Más contenido relacionado

La actualidad más candente (18)

Similar a Analysis Coversheet Final (20)

Analysis Coversheet Final

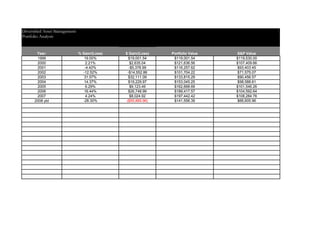

- 1. Diversified Asset Management

Portfolio Analysis

Year: % Gain/(Loss) $ Gain/(Loss) Portfolio Value S&P Value

1999 19.00% $19,001.54 $119,001.54 $119,530.00

2000 2.21% $2,635.04 $121,636.56 $107,409.66

2001 -4.42% -$5,378.99 $116,257.62 $93,403.45

2002 -12.52% -$14,552.86 $101,704.22 $71,575.07

2003 31.57% $32,111.09 $133,815.29 $90,456.57

2004 14.37% $19,229.97 $153,045.25 $98,588.61

2005 6.29% $9,123.49 $162,668.69 $101,546.26

2006 16.44% $26,748.99 $189,417.57 $104,592.64

2007 4.24% $8,024.92 $197,442.42 $108,284.76

-28.30% ($55,885.96) $141,556.39 $66,605.96

2008 ytd

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

- 2. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2006 11.06% 8.03% 3.03%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 10.00% $10.00 $110.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

$0.00 $0.00

Totals: $1,499.00 11.06% $165.79 $1,664.79

- 3. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2005 10.82% 8.03% 2.79%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

$200.00 12.00% $24.00 $224.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,699.00 10.82% $183.79 $1,882.79

- 4. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2004 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 5. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2003 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 6. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2002 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 7. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2001 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 8. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

2000 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 9. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

1999 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 10. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

1998 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 11. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

1997 10.66% 8.00% 2.66%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79

- 12. Diversified Asset Management

Portfolio Analysis

% Diff.

Portfolio S&P 500 Portfolio vs.

1996 10.66% 8.03% 2.63%

Year: % Gain / Loss: % Gain / Loss: S&P 500

Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value

SPY $100.00 8.99% $8.99 $108.99

MUNT $100.00 10.00% $10.00 $110.00

PTM $100.00 -10.00% -$10.00 $90.00

IWN $599.00 20.00% $119.80 $718.80

Q $100.00 2.00% $2.00 $102.00

RECT $100.00 1.00% $1.00 $101.00

MDY $100.00 2.00% $2.00 $102.00

IWO $100.00 4.00% $4.00 $104.00

IFU $100.00 10.00% $10.00 $110.00

KWJ $100.00 12.00% $12.00 $112.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

0.00% $0.00 $0.00

Totals: $1,499.00 10.66% $159.79 $1,658.79