MOT-MMI_Completion_2011-01-11

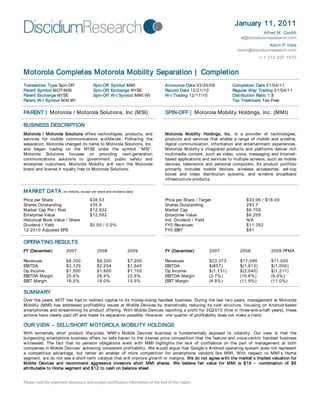

- 1. January 11, 2011 Alfred M. Cardilli al@discidiumresesearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 Please read the important disclosure and analyst certification information at the end of this report. Motorola Completes Motorola Mobility Separation | Completion Transaction Type Spin-Off Spin-Off Symbol MMI Announce Date 03/26/08 Completion Date 01/04/11 Parent Symbol MOT/MSI Spin-Off Exchange NYSE Record Date 12/21/10 Regular Way Trading 01/04/11 Parent Exchange NYSE Spin-Off W-I Symbol MMI WI W-I Trading 12/17/10 Distribution Ratio 1:8 Parent W-I Symbol MSI WI Tax Treatment Tax-Free PARENT | Motorola / Motorola Solutions, Inc (MSI) SPIN-OFF | Motorola Mobility Holdings, Inc. (MMI) BUSINESS DESCRIPTION Motorola / Motorola Solutions offers technologies, products, and services for mobile communications worldwide. Following the separation, Motorola changed its name to Motorola Solutions, Inc. and began trading on the NYSE under the symbol “ MSI” . Motorola Solutions focuses on providing next-generation communications solutions to government, public safety and enterprise customers. Motorola Mobility will own the Motorola brand and license it royalty free to Motorola Solutions. Motorola Mobility Holdings, Inc. is a provider of technologies, products and services that enable a range of mobile and wireline, digital communication, information and entertainment experiences. Motorola Mobility’s integrated products and platforms deliver rich multimedia content, such as video, voice, messaging and Internet- based applications and services to multiple screens, such as mobile devices, televisions and personal computers. Its product portfolio primarily includes mobile devices, wireless accessories, set-top boxes and video distribution systems, and wireline broadband infrastructure products. MARKET DATA (in millions, except per share and dividend data) Price per Share $38.53 Price per Share / Target $33.06 / $18.00 Shares Outstanding 335.6 Shares Outstanding 293.7 Market Cap Pre / Post $12,932 Market Cap $9,709 Enterprise Value $12,082 Enterprise Value $6,209 Historical Book Value / Share Ind. Dividend / Yield N/A Dividend / Yield $0.00 / 0.0% FY0 Revenues $11,352 12-2010 Adjusted EPS FY0 EBIT $81 OPERATING RESULTS FY (December) 2007 2008 2009 FY (December) 2007 2008 2009 PFMA Revenues $8,300 $8,200 $7,200 Revenues $23,373 $17,099 $11,050 EBITDA $2,129 $2,204 $1,640 EBITDA $(857) $(1,813) $(1,000) Op Income $1,500 $1,600 $1,100 Op Income $(1,131) $(2,040) $(1,211) EBITDA Margin 25.6% 26.9% 22.8% EBITDA Margin (3.7%) (10.6%) (9.0%) EBIT Margin 18.5% 19.0% 15.6% EBIT Margin (4.8%) (11.9%) (11.0%) SUMMARY Over the years, MOT has had to redirect capital to its money-losing handset business. During the last two years, management at Motorola Mobility (MMI) has addressed profitability issues at Mobile Devices by dramatically reducing its cost structure, focusing on Android-based smartphones and streamlining its product offering. With Mobile Devices reporting a profit for 3Q2010 (first in three-and-a-half years), these actions have clearly paid off and made its separation possible. However, one quarter of profitability does not make a trend. OUR VIEW – SELL/SHORT MOTOROLA MOBILITY HOLDINGS With extremely short product lifecycles, MMI’s Mobile Devices business is fundamentally exposed to volatility. Our view is that the burgeoning smartphone business offers no safe haven to the intense price competition that the feature and voice-centric handset business witnessed. The fact that no pension obligations went with MMI highlights the lack of confidence on the part of management at both companies in Mobile Devices’ achieving consistent profitability. We would argue that Google’s Android operating system does not represent a competitive advantage, but rather an enabler of more competition for smartphone vendors like MMI. With respect to MMI’s Home segment, we do not see a short-term catalyst that will improve growth or margins. We do not agree with the market’s implied valuation for Mobile Devices and recommend aggressive investors short MMI shares. We believe fair value for MMI is $18 – combination of $6 attributable to Home segment and $12 to cash on balance sheet.

- 2. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 2 of 14 The following key factors support our view for what lies ahead for MMI: • Smartphone market unlikely to escape pricing pressure resulting from intense competition; • 2011 likely far more challenging than 2010 in US for MMI; • iPhone impact on MMI’s smartphone volume in 2011; • Tablet opportunity likely overestimated for MMI; • 2011 US smartphone volume could be lower than consensus; • Home segment faces stiff competition from Cisco; • Dynamics of Google relationship; • Limited flexibility to generate cash; • No downside protection; • Microsoft impact on Android’s market share; • MMI’s sequential growth and market share of Android-based smartphones; and • History as a guide. VALUATION As of January 10, 2011, Motorola Mobility had a market capitalization of $9.5Bn with expected cash of approximately $3.5Bn immediately following its separation from Motorola giving MMI an equity value net of cash of $6.0Bn. In examining Motorola Mobility’s valuation, we valued each of its two business segments: Mobile Devices and Home. With Mobile Devices’ hovering near breakeven, we derived a valuation for the Home segment to arrive at an implied valuation for Mobile Devices. Based upon a 6.5x EV-to-2011 EBIT multiple for MMI’s Home segment, the following graph depicts how we believe that the market is valuing Motorola Mobility. Figure 1 As the chart above indicates, we believe the market’s implied valuation for Mobile Devices is $4.2Bn. Considering the nature (i.e. very short product cycles, persistent average selling price (ASP) compression, etc.) of Mobile Devices’ business, we would argue that investors should not be willing to pay more than 5.0x to 6.0x 2011 estimated EBIT. It follows then that the market’s expectation for 2011 EBIT for Mobile Devices is approximately $800 million. We do not believe that Mobile Devices will generate $800 million in EBIT for 2011. In fact, we project that the segment will lose $380 million at the operating line for 2011 even after assuming Mobile Devices sells 1 million tablets at an ASP of $500 and gross margin of 17.5%. Furthermore, we anticipate Mobile Devices struggling to generate operating income in 2012. As a result, we do not agree with the market’s implied valuation for Mobile Devices $3,500 $1,802 $4,172 Implied Valuation of Mobile Devices Home Mobile Devices Cash ($ in millions) Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 We do not agree with the market’s implied valuation for Mobile Devices and recommend aggressive investors short MMI shares above $25, which would result in 28% downside to our fair value estimate of $18.00 for MMI.

- 3. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 3 of 14 and recommend aggressive investors short MMI shares above $25, which would result in 28% downside to our fair value estimate of $18.00 for MMI. Tax Loss Associated with General Instrument Acquisition There is one caveat to our valuation. On January 5, 2000, Motorola completed its acquisition of General Instrument Corporation for $11.9Bn. We believe that the General Instrument business is the foundation for MMI’s Home segment operations. In light of our valuation for the Home segment, a future acquisition of this business has the potential to unlock a meaningful capital loss for tax purposes. It is a challenge to handicap the likelihood of monetizing this tax asset especially in light of the limitations imposed by MMI’s separation from Motorola, but we feel that investors should be aware of this positive catalyst. For the next two years, we do not believe that MMI can undertake the sale of its Home segment without jeopardizing the tax-free nature of the separation from Motorola. However, we believe that the investment banking community is aware of the existence of this tax loss buried inside MMI. PROJECTIONS In the following table, we summarize Motorola Mobility’s actual operating results for 2009 and the nine-month period ended October 2, 2010. More importantly, we include our projections for the fourth quarter of 2010 and full year 2011. We derived gross profit and gross margin by segment for actual and projected operating results. Figure 2 According to International Data Corporation (IDC), global smartphone volume in the first three quarters of 2010 was 200.6 million units, equating to growth of 67.7% compared to the 2009 nine month period. In projecting global smartphone volume for 4Q2010, we noted that year-over-year growth in the third quarter of 2010 was a very strong 91%, so we assumed a similar year-over-year growth rate for the fourth quarter of 2010. As a result, our fourth quarter 2010 estimate for global smartphone volume is 104 million. In MMI’s Form 10 filing, the company refers to global smartphone volume projections by Gartner. Gartner expects global smartphone volume to grow from 172 million units in 2009 to 564 million units in 2012, representing a 48% CAGR. In formulating our 2011 estimate for global smartphone volume, we used 304.6 million for 2010 and applied Gartner’s two-year CAGR of 48% to arrive at approximately 452 million smartphone units globally. The following graph sets forth these details for global smartphone volume. Actual and Projected Operating Results for MMI Actual Projections (in millions) 2009 9M Oct-2010 4Q2010 2010 2011 Revenues Mobile Devices 7,146$ 5,399$ 2,366$ 7,764$ 7,853$ Home 3,904 2,636 952 3,588 3,731 Total 11,050$ 8,035$ 3,317$ 11,352$ 11,584$ Gross Profit Mobile Devices 1,127$ 612$ 1,740$ 1,623$ Home 947 344 1,292 1,343 Total 2,074$ 956$ 3,032$ 2,966$ Operating Profit Mobile Devices (924)$ (311)$ 133$ (178)$ (380)$ Home 198 173 86 259 277 Total (727)$ (138)$ 219$ 81$ (103)$ Gross Margin Mobile Devices 20.9% 25.9% 22.4% 20.7% Home 35.9% 36.2% 36.0% 36.0% Total 25.8% 28.8% 26.7% 25.6% Operating Margin Mobile Devices (12.9%) (5.8%) 5.6% (2.3%) (4.8%) Home 5.1% 6.6% 9.1% 7.2% 7.4% Total (6.6%) (1.7%) 6.6% 0.7% (0.9%) We believe that the investment banking community is aware of the existence of this tax loss buried inside MMI. Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 In formulating our 2011 estimate for global smartphone volume, we used 304.6 million for 2010 and applied Gartner’s two-year CAGR of 48% to arrive at approximately 452 million smartphone units globally.

- 4. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 4 of 14 Figure 3 In the next table, we show how global smartphone volume for 2011 translates to MMI’s volumes. We also set forth our expectations for pricing in each market/region for 2011. In investor presentations and earnings calls, Dr. Sanjay Jha, MMI’s CEO, commented on where he believes the company is well-positioned to compete in smartphones. The regions identified by Dr. Jha were the US, China and Latin America. Europe was not highlighted as a region where MMI could generate meaningful smartphone volume because the company w ill need to make a significant investment in marketing to reposition the Motorola brand there. Figure 4 Volume, Market Share and ASP by Region (in millions) 2010E 2011E US Smartphone Volume 68.9 96.1 Growth 66.4% 39.6% Android-based Volume 30.0 34.6 Share 43.5% 36.0% MMI Volume 11.6 9.9 Share of US 16.8% 10.3% Share of Android-based 38.5% 28.5% Change in ASP (7.5%) China Smartphone Volume 40.2 67.9 Growth 68.8% Android-based Volume 3.0 6.8 Share 7.5% 10.0% MMI Volume 1.4 2.8 Share of China 3.5% 4.1% Share of China Android-based 46.4% 41.4% Change in ASP (1.0%) Latin America Smartphone Volume 14.0 23.5 Growth 67.7% Android-based Volume 1.7 3.4 Share 12.0% 14.5% MMI Volume 1.1 2.2 Share of Latin America 7.5% 9.4% Share of LA Android-based 62.5% 64.5% Change in ASP (1.0%) Source: Discidium Research Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 Europe was not highlighted as a region where MMI could generate meaningful smartphone volume because the company will need to make a significant investment in marketing to reposition the Motorola brand there. 119.7 200.6 54.5 104.0 174.2 304.6 451.8 - 50.0 100.0 150.0 200.0 250.0 300.0 350.0 400.0 450.0 500.0 2009A 2010A 2009A 2010E 2009A 2010E 2011E YTD Q3 Q4 Calendar Year Global Smartphone VolumeSource: IDC,DR estimates (in millions)

- 5. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 5 of 14 INVESTMENT THESIS Smartphone Market Unlikely to Escape Pricing Pressure Resulting from Intense Competition Some would argue that the repositioning of Mobile Devices’ product portfolio to the smartphone market of the handset industry will lead to a different outcome from what the business endured over the last decade, but we disagree. The same competitive forces apply. Indeed, we believe that Mobile Devices is more disadvantaged. Here is why. MMI’s smartphones run on the Android operating system (OS) from Google Inc. (NASDAQ: GOOG), while Apple Inc. (NASDAQ: AAPL) and Research In Motion Ltd (NASDAQ: RIMM) each have their own operating system. In our view, a smartphone manufacturer using another company’s platform, like Mobile Devices, lacks an ability to differentiate itself. In fact, management at Motorola Mobility indicated that the purchase decision of a handset/smartphone is 30% - 40% dependent on how it feels in a person’s hand. Stated another way, Motorola Mobility is capable of influencing less than half of what factors into the purchase of a smartphone. We presume that the other 60% - 70% of the purchase decision is influenced by software or platform, which puts Android-based competitors on equal footing, likely resulting in severe pricing pressure and the primary basis for competition among Android-based smartphone vendors. In investor meetings leading up to the separation, Motorola Mobility discussed the company’s rich heritage in industrial design. We would not disagree. However, we have to ask ourselves why that expertise in industrial design didn’t payoff in the voice-centric or feature handset market. Ultimately, this inability to differentiate manifests itself in declining average selling prices. The following graph depicts unit volume and average selling price for Mobile Devices from 2001 thru 2009. It is worth pointing out that Apple’s iPhone entered the handset market in January 2007. Between 2001 and 2006, despite 28.3% volume growth (CAGR), ASP declined by a 4.3% CAGR. Figure 5 At first glance, the volume and ASP combination does not warrant concern. However, we believe 2004 was an aberration unlikely to be emulated by Mobile Devices. In 2004, thanks to the success of the RAZR product, Mobile Devices enjoyed a 38.8% increase in volume and a 15.0% increase in ASP. Excluding the 2004 price increase, ASP decreases from $170 to $119, or 30% in a four-year period (8.5% per year). In short, the RAZR was able to arrest ASP erosion for only one year. With MMI’s Android-based smartphone strategy, the possibility of Mobile Devices striking gold again is extremely unlikely in our view. Apple and RIMM have the luxury of ecosystems created by their robust business models – integration of hardware and software. That combination translates into an ability to differentiate not based upon short product lifecycles but upon where and how technology will transform lives and experiences for users. $- $20 $40 $60 $80 $100 $120 $140 $160 $180 - 50.0 100.0 150.0 200.0 250.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 AverageSellingPrice(ASP) Shipments(inmillions) Mobile Devices - Unit Volume and Average Selling Price (ASP) Shipment Volume Average Selling Price (ASP) CAGR (2001-2006) Volume: 28.3% ASP: (4.2%) Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 Motorola Mobility indicated that the purchase decision of a handset/smartphone is 30% - 40% dependent on how it feels in a person’s hand. Stated another way, Motorola Mobility is capable of influencing less than half of what factors into the purchase of a smartphone. In short, the RAZR was able to arrest ASP erosion for only one year.

- 6. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 6 of 14 Competition is likely to become more intense in the smartphone market. Companies with complete flexibility in differentiating their products are better positioned to enjoy pricing power and, thus, consistent profitability. With a diminished ability to differentiate, we expect Mobile Devices’ required investment in marketing to gain smartphone market share will be significant. Today, smartphone pricing allows for enough gross margin dollars to make that investment. In the near future, we don’t expect that to be the case. As average selling prices compress, gross profit will vanish, preventing MMI from making the necessary investment in marketing, which is a precondition to competing for Mobile Devices. 2011 Likely Far More Challenging Than 2010 in US for MMI Along with the other Android-based smartphone players, MMI benefited from Verizon Wireless’ marketing effort behind its DROID platform. For 2010, the market share in the US achieved by Android-based smartphones was impressive. The following chart underscores the impressive performance of Android OS smartphones in the US from October 2009 to October 2010. The comScore MobiLens subscriber data clearly shows that Android-based smartphones captured a disproportionate share of growth as measured by US smartphone subscribers. Figure 6 In 2010, we estimate that there were over 68 million smartphone units shipped in the US, of which Android-based smartphones accounted for nearly 44%, or slightly below 30 million. In our opinion, MMI clearly benefited from its early adoption of the Android operating system and its relationship with Verizon Wireless. We estimate that MMI shipped over 11 million Android-based smartphones in the US for 2010, representing 39% of Android-based smartphone volume in the US. With HTC, Samsung, LG and others focusing aggressively on Android-based smartphones, we do not expect MMI to enjoy a similar share of Android-based US smartphone volume in 2011 especially considering the positive impact its Verizon Wireless relationship had on performance in 2010. Indeed, our store visits suggest that Samsung and HTC are well-positioned at other wireless carriers in the US. Furthermore, we learned that customer feedback indicates that the latest smartphones from HTC and Samsung are winning against MMI’s smartphones. The following table provides a sensitivity analysis for MMI’s 2011 smartphone volume in the US at various levels of Android-based market share and MMI’s share of that Android penetration. RIM 26% iOS (Apple) 23% Android (Google) 50% Other 1% Smartphone OS Platform Winners (Oct 2009 to Oct 2010) Source: DR and comScore MobiLens Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 As average selling prices compress, gross profit will vanish, preventing MMI from making the necessary investment in marketing, which is a precondition to competing for Mobile Devices. We estimate that MMI shipped over 11 million Android-based smartphones in the US for 2010, representing 39% of Android-based smartphone volume in the US.

- 7. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 7 of 14 Figure 7 According to our calculations, we estimate that MMI generated $1.4Bn in gross profit from its US smartphone volume in 2010. As noted earlier, we are forecasting a 7.5% decline in smartphone ASP for 2011. For 2011, we anticipate MMI achieving close to 30% share of the US Android-based smartphone volume resulting in approximately 10 million smartphone units in the US for MMI. The pricing pressure combined with volume loss will have a significant impact on gross margin for its US smartphone business, as we see it declining from 30% in 2010 to 24% in 2011. Given our assumption of a 7.5% decline in smartphone ASP for 2011, the following table quantifies the gross margin impact at varying levels of Android-based smartphone share in the US and MMI’s share of that Android-based volume. Figure 8 In summary, we expect 2011 to be a more challenging year for Android-based smartphones in the US and MMI’s Android-based smartphones particularly. iPhone Impact on MMI’s Smartphone Volume in 2011 As of Saturday, January 8, 2011, reports indicate that Verizon Wireless will be making an announcement on Tuesday, January 11th in New York City. It is widely anticipated that Verizon Wireless’ launch of Apple’s iPhone will be the centerpiece of the news event. Additional details suggest that the timing for the iPhone launch at Verizon Wireless is end of January. According to MMI’s Form 10 filing, Verizon Communications Inc. (NYSE: VZ), including Verizon Wireless, accounted for 17%, or $1.88Bn, of its $11.1Bn in net revenues. Motorola Mobility launched its Android-based smartphone initiative in the fourth quarter of 2009 at Verizon Wireless and sold 2.0 million Android-based smartphones in the quarter. We estimate that Verizon Wireless accounted for 95%, or 1.9 million, of MMI’s Android-based smartphone volume in 4Q2009. For 2010, we believe that Verizon Wireless could account for nearly half of MMI’s total smartphone units of 14.0 million – we are very confident that the figure will be north of 5.5 million. The following table shows a sensitivity analysis for MMI’s 2010 smartphone unit volume at Verizon Wireless. Figure 9 2011 MMI Smartphone Volume in US (in millions) 2011 MMI Share of Android-based Smartphone Volume in US 0.025 26.0% 28.5% 31.0% 33.5% 36.0% 38.5% 0.05 9.9 (12.5%) (10.0%) (7.5%) (5.0%) (2.5%) 0.0% 21.0% (22.5%) 5.3 5.8 6.3 6.8 7.3 7.8 26.0% (17.5%) 6.5 7.1 7.8 8.4 9.0 9.6 31.0% (12.5%) 7.8 8.5 9.3 10.0 10.7 11.5 36.0% (7.5%) 9.0 9.9 10.7 11.6 12.5 13.3 41.0% (2.5%) 10.3 11.3 12.2 13.2 14.2 15.2 46.0% 2.5% 11.5 12.6 13.7 14.8 15.9 17.0 2011USMarket ShareforAndroid- based Smartphones Impact on 2011 Gross Profit for MMI 2011 MMI Share of Android-based Smartphone Volume in US (in millions) 26.0% 28.5% 31.0% 33.5% 36.0% 38.5% (12.5%) (10.0%) (7.5%) (5.0%) (2.5%) 0.0% 21.0% (22.5%) (1,155)$ (1,086)$ (1,017)$ (948)$ (879)$ (809)$ 26.0% (17.5%) (983)$ (898)$ (812)$ (727)$ (641)$ (556)$ 31.0% (12.5%) (812)$ (710)$ (608)$ (506)$ (404)$ (303)$ 36.0% (7.5%) (641)$ (523)$ (404)$ (286)$ (167)$ (49)$ 41.0% (2.5%) (470)$ (335)$ (200)$ (65)$ 70$ 204$ 46.0% 2.5% (298)$ (147)$ 4$ 155$ 307$ 458$ 2011US MarketShare forAndroid- based Smartphones MMI 2010 Smartphone Volume at Verizon Wireless (in millions) 5.0% MMI's 2010 Net Revenues Derived from VZ 25$ 7.0 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 350$ 3.9 5.5 7.2 8.8 10.4 12.0 375$ 3.7 5.2 6.7 8.2 9.7 11.2 400$ 3.4 4.9 6.3 7.7 9.1 10.5 425$ 3.2 4.6 5.9 7.2 8.6 9.9 450$ 3.1 4.3 5.6 6.8 8.1 9.4 475$ 2.9 4.1 5.3 6.5 7.7 8.9 500$ 2.7 3.9 5.0 6.2 7.3 8.4 525$ 2.6 3.7 4.8 5.9 6.9 8.0 ASPforMMI2010 SmartphoneVolume atVerizonWireless Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 For 2010, we believe that Verizon Wireless could account for nearly half of MMI’s total smartphone units of 14.0 million – we are very confident that the figure will be north of 5.5 million.

- 8. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 8 of 14 Taking it a step further, the next table sensitizes the contribution to MMI’s gross profit from its Verizon Wireless-based smartphone volume in 2010 across gross margin levels for MMI’s US smartphone volume. We believe that the gross profit derived from MMI smartphone volume at Verizon Wireless in 2010 is likely north of $750 million. Figure 10 In Exhibit 1, given what we project for China and Latin America, we quantify the required smartphone volume increase MMI must generate in the US and Europe in 2011 at varying levels of MMI smartphones displaced by the iPhone at Verizon Wireless to offset the corresponding decrease in gross profit. Our analysis estimates that MMI sold 11.6 million smartphones in the US and Europe in 2010, of which 6.0 million smartphones were sold at Verizon Wireless. We offset a portion of the iPhone volume impact with anticipated growth from China and Latin America in 2011. Tablet Opportunity Likely Overestimated for MMI Much has been made concerning the opportunity represented by the tablet category especially given the success of the iPad. Samsung has had its Galaxy tablet in the market for a number of months. At last week’s Consumer Electronics Show in Las Vegas, Motorola Mobility unveiled its Xoom tablet to much fanfare. Research In Motion also launched its tablet initiative with the PlayBook introduction. Needless to say, the tablet opportunity has attracted some attention. It seems the list of tablet offerings expands by week. With Dell Inc. (NASDAQ: DELL) recently introducing its Streak tablet, we believe that it is worth reminding investors what the margin profile is of a hardware vendor. As the graph shows, Dell’s average gross margin and operating margin over the last 10 years are 18.0% and 7.2%, respectively. Figure 11 Impact on MMI's 2010 Gross Profit (in millions) 5.0% MMI's 2010 Net Revenues Derived from VZ 0.005 889$ 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 28.0% 385$ 544$ 702$ 861$ 1,020$ 1,179$ 28.5% 391$ 553$ 715$ 877$ 1,039$ 1,200$ 29.0% 398$ 563$ 728$ 892$ 1,057$ 1,221$ 29.5% 405$ 573$ 740$ 908$ 1,075$ 1,242$ 30.0% 412$ 582$ 753$ 923$ 1,093$ 1,263$ 30.5% 419$ 592$ 765$ 938$ 1,111$ 1,285$ 31.0% 426$ 602$ 778$ 954$ 1,130$ 1,306$ 31.5% 433$ 611$ 790$ 969$ 1,148$ 1,327$ 2010GrossMargin forUSSmartphone Volume 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Gross and Operating Margins for Dell Inc. (FY2001 to FY2010) Gross Margin OperatingMargin We believe that the gross profit derived from MMI smartphone volume at Verizon Wireless in 2010 is likely north of $750 million. Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 As the graph shows, Dell’s average gross margin and operating margin over the last 10 years are 18.0% and 7.2%, respectively.

- 9. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 9 of 14 In the next table, we quantify the impact on EBIT in 2011 for MMI’s tablet initiative. The sensitivity analysis evaluates the impact of two key variables: tablet volume and operating margin. Figure 12 Taking our analysis a step further, we attempt to assess the tablet opportunity’s effect on MMI’s share price. Again, using Dell as a proxy, the market’s valuation of Dell implies an EV- to-Jan 2012 EBIT multiple of 5.0x based upon FactSet estimates. Using this multiple and MMI’s 294 million outstanding shares, we evaluated the potential impact on MMI’s share price. Figure 13 In light of our analysis of MMI’s tablet business, we would argue that it is likely to have very little positive effect on the company’s equity value. Indeed, we expect the tablet business to become predicated on economies of scale, which should favor a company like Dell. 2011 US Smartphone Volume Could Be Lower Than Consensus After constructing 2011 demand for smartphones in the US from a different perspective, we believe that 95 million could be too high. In evaluating US demand for smartphones based upon wireless subscribers, we conclude that either the conversion rate for non-smartphone wireless subscribers to smartphones or replacement demand from smartphone subscribers will need to be quite substantial. As noted previously, we expect 2010 smartphone volume in the US to reach 69 million representing year-over-year growth of 66% from 2009. Gartner estimates a two-year CAGR of 48% between 2010 and 2012 in global smartphone volume, with the US accounting for between 21% and 22% of that volume. Consensus estimates for 2011 smartphone volume in the US is likely to approximate 95 million units. According to comScore MobiLens, there were 36.2 million smartphone subscribers in the US as of October 2009 (based on a 3-month rolling average). By October 2010, comScore MobiLens pegged that number at 60.7 million, for an increase of 67.7%. If we assume the same growth rate of 67.7% from October 2010 to October 2011, the number of smartphone subscribers in the US reaches nearly 102 million, an increase of approximately 41 million. Based upon a combination of our analysis and comScore MobiLens data, the following graph summarizes the smartphone wireless subscribers in the US. Tablet Impact on MMI Operating Income (in millions) 0.5 2011 MMI Tablet Volume 0.005 40$ 0.5 1.0 1.5 2.0 2.5 3.0 6.0% 15$ 30$ 45$ 60$ 75$ 90$ 6.5% 16$ 33$ 49$ 65$ 81$ 98$ 7.0% 18$ 35$ 53$ 70$ 88$ 105$ 7.5% 19$ 38$ 56$ 75$ 94$ 113$ 8.0% 20$ 40$ 60$ 80$ 100$ 120$ 8.5% 21$ 43$ 64$ 85$ 106$ 128$ Tablet Operating Marginin2011 Tablet Impact on MMI Share Price (in millions, except per share) 2011 MMI Tablet Volume 0.68$ 0.5 1.0 1.5 2.0 2.5 3.0 6.0% 0.26$ 0.51$ 0.77$ 1.02$ 1.28$ 1.53$ 6.5% 0.28$ 0.55$ 0.83$ 1.11$ 1.38$ 1.66$ 7.0% 0.30$ 0.60$ 0.89$ 1.19$ 1.49$ 1.79$ 7.5% 0.32$ 0.64$ 0.96$ 1.28$ 1.60$ 1.92$ 8.0% 0.34$ 0.68$ 1.02$ 1.36$ 1.70$ 2.04$ 8.5% 0.36$ 0.72$ 1.09$ 1.45$ 1.81$ 2.17$ Tablet Operating Marginin2011 Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 In light of our analysis of MMI’s tablet business, we would argue that it is likely to have very little positive effect on the company’s equity value. We conclude that either the conversion rate for non-smartphone wireless subscribers to smartphones or replacement demand from smartphone subscribers will need to be quite substantial.

- 10. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 10 of 14 Figure 14 What we find interesting is that there is a discrepancy of 54 million smartphone units when comparing US smartphone shipment volume for 2011 by industry analysts and growth in smartphone wireless subscribers in the US. Admittedly, there is a mismatch as far as timing – calendar year 2011 for industry projections versus October 2010 to October 2011 for our estimate of smartphone wireless subscriber growth. Timing aside, if we assume that smartphone owners in the US replace their devices once every three years, we arrive at replacement demand of approximately 20.2 million. As a result, unless there is a larger increase in smartphone penetration in the US resulting in growth greater than 68% in smartphone subscribers, we believe that US smartphone volume growth could fall short of 95 million units in 2011. Home Segment Faces Stiff Competition from Cisco The foundation for MMI’s Home business was the purchase of General Instrument in January 2000. This business is profitable, but not to any impressive degree. It experiences limited growth as its primary competitor is Cisco Systems (NASDAQ: CSCO). Cisco purchased Scientific Atlanta a number of years ago and competes head-to-head with MMI’s Home business on a meaningful portion of its revenue base. Accordingly, it is hard to envision the Home business warranting any kind of premium valuation from investors. According to our calculations, the Home segment generates gross margins in the mid-30’s and operating margins in the 5% to 8% range. Furthermore, it is responsible for only a third of MMI’s net revenues. As a slow growth, less capital intensive business, we assume that operating profit roughly equates to operating cash flow. Accordingly, MMI’s Home business is capable of generating approximately $264 million in cash annually. As a point of reference, Mobile Devices generated a non-GAAP operating loss of $924 million for 2009. Results for 2008 and 2007 were even worse. In our view, any meaningful opportunity related to convergence is unlikely to materialize in the next 24 months. Thus, the Home segment’s financial performance is expected to remain consistent with recent history – a stable, slow-growth business with unimpressive profitability. Dynamics of Google Relationship Partnering with Google has clearly been an excellent decision in the short-run and likely resuscitated MMI’s Mobile Devices business. Mobile Devices’ adoption of the Android- platform has positioned the company to compete in smartphones. We surmise that MMI entered this strategic relationship more out of survival than what Google can or will do for the long-term success of Mobility. Ultimately, Google cares about adoption of its Android OS in the world of mobile devices. It is likely that Google welcomes additional device-makers to Android. We acknowledge that Google is likely concerned with its partners’ success, but the question is to what degree. In our opinion, the impact on Android-based smartphone makers 36.2 60.7 101.8 15.5% 25.9% 43.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% - 20.0 40.0 60.0 80.0 100.0 120.0 Oct-09 Oct-10 Oct-11 PenetrationofSmartphoneSubscribersofWirelessSubscribersinUS USSmartphoneWirelessSubscribers US Smartphone Wireless Subscriber Growth US Smartphone Subs Smartphone PenetrationSource: comScore MobiLens, DR estimate (in millions) Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 According to our calculations, the Home segment generates gross margins in the mid-30’s and operating margins in the 5% to 8% range. Ultimately, Google cares about adoption of its Android OS in the world of mobile devices.

- 11. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 11 of 14 will be akin to the effect Microsoft’s operating system had on hardware vendors in the personal computer industry. In the end, with mobile devices accounting for more searches, Google has to be focused on one objective – penetration of the Android OS. As an early adopter of Android, management at MMI has alluded to its closeness with Google. Indeed, Dr. Jha stated that MMI has had a group in close proximity to the Android team. Of course, MMI works closely with Google in formulating where smartphones are headed, but there are a number of other smartphone players (i.e. Samsung, HTC, among others) influencing Android’s evolution as well. Limited Flexibility to Generate Cash The tax-free nature of the transaction may limit MMI’s options should the Mobile Devices business begin to consume cash. The Home business is profitable and throws off cash, but not to the degree necessary to fund substantial losses at Mobile Devices. Furthermore, we believe that Mobility cannot sell a material portion of its assets to raise cash without triggering tax implications for Motorola Solutions (tax credits and carryforwards). Beyond the two-year anniversary of the separation, MMI gains added flexibility of being able to divest a substantial portion of its assets without negative tax implications. Is this a real concern? We believe it is, and management at Motorola Solutions must agree with us. The fact that no pension obligations went with MMI highlights the lack of confidence on the part of management at both companies in Mobile Devices’ achieving consistent profitability. Rather than facing the prospect of a lawsuit in the event that MMI is unable to meet pension obligations allocated in the separation, management likely reasoned that it is best for Motorola Solutions to assume the entire obligation. Next, some of the details within the trademark licensing agreement between Motorola Solutions and Mobility led us to believe that the long-term viability of MMI had to be a primary concern. Under the agreement’s terms, Motorola Solutions has a right of first refusal to purchase the Motorola Marks in the event Mobility becomes insolvent, files for bankruptcy (Chapter 11 reorganization excluded) or begins proceedings to liquidate. No Downside Protection Once separated, MMI no longer will have the safety net of the cash flow generated from Motorola Solutions’ businesses. For many years, Motorola has had to redirect capital to Mobile Devices while it struggled to compete in the handset business. The economic downturn exacerbated Mobile Devices’ predicament, forcing drastic changes to its focus and cost structure. Thanks to Motorola’s other businesses, MMI was afforded a second chance. Without the redirected capital, MMI would very likely not exist today. Microsoft Impact on Android’s Market Share And finally, Microsoft Corporation (NASDAQ: MSFT) is likely to have something to say about convergence. Microsoft introduced Windows Mobile 7 recently. It is improbable that Microsoft will be ceding mobile computing to Google’s Android OS or any other competitor anytime soon. Any loss of momentum by Android as a result of Windows Mobile recapturing smartphone volume/market share is likely to have a negative impact on Google’s device partners like MMI. Microsoft understands that more computing and interacting is being done away from traditional computing devices like PCs and notebooks, so we expect the company to pursue aggressively its mobile computing initiatives. MMI’s Sequential Growth and Market Share of Android-based Smartphones Mobile Devices launched its first smartphone in the fourth quarter of 2009. In that quarter, the company sold 2.0 million smartphone units. Recently, management has stated that it is comfortable with the high end of its 12 – 14 million smartphone unit guidance for 2010. With 8.8 million smartphone units shipped in the nine-month period ended October 2, 2010, Mobile Devices expects smartphone volume of 5.2 million units, translating to sequential growth slowing from 40.7% to 36.8%. For first quarter of 2011, although management has not provided smartphone volume guidance, it did allude to industry seasonality – a 7% to 10% decline. We believe that management would be delighted with a typical seasonal decline to 4.8 million smartphone units. However, with Verizon Wireless’ iPhone launch, we anticipate a more pronounced fall-off in Mobile Devices’ smartphone volume for first quarter of 2011. The following graph shows sequential growth in volume for Mobile Devices’ smartphones since it launched its first smartphone models in 4Q2009. Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 The fact that no pension obligations went with MMI highlights the lack of confidence on the part of management at both companies in Mobile Devices’ achieving consistent profitability. Any loss of momentum by Android as a result of Windows Mobile recapturing smartphone volume/market share is likely to have a negative impact on Google’s device partners like MMI. For first quarter of 2011, although management has not provided smartphone volume guidance, it did allude to industry seasonality – a 7% to 10% decline.

- 12. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 12 of 14 Figure 15 Admittedly, sequential growth of 36+ % is impressive and unlikely to set off concerns about the health of MMI’s smartphone business. However, it is worth putting the sequential growth into context by examining MMI’s market share of Android-based smartphones in the first three quarters of 2010 in the regions where MMI competes. The following chart shows a worrisome trend and underscores how quickly the competitive forces might be emerging in the Android-based ecosystem for MMI. Figure 16 History as a Guide History suggests that hardware-centric business models become dependent upon scale and a victim of commoditization. We need to look no further than IBM Inc. (NYSE: IBM). Before Microsoft standardized an operating system for the personal computer, IBM and other hardware players enjoyed a meaningful piece of the value chain. With the advent of a standard operating system, hardware companies found it increasingly difficult to compete on any trait besides price. Microsoft and its software won the day, and its shareholders reaped the rewards over a very long period of time. 15.0% 17.4% 40.7% 36.8% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 1Q2010 2Q2010 3Q2010 4Q2010 Mobile Devices' Smartphone Unit Volume Sequential Growth 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 1Q2010 2Q2010 3Q2010 MMI Market Share of Android-based Smartphones by Region US Asia Pacific Latin AmericaSource: Gartner Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970

- 13. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 13 of 14 Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 Exhibit 1 | Analysis of iPhone Impact at Verizon Wireless for 2011 (in millions, except ASP) iPhone Impact on VZ-based MMI Smartphone Demand 2.0 2.5 3.0 3.5 4.0 4.5 5.0 2010 US Smartphone ASP for MMI 398.45$ 398.45$ 398.45$ 398.45$ 398.45$ 398.45$ 398.45$ Revenue Impact on MMI 797$ 996$ 1,195$ 1,395$ 1,594$ 1,793$ 1,992$ Gross Margin for US Smartphone in 2010 for MMI 30.3% 30.3% 30.3% 30.3% 30.3% 30.3% 30.3% Gross Profit Impact on MMI 241$ 301$ 362$ 422$ 482$ 543$ 603$ Gross Profit Increase for 2011 in China & Latin Am for MMI 178 178 178 178 178 178 178 Gross Profit Deficit in 2011 63$ 123$ 184$ 244$ 304$ 365$ 425$ Gross Margin for US Smartphone in 2011 for MMI 23.9% 23.9% 23.9% 23.9% 23.9% 23.9% 23.9% Req Revenue from Non-VZ Smartphone in US 264$ 515$ 767$ 1,019$ 1,271$ 1,523$ 1,775$ US Smartphone ASP in 2011 for MMI 368.57$ 368.57$ 368.57$ 368.57$ 368.57$ 368.57$ 368.57$ Req Non-VZ US/Europe Smartphone Volume Inc in 2011 0.7 1.4 2.1 2.8 3.4 4.1 4.8 2010 Non-VZ US/Europe Smartphone Volume 5.6 5.6 5.6 5.6 5.6 5.6 5.6 2011/2010 US/Europe Smartphone Vol Growth at Non-VZ 12.9% 25.2% 37.5% 49.8% 62.1% 74.5% 86.8%

- 14. MOT/MSI - MMI | Spin-Off | Completion | January 11, 2011 www.discidiumresearch.com Page 14 of 14 Alfred M. Cardilli al@discidiumresearch.com Kevin P. Hare kevin@discidiumresearch.com + 1 312 207 1970 Addendum Analyst Certification I, Alfred M. Cardilli, hereby certify that all of the views expressed in this research report accurately reflect my personal views about the subject companies, investment products, strategies or other matters discussed. I also certify that my specific recommendations or views expressed in this report are in no way directly or indirectly influenced by the source or structure of my compensation. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views in this report. I do not own securities in Motorola, Inc. and/or Motorola Mobility Holdings, Inc. and have not owned such securities within the last twelve months. Other Disclaimers This confidential report is issued and distributed by Discidium Research LLC (“ Discidium,” “ we,” “ us” or “ our” ) solely to our clients for information purposes only and is not to be used or considered as an offer to sell, buy, or subscribe for securities or other financial instruments (“ investment products” ). Redistribution of this report, in whole or in part, is strictly prohibited. This report is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or would subject Discidium to any registration or licensing requirement. Nothing in this report constitutes investment, legal, accounting or tax advice, nor a representation that any investment product or strategy is suitable or appropriate to your individual circumstances, nor otherwise constitutes a personal recommendation to you. You should exercise your independent judgment and consult your own independent professional advisors if you have questions about such products or strategies. Information and opinions presented in this report have been obtained or derived from sources believed by Discidium to be reliable, but Discidium makes no representation as to their accuracy or completeness. Discidium accepts no liability for losses arising from the use of the content presented in this report, except that this exclusion of liability does not apply where such liability cannot be legally waived by Discidium. Discidium may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views, and analytical methods of the analysts who prepared them and Discidium is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report. Past performance of investment products or strategies discussed in this report should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. The price, value, and income of any investment product can fall as well as rise. Information, opinions, and estimates contained in this report reflect a judgment, at its original date of publication, by Discidium or its employees and are subject to change without notice. Also, the value of investment products may be subject to exchange rate fluctuation that may have a positive or negative effect on the price or income of such investment products. Some investment products and strategies discussed in this report may require a high level of scrutiny by prospective investors. For example, structured securities are complex investment products, typically involve a high degree of risk, and are intended for sale only to sophisticated investors who are capable of understanding and assuming the risks involved. Further, high volatility investment products may experience sudden and large falls in their value causing losses when that investment is realized. Such losses may exceed the amount of initial investment and, in some circumstances, investors may be required to pay more money to support those losses. Also, some investment products may not be readily realizable and it may be difficult to sell or realize such investments. All material presented in this report, unless specifically indicated otherwise, is under copyright to Discidium. None of the material nor any copy of it may be altered in any way or transmitted, copied, or distributed to any other party without the prior express written permission of Discidium. All copyrighted material, trademarks, service marks and logos used in this report are the intellectual property of Discidium. This report may provide information on or links to other websites or third-parties. We have not reviewed such website or third-party information and take no responsibility for any content contained therein. Such information is provided solely for your convenience and the third-party content does not in any way form part of this document. Clients assume any risk from accessing such third-party information.