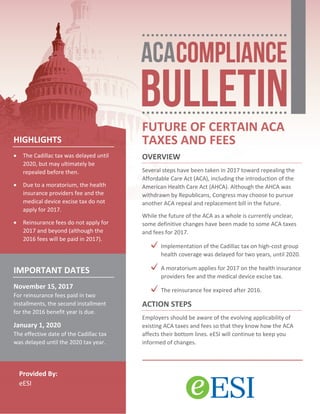

Future of Certain ACA Taxes and Fees

•

1 recomendación•126 vistas

While the future of the ACA as a whole is currently unclear, some definitive changes have been made to some ACA taxes and fees for 2017.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (19)

News Flash July 10 2013 IRS Clarifies Pay-or-Play Delay

News Flash July 10 2013 IRS Clarifies Pay-or-Play Delay

Health Reform Bulletin 122 | 2017 Inflationary Adjustments and more

Health Reform Bulletin 122 | 2017 Inflationary Adjustments and more

Health Reform Bulletin 131 | The ACA Remains The Law of The Land

Health Reform Bulletin 131 | The ACA Remains The Law of The Land

Health Reform - Additional IRS Approaches to the Cadillac Tax; Transitional R...

Health Reform - Additional IRS Approaches to the Cadillac Tax; Transitional R...

Health Reform Bulletin 138 | Status of Individual Mandate; Understanding IRS ...

Health Reform Bulletin 138 | Status of Individual Mandate; Understanding IRS ...

Crystal Connection (1/2019): Trending News in Employee Benefits, January 2019

Crystal Connection (1/2019): Trending News in Employee Benefits, January 2019

Health Reform Bulletin 116 Year End Wrap Up 12-29-15

Health Reform Bulletin 116 Year End Wrap Up 12-29-15

Destacado

Destacado (8)

Overview and Implications of the House Republican Bill

Overview and Implications of the House Republican Bill

Similar a Future of Certain ACA Taxes and Fees

Similar a Future of Certain ACA Taxes and Fees (20)

Health Reform Bulletin 137 | Delay of Certain ACA Taxes and Fees; Benefit and...

Health Reform Bulletin 137 | Delay of Certain ACA Taxes and Fees; Benefit and...

How to Avoid a Head-on Collision with The Cadillac Tax

How to Avoid a Head-on Collision with The Cadillac Tax

Health Reform Bulletin 116 | Year-End Wrap Up Dec. 29, 2015

Health Reform Bulletin 116 | Year-End Wrap Up Dec. 29, 2015

Health Reform Bulletin 124 | Qualified Small Employer HRAs and Year-end Remin...

Health Reform Bulletin 124 | Qualified Small Employer HRAs and Year-end Remin...

Health Reform Bulletin 124 | Qualified Small Employer HRAs and Year-end Remin...

Health Reform Bulletin 124 | Qualified Small Employer HRAs and Year-end Remin...

Post-Election: What are the Impacts? Ellen Feeney, Vice President, Legal Cou...

Post-Election: What are the Impacts? Ellen Feeney, Vice President, Legal Cou...

May 2017 Summary of the American Health Care Act T.docx

May 2017 Summary of the American Health Care Act T.docx

Don’t Miss Out on the Newly Supercharged Employee Retention Tax Credit

Don’t Miss Out on the Newly Supercharged Employee Retention Tax Credit

What Is Life After Coronavirus? New Tax-Related Provisions For Increased Cash...

What Is Life After Coronavirus? New Tax-Related Provisions For Increased Cash...

Health Reform Bulletin 125 | Updated Employer Shared Responsibility Guidance,...

Health Reform Bulletin 125 | Updated Employer Shared Responsibility Guidance,...

Overview of Tax Provisions of Health Care Act and HIRE Act

Overview of Tax Provisions of Health Care Act and HIRE Act

Health Reform: Interim Guidance on Expatriate Plans; Updates on ACA Reportin...

Health Reform: Interim Guidance on Expatriate Plans; Updates on ACA Reportin...

Massachusetts Releases Proposed Regulations on EMAC Supplement; HIRD Form Ret...

Massachusetts Releases Proposed Regulations on EMAC Supplement; HIRD Form Ret...

Más de Kelley M. Bendele

Más de Kelley M. Bendele (18)

Compliance Bulletin - Washington Enacts Employee-paid Long-term Care Program

Compliance Bulletin - Washington Enacts Employee-paid Long-term Care Program

Compliance Bulletin - DOL Issues Opinion Letter on Gig Worker Classification

Compliance Bulletin - DOL Issues Opinion Letter on Gig Worker Classification

Compliance Bulletin - Federal Court Strikes Down Association Health Plan Rules

Compliance Bulletin - Federal Court Strikes Down Association Health Plan Rules

ACA Compliance Bulletin - IRS Issues Letter 5699 to Noncompliant Employers

ACA Compliance Bulletin - IRS Issues Letter 5699 to Noncompliant Employers

ACA Compliance Bulletin - Final Rule Expands Short-Term, Limited-Duration Ins...

ACA Compliance Bulletin - Final Rule Expands Short-Term, Limited-Duration Ins...

ACA Compliance Bulletin - Affordability Percentages Will Increase for 2019

ACA Compliance Bulletin - Affordability Percentages Will Increase for 2019

ACA Compliance Bulletin - HHS Extends Transition Policy for Non-ACA Compliant...

ACA Compliance Bulletin - HHS Extends Transition Policy for Non-ACA Compliant...

U.S. Justice Department Reverses Title VII Transgender Policy

U.S. Justice Department Reverses Title VII Transgender Policy

IRS Confirms ACA Mandate Penalties Still Effective

IRS Confirms ACA Mandate Penalties Still Effective

HHS Extends Transition Policy for Non-ACA Compliant Health Plans

HHS Extends Transition Policy for Non-ACA Compliant Health Plans

Último

(Deeksha) 💓 9920725232 💓High Profile Call Girls Navi Mumbai You Can Get The Service Of A Mumbai Call Girl At Any Time

WHATSAPP On Here:9920725232

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ >> 03-05-2024 (GRV)

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES(Deeksha) 💓 9920725232 💓High Profile Call Girls Navi Mumbai You Can Get The S...

(Deeksha) 💓 9920725232 💓High Profile Call Girls Navi Mumbai You Can Get The S...Ahmedabad Call Girls

Último (20)

Best Lahore Escorts 😮💨03250114445 || VIP escorts in Lahore

Best Lahore Escorts 😮💨03250114445 || VIP escorts in Lahore

💚 Punjabi Call Girls In Chandigarh 💯Lucky 🔝8868886958🔝Call Girl In Chandigarh

💚 Punjabi Call Girls In Chandigarh 💯Lucky 🔝8868886958🔝Call Girl In Chandigarh

Mathura Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Mathura Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

raisen Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

raisen Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Jaipur Call Girls 9257276172 Call Girl in Jaipur Rajasthan

Jaipur Call Girls 9257276172 Call Girl in Jaipur Rajasthan

Tirupati Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Tirupati Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Dehradun Call Girls 8854095900 Call Girl in Dehradun Uttrakhand

Dehradun Call Girls 8854095900 Call Girl in Dehradun Uttrakhand

bhopal Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

bhopal Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Kolkata Call Girls Miss Inaaya ❤️ at @30% discount Everyday Call girl

Kolkata Call Girls Miss Inaaya ❤️ at @30% discount Everyday Call girl

dhanbad Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

dhanbad Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

VIP Call Girls Noida Sia 9711199171 High Class Call Girl Near Me

VIP Call Girls Noida Sia 9711199171 High Class Call Girl Near Me

neemuch Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

neemuch Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Escorts Service Ahmedabad🌹6367187148 🌹 No Need For Advance Payments

Escorts Service Ahmedabad🌹6367187148 🌹 No Need For Advance Payments

Thrissur Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Thrissur Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Call Girls Service Anantapur 📲 6297143586 Book Now VIP Call Girls in Anantapur

Call Girls Service Anantapur 📲 6297143586 Book Now VIP Call Girls in Anantapur

(Deeksha) 💓 9920725232 💓High Profile Call Girls Navi Mumbai You Can Get The S...

(Deeksha) 💓 9920725232 💓High Profile Call Girls Navi Mumbai You Can Get The S...

Call Girl in Bangalore 9632137771 {LowPrice} ❤️ (Navya) Bangalore Call Girls ...

Call Girl in Bangalore 9632137771 {LowPrice} ❤️ (Navya) Bangalore Call Girls ...

Jalna Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Jalna Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

bhubaneswar Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

bhubaneswar Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Ozhukarai Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Ozhukarai Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Future of Certain ACA Taxes and Fees

- 1. Provided By: eESI FUTURE OF CERTAIN ACA TAXES AND FEES OVERVIEW Several steps have been taken in 2017 toward repealing the Affordable Care Act (ACA), including the introduction of the American Health Care Act (AHCA). Although the AHCA was withdrawn by Republicans, Congress may choose to pursue another ACA repeal and replacement bill in the future. While the future of the ACA as a whole is currently unclear, some definitive changes have been made to some ACA taxes and fees for 2017. Implementation of the Cadillac tax on high-cost group health coverage was delayed for two years, until 2020. A moratorium applies for 2017 on the health insurance providers fee and the medical device excise tax. The reinsurance fee expired after 2016. ACTION STEPS Employers should be aware of the evolving applicability of existing ACA taxes and fees so that they know how the ACA affects their bottom lines. eESI will continue to keep you informed of changes. HIGHLIGHTS • The Cadillac tax was delayed until 2020, but may ultimately be repealed before then. • Due to a moratorium, the health insurance providers fee and the medical device excise tax do not apply for 2017. • Reinsurance fees do not apply for 2017 and beyond (although the 2016 fees will be paid in 2017). IMPORTANT DATES November 15, 2017 For reinsurance fees paid in two installments, the second installment for the 2016 benefit year is due. January 1, 2020 The effective date of the Cadillac tax was delayed until the 2020 tax year.

- 2. 2This ACA Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. Overview A federal budget bill enacted for 2016 made the following significant changes to three ACA tax provisions: Delayed implementation of the ACA’s Cadillac tax for two years, until 2020; Imposed a one-year moratorium on the ACA’s health insurance providers fee for 2017; and Imposed a two-year moratorium on the ACA’s medical device excise tax for 2016 and 2017. In addition, the ACA’s reinsurance fee expired after 2016, although the 2016 fees will be paid in 2017. Failure of the AHCA On March 24, 2017, Republican leadership in the U.S. House of Representatives withdrew the AHCA—their proposed legislation to repeal and replace the ACA. A House vote was scheduled to take place on that day, but House Republicans could not secure enough votes to approve the legislation and, instead, canceled the vote. As a result, the ACA will remain in place at this time. Because the House was unable to pass the AHCA, the ACA remains current law, and employers must continue to comply with all applicable ACA provisions. Both President Donald Trump and House Republican leadership have stated that they now intend to focus on other issues. Despite this, Congress may choose to pursue their own ACA repeal and replacement in the future. Cadillac Tax Delayed The ACA imposes a 40 percent excise tax on high-cost group health coverage, also known as the “Cadillac tax.” This provision taxes the amount, if any, by which the monthly cost of an employee's applicable employer-sponsored health coverage exceeds the annual limitation (called the employee’s excess benefit). The tax amount for each employee’s coverage will be calculated by the employer and paid by the coverage provider who provided the coverage. Although originally intended to take effect in 2013, the Cadillac tax was immediately delayed until 2018 following the ACA’s enactment. The 2016 federal budget further delayed implementation of this tax for an additional two years, until 2020. The 2016 federal budget bill also: Removed a provision prohibiting the Cadillac tax from being deducted as a business expense; and Required a study to be conducted on the age and gender adjustment to the annual limit. There is some indication that this additional delay will lead to an eventual repeal of the Cadillac tax provision altogether. Over the past several years, a number of bills have been introduced into Congress to repeal this tax. Although President Trump has not directly indicated that he intends to repeal the Cadillac tax, he has stated that repealing and replacing the ACA is a main goal for his administration. There is some indication that the additional two-year delay will lead to an eventual repeal of the ACA’s Cadillac tax altogether.

- 3. 3This ACA Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. The AHCA would have delayed the Cadillac tax’s effective date even further, so that it would have applied only for taxable periods beginning after Dec. 31, 2025. However, the AHCA was withdrawn before the House vote. Moratorium on the Providers Fee Beginning in 2014, the ACA imposed an annual, nondeductible fee on the health insurance sector, allocated across the industry according to market share. This health insurance providers fee, which is treated as an excise tax, is required to be paid by Sept. 30 of each calendar year. The first fees were due Sept. 30, 2014. The 2016 federal budget suspended collection of the health insurance providers fee for the 2017 calendar year. Thus, health insurance issuers are not required to pay these fees for 2017. Employers are not directly subject to the health insurance providers fee. However, in many cases, providers of insured plans have been passing the cost of the fee on to the employers sponsoring the coverage. As a result, this one-year moratorium may result in significant savings for some employers on their health insurance rates. Moratorium on the Medical Devices Tax The ACA also imposes a 2.3 percent excise tax on the sales price of certain medical devices, effective beginning in 2013. Generally, the manufacturer or importer of a taxable medical device is responsible for reporting and paying this tax to the IRS. The 2016 federal budget suspended collection of the medical devices tax for two years, in 2016 and 2017. As a result, this tax does not apply to sales made between Jan. 1, 2016, and Dec. 31, 2017. Reinsurance Fees Under the ACA, health insurance issuers and self-funded group health plans must also pay fees to support a transitional reinsurance program for the first three years of Exchange operation (2014-16) to help stabilize premiums for individual market coverage. Fully insured plan sponsors do not have to pay the fee directly. Because the transitional reinsurance program was operational only through 2016, reinsurance fees do not apply for 2017 and beyond (although the 2016 fees will be paid in 2017). Reinsurance fees may be paid in either one lump sum or in two installments. For the 2016 benefit year, reinsurance fees are due as follows: Paid in Two Installments Paid in One Lump Sum • Due Nov. 15, 2016: Submit the 2016 contribution form and schedule payment of the first collection, then duplicate the form and schedule payment of the second collection. • Due Jan. 15, 2017: Remit the first contribution amount of $21.60 per covered life. • Due Nov. 15, 2017: Remit the second contribution amount of $5.40 per covered life. • Due Nov. 15, 2016: Submit the 2016 contribution form and schedule payment. • Due Jan. 15, 2017: Pay the full contribution amount of $27 per covered life.