McKinsey Survey: Italian B2B decision maker response to COVID-19 crisis

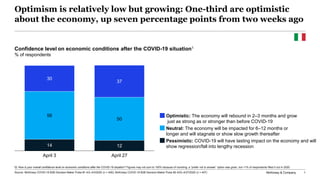

- 1. McKinsey & Company 1 Optimism is relatively low but growing: One-third are optimistic about the economy, up seven percentage points from two weeks ago Confidence level on economic conditions after the COVID-19 situation1 % of respondents 14 12 56 50 30 37 April 3 April 27 Optimistic: The economy will rebound in 2–3 months and grow just as strong as or stronger than before COVID-19 Neutral: The economy will be impacted for 6–12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have lasting impact on the economy and will show regression/fall into lengthy recession Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 400); McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 1Q: How is your overall confidence level on economic conditions after the COVID-19 situation? Figures may not sum to 100% because of rounding; a “prefer not to answer” option was given, but <1% of respondents filled it out in 2020.

- 2. McKinsey & Company 2 Italy remains slightly less optimistic compared to other regions, ahead of only Japan, South Korea, and Spain 12 11 9 12 18 12 10 41 13 12 10 43 47 47 50 49 50 29 19 48 58 51 41 45 42 43 37 33 39 68 71 10 30 37 50 ItalyFrance UKSpainAll countries Germany 2 China India Japan S. Korea Brazil US Confidence level on economic conditions after the COVID-19 situation1 % of respondents Optimistic: The economy will rebound in 2–3 months and grow just as strong as or stronger than before COVID-19 Pessimistic: COVID-19 will have lasting impact on the economy and will show regression/fall into lengthy recession Neutral: The economy will be impacted for 6–12 months or longer and will stagnate or show slow growth thereafter 1Q: How is your overall confidence level on economic conditions after the COVID-19 situation? Figures may not sum to 100% because of rounding; a “prefer not to answer” option was given, but <1% of respondents filled it out in 2020. Europe APAC 1% -9% 4% 7% 0% 0% 12% 3% 2% 8% -10% -5% Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/20–4/28/2020, (US n = 607), (France n = 219), (Spain n = 215), (Italy n = 407), (UK n = 218), (Germany n = 414), (China n = 443), (South Korea n = 200), (Japan n = 202), (India n = 411), (Brazil n = 419) Percentage- point change in optimism between April 1–9 surveys and April 20– 28 surveys

- 3. McKinsey & Company 3 Italy overall budget continues to decline more so than Europe averages; near term spend also reductions decelerate 64 64 27 23 9 April 3 April 27 12 Company’s budget (changes already made)2 Expected in the next two weeks3 Italy Europe4 61 58 26 24 1813 April 28April 6 Spend shifts as a result of COVID-19 % of spend changes 56 47 32 34 19 April 3 April 27 12 56 43 29 33 16 24 April 28April 6 1“About the same” refers to ±3% change in budget. 2Q: How has the coronavirus (COVID-19) situation affected your company’s budget for the following areas? Percentages may not add to 100 because of rounding. 3Q: How do you think spending on the following may change in the next two weeks? Percentages may not add to 100 because of rounding. 4Includes survey respondents from (France n = 219), (Spain n = 215), (Italy n = 407), (UK n = 218), (Germany n = 414). Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 400); McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) IncreasedAbout the same1Reduced

- 4. McKinsey & Company 4 Respondents report steep downward budget shifts across all categories, with banking and insurance least affected to date 68 57 51 69 72 68 76 61 67 70 60 59 63 24 30 32 20 19 24 16 23 21 23 21 23 27 8 13 17 11 9 7 8 16 12 7 19 18 10 Distribution and transportation Software and telecom Banking and insurance Commodity inputs Packaging Specialty inputs Energy Processing supplies Finished goods Vehicles Capital equipment IT hardware Real estate Reduced About the same3 Increased Budget changes due to COVID-19 (changes already made)1 % of respondents Net intent2 Services Inputs Capex -60% -44% -34% -58% -63% -61% -67% -45% -56% -63% -41% -40% -53% Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 1Q: How has the coronavirus (COVID-19) situation affected your company’s budget for the following areas? Figures may not sum to 100% because of rounding. 2Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. 3“About the same” refers to ±3% change in budget.

- 5. McKinsey & Company 5 Advanced industries are experiencing the most significant decline in budget across categories Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 1Budget net intent is described as the % of budget decreases subtracted from the % of budget increases. 2Q: How has the coronavirus (COVID-19) situation affected your company’s budget for the following areas? 3“About the same” budget changes are those that are +/- 3%. Budget net intent1 per category for each industry2 Overall industry net intent % where budget is about the same3 Advanced industries Technology, media, and telecom Global energy and materials Pharma and medical products Travel, transportation, and logistics Global finance, banking, and insurance Consumer/Retail Services Inputs Capex Specialty inputs Energy Processing supplies Packaging Commodity inputs Finished goods Software and telecom Banking and insurance Distribution and transportation Capital equipment IT hardware Vehicles Real estate 17 26 17 29 24 32 22 Net intent: % of budget decreases subtracted from the % of budget increases Below -50 -50 to -25 -25 to 0 0 to 25 25 to 50 50+

- 6. McKinsey & Company 6 In the next two weeks, pockets of near-term decline in spend are likely to decrease in severity Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 1Net intent is described as the % of spending decreases subtracted from the % of spending increases. 2Q: How do you think spending on the following may change in the next two weeks? 3“About the same” spending changes are those that are +/- 3%. Net intent: % of budget decreases subtracted from the % of budget increases Below -50 -50 to -25 -25 to 0 0 to 25 25 to 50 50+ Next two-week spending net intent1 per category for each industry2 Overall industry net intent % where budget is about the same3 Advanced industries Technology, media, and telecom Global energy and materials Pharma and medical products Travel, transportation, and logistics Global finance, banking, and insurance Consumer/Retail Services Inputs Capex Specialty inputs Energy Processing supplies Packaging Commodity inputs Finished goods Software and telecom Banking and insurance Distribution and transportation Capital equipment IT hardware Vehicles Real estate 27 32 28 26 29 59 35

- 7. McKinsey & Company 7Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) Pharma and medical products Technology, media, telecom Advanced industries Global energy and materials Travel, transportation, and logistics Global finance, banking, and insurance Consumer/retail All industries are shifting capacity down in light of tempered demand; advanced industries and travel seeing sharpest declines Flat -15% Demand for products/ services Operational capacity (eg, production)3 Flat-15% Impact of COVID-19 on demand and capacity1,2 % change due to COVID-193 1Q: How has the coronavirus (COVID-19) situation affected your company’s production (operation) capacity? Percentages may not add to 100 because of rounding. 2Q: How has the coronavirus (COVID-19) situation affected demand for your company’s products/services? Percentages may not add to 100 because of rounding. 3Weighted average uses following midpoints: “increased/reduced 25+%” is +/- 30%, “increased/reduced 11–25%” is +/- 18%, “increased/reduced 4–10%” is +/- 7%, “About the same (+/- 3%)” is 0%.

- 8. McKinsey & Company 8 Companies are reducing marketing spend in all regions; nearly 60 percent of Italy’s B2B companies have reduced their marketing 62 63 58 56 68 71 62 69 65 71 58 57 18 19 21 23 18 14 19 8 26 20 16 20 20 18 21 21 14 15 19 24 8 10 26 23 SpainAll countries Germany ChinaFrance USItaly UK India S. KoreaJapan Brazil Europe APAC Marketing spend change1 % of responses 1Q: How has the coronavirus (COVID-19) situation affected your company’s marketing spend across all channels? Percentages may not add to 100 because of rounding. 2“About the same” refers to ±3% change in budget. IncreasedAbout the same2Reduced Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/20–4/28/2020, (US n = 607), (France n = 219), (Spain n = 215), (Italy n = 407), (UK n = 218), (Germany n = 414), (China n = 443), (South Korea n = 200), (Japan n = 202), (India n = 411), (Brazil n = 419)

- 9. McKinsey & Company 9 The importance of digital sales has doubled over that of traditional sales interactions since the onset of COVID-19 Importance of digital vs traditional to B2B buyers themselves1,2 Points allocated out of 100 1Q: Prior to COVID-19, how important were each of these methods in delivering an overall outstanding sales experience? Please distribute 100 points across these two items, giving more points to the method that you believe is more important to you personally when interacting with your suppliers. 2Q: Now, thinking about the next two weeks given the environment with COVID-19, how important are each of these methods in delivering an overall outstanding sales experience? Please distribute 100 points across these two items, giving more points to the method that you believe is more important to you personally when interacting with your suppliers. 3Q: Prior to COVID-19, how important was each method in delivering an overall outstanding sales experience? Distribute 100 points across these items, giving more points to the method that you believe is more important to your customers. 4Q: Now, thinking about the next two weeks given the environment with COVID-19, how important are each of these methods in delivering an overall outstanding sales experience? Please distribute 100 points across these two items, giving more points to the method that you believe is more important to your customers. Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 400); McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) Importance of digital vs traditional to B2B company customers3,4 Points allocated out of 100 45 65 55 35 Before COVID-19 April 27 +45% 48 69 52 31 Before COVID-19 April 3 +45% Traditional Digital

- 10. McKinsey & Company 10 Digital, self-serve, and directed channels are now seen as the most beneficial for researching suppliers 28 22 22 18 15 29 18 8 16 16 14 13 11 23 23 15 Supplier website Live chatInfo on mobile app Online material from supplier Post on social media/ online Google/web search Email from sales rep Text from sales rep Trade show Industry publication Customer referral Referral from someone in my industry Print material from supplier Meeting sales rep in person Call from sales rep Direct mail from sales rep 1Q: What ways of interacting with a supplier would be most beneficial to you when researching/considering suppliers going forward? Rank up to 3 that would be most beneficial. A free-response option was given, but <1% of respondents filled it out in 2020; ~12% of respondents answered ‘None of these’ as one of their top three responses. Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 400) Most beneficial supplier interactions for researching/considering suppliers1 % of respondents ranking in top 3 Digital Self-serve Directed Self-serve Directed Traditional

- 11. McKinsey & Company 11 Self-serve ordering is preferred significantly more over other methods 50 42 35 34 39 28 25 21 Ordering from sales rep in person Using call center/customer service Using my company’s e-procurement portal Using a supplier’s website Calling sales repUsing a mobile app Using my company’s procurement department Emailing sales rep Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 400) 1Q: Which of the following methods do you/would you most prefer to use when submitting your order? Please rank up to 3 that would be most beneficial. Self-serve Internal processes Most preferred method for ordering1 % of respondents ranking in top 3 Sales rep involvement

- 12. McKinsey & Company 12 58 50 42 42 3 18 44 51 48 2 In-person/field sales team (eg, meeting with customers face to face) Online/web support (eg, chatting with customers via video/website/mobile app to support purchase) Inside sales team (eg, interacting with customers on the phone) E-commerce (eg, products/services sold directly online with no sales rep involved) Other During COVID-19Before COVID-19 Go-to-market sales model during COVID-191,2 % of respondents 96% shifted their GTM model3 during COVID-19 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) The majority of companies that serve other businesses have shifted their go-to-market model in response to the COVID-19 crisis 1Q: In what ways was your company’s product or service sold before COVID-19? 2Q: Now today, in what ways is your company’s product or service sold during COVID-19? 3Q: Which of the following statements best describe the changes your company has made to its commercial and go-to-market model during COVID-19?

- 13. McKinsey & Company 13 E-commerce revenue is up more than 35 percent since the onset of COVID-19 Percent of company revenue driven by e-commerce before and during COVID-19 (among companies that sell online)1,2 Average % of total revenue Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 47 64 During COVID-19Before COVID-19 +36% 1Q: Approximately what percentage of your company’s revenue before COVID-19 was driven by…Figures may not sum to 100% because of rounding. 2Q: Approximately what percentage of your company’s revenue during COVID-19 is now driven by…Figures may not sum to 100% because of rounding.

- 14. McKinsey & Company 14 E-commerce share of overall B2B company revenue is up in all countries, most notably Brazil and Italy Percent of company revenue driven by e-commerce before and during COVID-19 (among companies that sell online)1,2 Average % of total revenue 45 56 51 47 46 47 44 42 47 61 42 40 56 65 56 64 51 57 52 47 53 68 62 52 All countries IndiaFrance JapanUKGermany SpainItaly China S. Korea Brazil US 1Q: Approximately what percentage of your company’s revenue before COVID-19 was driven by…Figures may not sum to 100% because of rounding. 2Q: Approximately what percentage of your company’s revenue during COVID-19 is now driven by…Figures may not sum to 100% because of rounding. Before COVID-19 During COVID-19 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/20–4/28/2020, (US n = 607), (France n = 219), (Spain n = 215), (Italy n = 407), (UK n = 218), (Germany n = 414), (China n = 443), (South Korea n = 200), (Japan n = 202), (India n = 411), (Brazil n = 419) Europe APAC 23% 16% 11% 21%36% 20% 12%13% 11% 46% 29%12% X% % change

- 15. McKinsey & Company 15 2 14 37 42 6 As effective as before April 3 Much less effective Somewhat more effective Somewhat less effective Much more effective 100 1Q: How effective is your company’s new sales model at reaching and serving customers? Figures may not sum to 100% because of rounding. 68% of B2B decision makers believe the new sales model is as effective or more so than prior to COVID-19 (up from 52% in early April) Effectiveness of new sales model in reaching and serving customers1 % of respondents Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 400); McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 5 20 43 26 6 April 27 100 53% as effective or more so compared to prior to COVID-19 68% as effective or more so compared to prior to COVID-19

- 16. McKinsey & Company 16 Companies are likely to keep their new sales model for more than 12 months after the onset of the COVID-19 crisis 35 47 13 4 Very likely to sustain 12+ months after N/A, made no go-to-market changes Somewhat likely to sustain 12 months after Unlikely to sustain 12 months after 82% are “very likely” or “somewhat likely” to sustain these shifts 12+ months after COVID-19 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) Staying power of new sales models1 % of respondents 1Q: Which of the following statements best describe the changes your company has made to its commercial and go-to-market model during COVID-19? Figures may not sum to 100% because of rounding.

- 17. McKinsey & Company 17 More than 80 percent of B2B companies have adjusted incentives in response to the effects of COVID-19 32 28 16 16 14 13 No change Lower quotas Short-term bonuses/incentives Higher quotas More fixed incentives More variable incentives Sales team incentive structure changes in response to COVID-191 % of respondents Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 1Q: To what extent has your company made changes to the incentive structure of your sales team in light of COVID-19? Figures may not sum to 100% because of rounding.

- 18. McKinsey & Company 18 22 18 15 14 14 10 7 Advanced industries Technology, media, and telecom Global finance, banking, and insurance Pharma and medical products Global energy and materials Travel, transportation, and logistics Consumer/Retail 9 20 19 18 20 14 $1M to < $25M $1B to < $10B $25M to < $100M $100M to < $500M $500M to < $1B $10B+ 7 7 15 14 25 14 9 8 10,000–49,999 <50 50–99 500–999 100–499 1,000–9,999 50,000–99,999 100,000+ Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/27/2020 (n = 407) 1 Percentages may not sum to 100 because of rounding. Survey respondents by no. of employees of company % of respondents1 Survey respondents by role in company % of respondents1 Survey respondents by industry % of respondents1 Survey respondents by annual revenue of company % of respondents1 19 18 15 14 9 7 7 6 6 Shipping/logistics R&D/Innovation/Product design Top management Purchasing Operations Sales IT/computer services Marketing Engineering B2B Pulse Decision-Maker Pulse #2: Respondent Overview Pulse #1 closed on April 3, 2020 Pulse #2 closed on April 27, 2020