09/09/11 KCobb 1099s issued to FPFG; FPFI's position for treating distributions 235.00 1.30 305.50 as interest income; use of NOL's of former consolidated group and other matters 09/12/11 J Jenkins Email memo to Leo Carey re Plan of Liquidation. 275.00 1.50 412.50 09/13/11 J Jenkins Telcon with Leo Carey re email about Plan, etc 275.00 0.30 82.50 review of MOR;s for 2010 revenue & deductions; prepare 09/15/11 KCobb 235.00 3.20 752.00 workpapers and Analysis of 2009 and 2010 transactions and assist in preparation 09/15/11 J Jenkins 275.00 3.50 962.50 of2010 Form 1120 A. Continued tracing various entries from FPFI records to FPFG 09/16/11 225.00 2.30 517.50 DiFrancesco general ledger entries for comparison 09/16/11 J Jenkins Researching SEC filings in FPFI reorg period (1999-2000) 275.00 3.50 962.50 prep of revised POA; review e-mail on shareholders list; prep 09/19/11 KCobb 235.00 1.90 446.50 client copy of tax return & organize files Retrieved "Summary of Group Distributions from FPFI" and A. 09/19/11 began updating same using recently received data from FPFI 225.00 4.10 922.50 DiFrancesco accountants and began tracing 09/19/11 J Jenkins Prep for meeting w Trustee Re Fee hearing 275.00 2.50 687.50 09/20/11 KCobb e-mail POA to trustee; draft cover ltr for copy of tax return 235.00 0.20 47.00 A. Continued updating "Summary" carefully tracing distributions 09/20/11 225.00 2.40 540.00 DiFrancesco from FPFI to "Summary" 09/20/11 J Jenkins Prep for and meeting with Trustee Orwig etal at SNR 275.00 2.00 550.00 Prepare August 2011 MOR; prepare project list for Trustee's 09/21/11 J Jenkins 275.00 3.00 825.00 declaration 09/22/11 J Jenkins Prep August 2011 MOR 275.00 1.50 412.50 Finalized Summary update and began tracing total distributions A. 09/23/11 from FPFI website to Summary and adjusted Summary 225.00 2.50 562.50 DiFrancesco accordingly Witness & Exhibit List; upload MOR; at Lain Faulkner re FPFI 09/23/11 J Jenkins 275.00 3.00 825.00 distribution cancelled checks Began comparing adjusted Summary to one previously A. 09/26/11 distributed to determine differences and reconciling both 225.00 4.50 1,012.50 DiFrancesco documents. Page4 EXHIBIT A

- 12. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Emgloyee Descrigtion Rate ation Amount Prep for and attend Hearing on fee applications; upload 09/27/11 J Jenkins 275.00 3.20 880.00 proposed order Preparation of specific workpapers; meeting with Jim Jenkins A. 09/28/11 reviewing current workpapers and determining remaining data to 225.00 4.30 967.50 DiFrancesco be accumulated. Telcon with P Franklin re preparation for hearing on W Maxwell 2004 motion and related issues; read W Maxwell response and 09/28/11 J Jenkins objection to 2004 motion; tracing The Premier Group 275.00 6.50 1,787.50 transactions related to Jan 2008 purchase and payments on purchase 09/29/11 KCobb assist JJ w/ creating reports in quickbooks of vendor payments. 235.00 0.90 211.50 Reading document relating to hearing on W Maxwell 2004 ; telcon with Peter Franklin re Mitsubishi documents and related; tracing and downloading FPFG vendor payments reports and 09/29/11 J Jenkins 275.00 6.50 1,787.50 related reports on Consulting and Legal Professional fees; telcon with John Volny re questions on purchases of Rutgers, Globalnet and Premeir and related questions A. Began implementing changes recommended by Jenkins 09/30/11 225.00 2.90 652.50 DiFrancesco specifically as relates to reconciling various worksheets. Transaction analysis of sub purchases, legal fees ; met with 09/30/11 J Jenkins John V re purchase amounts v. operating advances to Rutgers 275.00 5.50 1,512.50 and Globalnet and Premier; organize and finalize analysis Began reviewing activity for various FPFG bank statements A. 10/03/11 (Bank of America) and tracing results to general ledger and 225.00 3.10 697.50 DiFrancesco updating date for activity subsequent to posting of Quick Books Continued and finalized reviewing activity for BOA accounts and A. 10/04/11 prepared suggested journal entries for use in preparation of 225.00 4.20 945.00 DiFrancesco federal tax returns A. Began recording transactions within Wells Fargo Bank (4223) 10/06/11 225.00 3.70 832.50 DiFrancesco from 6/30/08 to 6/30/09. 10/10/11 J Jenkins TC & email memo to D Marsh re IRS tax notice re 2010 Fm 1120 275.00 0.40 110.00 A. Continued recording transactions within Wells Fargo Bank 10/11/11 225.00 3.20 720.00 DiFrancesco (4223) from 6/30/08 to 6/30/09 on Excel spreadsheet. Finalized recap of receipts and disbursements within Fargo A. 10/12/11 (4223) and began recording same on Excel for Fargo (8176) 225.00 3.90 877.50 DiFrancesco from April through June 2009 Page 5 EXHIBIT A

- 13. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Employee Description Rate ation Amount Analyzing documents received in connection with Velia Charters 10/13/11 J Jenkins project; assisting A DiFrancesco with locating Ole enterprises 275.00 2.50 687.50 and other 2007-08 financial files for 2007/2008 Corp Tax Finalized spreadsheet for Fargo (8176) and reviewed results for A. 10/14/11 both Fargo accounts attempting to identify specific transactions 225.00 4.10 922.50 DiFrancesco and possible trace to other FPFG accounts A. Began researching files for financial data for Ole' Auto especially 10/17/11 225.00 2.10 472.50 DiFrancesco as related to year end 2007 & 3/08 Continued research relating to Ole"; reviewing prior year tax A. 10/18/11 returns (2006 & 2005) as relates to Ole' and FPFG as a single 225.00 2.90 652.50 DiFrancesco tax entity TC P Franklin re "source of document" questions raised by W 10/18/11 J Jenkins 275.00 2.50 687.50 Maxwell; followup research Finalized review of prior years tax returns: reviewed comparative A. 10/19/11 trial balances for FPFG posted on Quick Books for 2006 to data 225.00 4.30 967.50 DiFrancesco contained on 2006 federal tax returns. Memo to E Lovall re questions Re "Source of Documents" used 10/19/11 J Jenkins 275.00 0.50 137.50 in tracing subsidiary transactions A. Meeting with J. Jenkins relating to year end balances tax returns 10/20/11 225.00 1.90 427.50 DiFrancesco vs. quickbooks and possible adjustments Prep for and meeting with P Franklin and E Lovall at FSLH Re 10/20/11 J Jenkins 275.00 3.00 825.00 document used in tracing Velia transactions and other analysis Began researching documents and internet relating to FPFG A. 10/21/11 purchase of Rutgers and tracing cash activity to quick book 225.00 2.40 540.00 DiFrancesco entries. 10/21/11 J Jenkins Assist D Marsh with reports to US Trustee program 275.00 0.80 220.00 TC P Franklin Re analysis and tracing of legal fees paid in 10/22/11 J Jenkins 275.00 2.50 687.50 2007/08; followup analysis and tracing Reading plan, disclosure and trust documents; prepare email 10/23/11 J Jenkins 275.00 3.00 825.00 memo to D Skierski re questions and issues A. Finalizing research of Rutgers pruchase and obtaining 10/24/11 225.00 2.10 472.50 DiFrancesco documents relating to actural transaction Page 6 EXHIBIT A

- 14. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Dur- $ Date EmQioyee DescriQtion Rate ation Amount Analyzing and tracing legal fee payments and related transactions; searching document files for bank documents and statements; reconciling cash transactions to accounting detail 10/24/11 J Jenkins and adjustments; discuss plan and disclosure issues with Kirk 275.00 6.50 1,787.50 Cobb; telcons with P Franklin and reading draft of Liquidation Trust received today; respond to email memos from P Franklin and D Skierski research and prep form 4506 requesting copies of 1999- 2001 10/25/11 KCobb 235.00 0.80 188.00 consolidated tax returns to get pre-bankruptcy tax information Meeting with J. Jenkins relating to transactions involving J. A. Maxwell from various sourches withing quickbooks; began 10/25/11 225.00 3.10 697.50 DiFrancesco researching all trial balances of all entities for possible transactions involving Maxwell Tracing wire transfers and adjustments to and from W Maxwell; met with A DiFrancesco reconciling information and analysis; 10/25/11 J Jenkins 275.00 4.50 1,237.50 followup tracing to Oppenheimer records; TC w P Franklin and D Skierski re Plan, Disclosure and Trust documents mtg w/ J Jenkins,P Franklin & John Volney, re W. Maxwell 10/26/11 KCobb 235.00 0.50 117.50 subpeona Finalized Maxwell review; discussed same with Jenkins and A. 10/26/11 researched the various accounts charged with Maxwell 225.00 2.70 607.50 DiFrancesco disbursements Prepare information for meeting w P Franklin & J Volney; meeting and followup with A DiFrancesco to research Rutgers 10/26/11 J Jenkins 275.00 5.00 1,375.00 and Global Net transactions; prepare Sept MORand transmit to trustee and attorneys Began extensive review of all entries and documents including A. 10/27/11 internet access relating to purchase of Globolnet interests and 225.00 3.10 697.50 DiFrancesco cash transactions involved in the acqusition of these interests. 10/27/11 J Jenkins Upload Sept MOR to ECF 275.00 0.50 137.50 A. Finalized Globolnet activity and discussed final results with 10/28/11 225.00 1.90 427.50 DiFrancesco Jenkins including actual purchase documents Reviewed numerous documents relating to financial information A. 11/01/11 for Ole' Auto group; acquired year end 2007 balance sheet & 225.00 3.10 697.50 DiFrancesco income statement for use in consolidated tax return. Began preparation of 2007 consolidated financial statements for A. 11/02/11 FPFG & Ole'; researched FPFG 2007 general ledger for activity 225.00 2.70 607.50 DiFrancesco involving Ole'. A. Completed 2007 consolidated financial statements (FPFG & 11/03/11 225.00 3.10 697.50 DiFrancesco Ole'); Page 7 EXHIBIT A

- 15. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Dur- $ Date EmQIO)lee DescriQtion Rate ation Amount Researched selected accounts at 12/31/2007 and recorded A. specific activity within those accounts for use in preparation of 11/08/11 225.00 3.40 765.00 DiFrancesco consolidated tax return; completed preliminary balance sheet & P&L for FPFG for year 2008 to include in 2008 tax return A. Began researching details relating to unidentified transactions 11/09/11 225.00 2.90 652.50 DiFrancesco occuring in 2008 & 2009; meeting with Jim Jenkins re: same Assist with locating and reconciling transaction info from 08-09 11/09/11 J Jenkins 275.00 2.50 687.50 with A Difrancesco; telcon and analyzing data from E Lovall Continued research of cash transactions, especially as relates to A. Wells Fargo accts, for 2008 & 2009; began identifying selected 11/10/11 225.00 3.60 810.00 DiFrancesco items from information received from various sources including Preference Analysis Recapped all cash entries for year 2008; identified those from known sources (remaining entries to be discussed at a later A. 11/11/11 date); prepared preliminary year end 2008 financial statements 225.00 3.70 832.50 DiFrancesco requiring further adjustment; cursory review of payroll and payroll tax expense for FPFG during 2008. Analysis- IRS claim and search for related documents; met with 11/11/11 J Jenkins 275.00 2.00 550.00 K Cobb re filed and unfiled Forms 1120 Began recapping all receipts and disbursements for year 2009 A. from various sources including MORs; began creating adjusting 11/14/11 225.00 3.50 787.50 DiFrancesco entries to record these events to be posted to trial balance worksheets for 2009. Finalized all financial activity for 2009; completed preliminary A. 11/16/11 adjusting entries and completed preliminary trial balance at 225.00 3.40 765.00 DiFrancesco 12/31/09 Reviewed trial balances for 2007, 2008 &2009; made certain A. adjustments relating to comparative numbers; prepared excel 11/17/11 225.00 2.80 630.00 DiFrancesco worksheet containing year end balance sheet details for inclusion in preparation of 1120s for each year. A. More definitive review/research relating to payroll for 1st & 2nd 11/18/11 225.00 2.60 585.00 DiFrancesco Qtr 2008 Continued researching payroll activity for year 2008 discovering A. that FPFG employees were being paid by other entities long 11/21/11 225.00 2.70 607.50 DiFrancesco after the books for FPFG stopped posting to the GIL; discussed same with J. Jenkins. Completed review of payroll activity; traced and noted selected A. entries between various related entities as affects FPFG; 11/22/11 225.00 2.80 630.00 DiFrancesco updated FPFG trial balance to include balances per MOR, schedules, and 1120 for comparison purposes Page 8 EXHIBIT A

- 16. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Emglo~ee Descrigtion Rate ation Amount A. Completed final adjustments to trial balances for 2007, 2008 & 11/23/11 225.00 2.50 562.50 DiFrancesco 2009. Submitted all to K. Cobb for review and discussion. Prep & upload October 2011 MOR; telcons with E Lovall re MOR 11/30/11 J Jenkins 275.00 2.00 550.00 information Meeting w E Lovall Re Patton Boggs preference settlement; 12/06/11 J Jenkins meeting w P Franklin & E Lovall re disclosure hearing 275.00 3.50 962.50 preparation; discussed income tax reporting issues with K Cobb 12/07/11 KCobb re-draft & print request for prior tax returns, disc w/ J. Jenkins 235.00 0.60 141.00 Email memo to Denise Marsh transmitting request to IRS for 12/09/11 J Jenkins 275.00 0.50 137.50 copies of 199-2001 Form 1120. At Court - Patton Boggs settlement; TC M Orwig re call from K Rust in UST Office; tc K Rust re copies of MORs; copy July - 12/12/11 J Jenkins October 2011 MORs, draft transmittal and deliver to UST Office; 275.00 3.50 962.50 TC D Skierski re probable schedule for plan voting and confirmation TC P Franklin re meeting with D Obergfeld, claims by lawsuit 12/13/11 J Jenkins 275.00 0.40 110.00 defendants against Debtor 12/22/11 J Jenkins Prepare and upload Nov 2011 MOR 275.00 2.50 687.50 01/21/12 J Jenkins Prepare Dec 2011 MOR 275.00 2.00 550.00 01/23/12 J Jenkins Upload Dec 2011 MOR 275.00 0.50 137.50 01/25/12 J Jenkins At Court for Confirmation Hearing on Trustee's Plan 275.00 2.50 687.50 Review of drafts of Order of Confirmation; discuss with P. 01/30/12 J Jenkins 275.00 1.00 275.00 Franklin; review of revised Order of Confirmation; discuss w/ J. Jenkins; 02/01/12 KCobb 235.00 1.40 329.00 call toP. Franklin; exchange e-mails w P Franklin on same Discuss draft confirmation order with K Cobb; review D Skierski 02/01/12 J Jenkins 275.00 2.50 687.50 post-confirmation task list and prepare listing of additional items Research claim filed by Edwin Perkins, former Ole Auto exec 02/08/12 J Jenkins 275.00 4.50 1,237.50 and alter ego issues; report result to D Skierski 02/09/12 KCobb Obtain EIN for FPFG Liquidating Trust 235.00 0.60 141.00 Transmit Trust ID #to J Black for opening new bank accounts at 02/09/12 J Jenkins 275.00 0.30 82.50 Wells Fargo Page 9 EXHIBIT A

- 17. ROBBINS TAPP COBB & ASSOCIATES, PLLC Detail Time Activities By Client July 26, 2011 to February 22, 2012 Client Name: FirstPius Financial Group, Inc , Case No. 09-33918-HDH-11 Activity Our- $ Date Employee Description Rate ation Amount review and respond to e-mail from Wells Fargo request for State 70.50 02/14/12 K Cobb 235.00 0.30 filings documents for FPFG Liquidating Trust Prepare memo to Wells Fargo bank renew accounts and 550.00 02/14/12 J Jenkins 275.00 2.00 transfers needed to fund liquidating trust Meeting with D Skierski re Post-confirm claim records and other 110.00 02/21/12 J Jenkins 275.00 0.40 financial records Totals 365.40 91,177.00 PERSONNEL SUMMARY KCobb 55.20 12,972.00 A DiFrancesco 142.00 31,950.00 J Jenkins 168.20 46,255.00 Totals 365.40 91,177.00 Page 10 EXHIBIT A

- 18. ROBBINS TAPP COBB & ASSOCIATES, PLLC FIRSTPLUS FINANCIAL GROUP, INC. 09-33918-HDH-11 THIRD AND FINAL CHAPTER 11 APPLICATION FOR ALLOWANCE OF ACCOUNTING FEES AND OF EXPENSES PROJECT BREAKDOWN Pursuant to Local Rules for the Northern District of Texas, Dallas Division, the Applicant is to provide an exhibit concerning a breakdown of the projects and services performed and the costs of those services. Therefore, the Applicant provides this Project Breakdown in support of the Application. Applicant has divided its services into five different areas or projects as follows: I. REPORTING TO U.S. TRUSTEE PROGRAM. PREPARATION OF MONTHLY OPERATING REPORTS AND OTHER ASSISTANCE IN ADMINISTERING CASE Applicant prepared Monthly Operating Reports for the months of July 2011 through January 2012 during the application period. These services included analyzing and summarizing Debtor's receipts and disbursement and related transactions. Applicant expended 17.8 hours in connection with preparation of Monthly Operating Reports and related reports for a total of $4,895.00 in accounting fees. II. FEDERAL TAX ISSUES Applicant analyzed and traced financial and tax information into Debtor's and Debtor's related and subsidiary entities books, records and prior tax returns. Transactions between Debtor, FPFI Creditors' Trust, FPFG Grantor Trust, FPFG shareholders and the entities created or allegedly acquired in 2007 and 2008 were analyzed for taxability or as offsets against taxable income. No tax returns had been filed by the Debtor or a consolidated group, which may or may not exist, since the Corporate Tax Return filed for 2006. Applicant prepared and filed a Federal Income Tax return for the calendar year 2010 using the best information available. Applicant through the Chapter 11 Trustee requested and received copies of tax returns for the years 1999 and 2001 and performed other summarization and analysis, which will assist in preparing tax returns for remaining unfiled years Applicant assisted with analysis of tax issues in connection with preparation of Trustee's First Amended Plan of Liquidation and related liquidation trust. Applicant expended 160.7 hours in connection with tax transaction analysis and research for a total of $36,573.50 in accounting fees. PROJECT BREAKDOWN SUPPLEMENT TO THIRD AND FINAL CHAPTER 11 APPLICATION OF ROBBINS TAPP COBB & ASSOCIATES, PLLC - Page 1 EXHIBIT 8

- 19. Ill. PROPERTY OF THE DEBTOR AND PRE-PETITION TRANSACTIONS Applicant made a limited investigation of the subsidiaries and other entities created or allegedly acquired in 2007 and 2008, transactions between the Debtor and these entities, and regulatory reports filed with the Securities and Exchange Commission. Applicant traced distributions from the FPFI Creditors' Trust into the Debtor's accounting records, investigated transactions in the FPFG Grantor Trust where possible, analyzed expenditures for purchase of subsidiaries, property and expenses and provided assistance and information as requested by the Trustee and his counsel. Applicant assisted counsel for Trustee in recovering or tracing property of the Debtor. Applicant traced and analyzed sources of funds used to purchase a Mitsubishi airplane titled in the name of an alleged subsidiary of Debtor and well as tracing the sources of funds used to purchase or pay a portion of the purchase price of alleged subsidiaries of Debtor in 2007 and 2008 to payments recorded as legal fees on Debtor's records. Applicant expended 57.0 hours in connection with tracing and analysis of property transactions for a total of $15,809.00 in accounting fees. IV. PREPARATION OF SECOND INTERIM FEE APPLICATION Applicant prepared and filed its First Interim Fee Application and Request For Reimbursement Of Expenses in November and December, 2010. Applicant expended 19.6 hours in connection with preparing and filing its Second Interim Fee Application, which was filed on September 2, 2011, for a total of $5,377.00 in accounting fees V. ASSISTANCE WITH PREPARATION AND IMPLEMENTATION OF THE AMENDED PLAN OF LIQUIDATION, LIQUIDATING TRUST AND DISCLOSURE STATEMENT Applicant provided assistance, tax research and analysis to counsel for the Trustee in the preparation of the amended plan of liquidation, creation and operation of the liquidating trust and the related information provided in the disclosure statement. Applicant provided assistance, as requested, in the post-confirmation implementation of the elements of the plan and trust. Applicant expended 103.8 hours in connection with assisting in the preparation and implementation of the amended plan of liquidation, liquidating trust and disclosure statement for a total of $26,734.50 in accounting fees. PROJECT BREAKDOWN SUPPLEMENT TO THIRD AND FINAL CHAPTER 11 APPLICATION OF ROBBINS TAPP COBB & ASSOCIATES, PLLC - Page 2 EXHIBIT 8

- 20. VI. INVESTIGATION OF CLAIMS AGAINST THE DEBTOR Applicant, at the request of counsel for the Trustee, evaluated and reported its findings on two claims against the Debtor. Applicant expended 6.5 hours in connection with tracing and analysis of property transactions for a total of $1,787.50 in accounting fees. Respectfully submitted, Is/ J. James Jenkins J. James Jenkins, CPA Robbins Tapp Cobb & Associates, PLLC 600 N. Pearl, LB. 146 Dallas, TX. 75201 Telephone (214) 979-2323 Telecopier (214) 979-2423 Email: jenkinsjj@sbcglobal. net ACCOUNTANTS FOR THE TRUSTEE PROJECT BREAKDOWN SUPPLEMENT TO THIRD AND FINAL CHAPTER 11 APPLICATION OF ROBBINS TAPP COBB & ASSOCIATES, PLLC - Page 3 EXHIBIT 8