1 May Daily market report

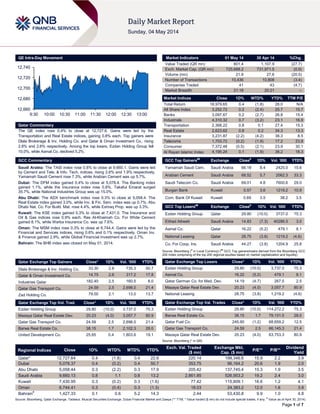

- 1. Page 1 of 7 QE Intra-Day Movement Qatar Commentary The QE index rose 0.4% to close at 12,727.6. Gains were led by the Transportation and Real Estate indices, gaining 0.8% each. Top gainers were Dlala Brokerage & Inv. Holding Co. and Qatar & Oman Investment Co., rising 2.8% and 2.6% respectively. Among the top losers, Ezdan Holding Group fell 10.0%, while Aamal Co. declined 5.2%. GCC Commentary Saudi Arabia: The TASI index rose 0.8% to close at 9,660.1. Gains were led by Cement and Tele. & Info. Tech. indices, rising 2.6% and 1.9% respectively. Yamamah Saudi Cement rose 7.3%, while Arabian Cement was up 5.7%. Dubai: The DFM index gained 0.4% to close at 5,078.4. The Banking index gained 1.1%, while the Insurance index rose 0.8%. Takaful Emarat surged 35.7%, while National Industries Group was up 15.0%. Abu Dhabi: The ADX benchmark index rose 0.3% to close at 5,058.4. The Real Estate index gained 3.0%, while Inv. & Fin. Serv. index was up 0.7%. Abu Dhabi Nat. Co. For Build. Mat. rose 4.4%, while Eshraq Prop. was up 3.3%. Kuwait: The KSE index gained 0.3% to close at 7,431.0. The Insurance and Oil & Gas indices rose 0.9% each. Ras Al-Khaimah Co. For White Cement gained 8.1%, while Warba Insurance Co. was up 7.6%. Oman: The MSM index rose 0.3% to close at 6,744.4. Gains were led by the Financial and Services indices, rising 0.6% and 0.1% respectively. Oman Inv. & Finance gained 2.9%, while Global Financial Investment was up 2.7%. Bahrain: The BHB index was closed on May 01, 2014. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co. 33.30 2.8 735.3 50.7 Qatar & Oman Investment Co. 14.75 2.6 317.2 17.8 Industries Qatar 182.40 2.5 160.5 8.0 Qatar Gas Transport Co. 24.59 2.5 2,698.0 21.4 Zad Holding Co. 79.00 2.1 13.0 13.7 Qatar Exchange Top Vol. Trad. Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 29.80 (10.0) 3,737.0 75.3 Mazaya Qatar Real Estate Dev. 20.23 (4.0) 3,057.7 80.9 Qatar Gas Transport Co. 24.59 2.5 2,698.0 21.4 Barwa Real Estate Co. 38.15 1.7 2,102.3 28.0 United Development Co. 25.65 0.4 1,803.6 19.1 Market Indicators 01 May 14 30 Apr 14 %Chg. Value Traded (QR mn) 801.4 1,107.9 (27.7) Exch. Market Cap. (QR mn) 725,688.2 731,971.5 (0.9) Volume (mn) 21.9 27.6 (20.5) Number of Transactions 10,436 10,808 (3.4) Companies Traded 41 43 (4.7) Market Breadth 21:18 20:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,979.65 0.4 (1.8) 28.0 N/A All Share Index 3,252.72 0.2 (2.4) 25.7 15.7 Banks 3,097.67 0.2 (2.7) 26.8 15.4 Industrials 4,310.32 0.7 (3.2) 23.1 16.9 Transportation 2,368.22 0.8 0.1 27.4 15.3 Real Estate 2,623.62 0.8 0.2 34.3 13.3 Insurance 3,231.87 (2.2) (4.2) 38.3 8.5 Telecoms 1,703.72 (0.2) (1.9) 17.2 23.8 Consumer 7,372.48 (0.5) (2.1) 23.9 30.1 Al Rayan Islamic Index 4,195.24 0.1 (1.9) 38.2 18.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Yamamah Saudi Cem. Saudi Arabia 66.18 8.4 2425.0 15.6 Arabian Cement Saudi Arabia 68.52 5.7 2062.3 33.3 Saudi Telecom Co. Saudi Arabia 69.01 4.8 7600.6 29.0 Burgan Bank Kuwait 0.57 3.6 1219.2 10.9 Com. Bank Of Kuwait Kuwait 0.69 3.5 38.2 3.5 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 29.80 (10.0) 3737.0 75.3 Etihad Atheeb Saudi Arabia 14.83 (7.3) 40286.5 3.0 Aamal Co. Qatar 16.22 (5.2) 479.1 8.1 National Leasing Qatar 28.75 (3.8) 1219.2 (4.6) Co. For Coop. Ins. Saudi Arabia 44.27 (3.8) 1204.9 25.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 29.80 (10.0) 3,737.0 75.3 Aamal Co. 16.22 (5.2) 479.1 8.1 Qatar German Co. for Med. Dev. 14.19 (4.7) 267.5 2.5 Mazaya Qatar Real Estate Dev. 20.23 (4.0) 3,057.7 80.9 National Leasing 28.75 (3.8) 1,219.2 (4.6) Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 29.80 (10.0) 114,272.2 75.3 Barwa Real Estate Co. 38.15 1.7 79,131.5 28.0 Qatar Fuel Co. 245.90 (1.2) 68,659.2 12.5 Qatar Gas Transport Co. 24.59 2.5 66,145.3 21.4 Mazaya Qatar Real Estate Dev. 20.23 (4.0) 63,753.3 80.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,727.64 0.4 (1.8) 0.4 22.6 220.14 199,346.6 15.9 2.2 3.9 Dubai 5,078.37 0.4 (0.2) 0.4 50.7 353.75 96,164.2 20.6 1.9 2.0 Abu Dhabi 5,058.44 0.3 (2.2) 0.3 17.9 205.42 137,745.4 15.3 1.9 3.5 Saudi Arabia 9,660.13 0.8 1.1 0.8 13.2 2,861.85 526,953.2 19.2 2.4 3.0 Kuwait 7,430.95 0.3 (0.2) 0.3 (1.6) 77.42 115,809.1 16.6 1.2 4.1 Oman 6,744.41 0.3 (0.4) 0.3 (1.3) 18.03 24,383.2 12.0 1.6 3.9 Bahrain# 1,427.33 0.1 0.6 5.2 14.3 2.44 53,430.8 9.9 1.0 4.8 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any; # Value as of April 30, 2014) 12,660 12,680 12,700 12,720 12,740 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE index rose 0.4% to close at 12,727.6. The Transportation and Real Estate led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Dlala Brokerage & Inv. Holding Co. and Qatar & Oman Investment Co. were the top gainers, rising 2.8% and 2.6% respectively. Among the top losers, Ezdan Holding Group fell 10.0%, while Aamal Co. declined 5.2%. Volume of shares traded on Thursday fell by 20.5% to 21.9mn from 27.6mn on Wednesday. Further, as compared to the 30-day moving average of 28.8mn, volume for the day was 23.9% lower. Ezdan Holding Group and Mazaya Qatar Real Estate Dev. were the most active stocks, contributing 17.0% and 13.9% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Kuwait Reinsurance Co. (KUWAITRE) S&P Kuwait FSR BBB+ BBB+ – Positive Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency) Earnings Releases Company Market Currency Revenue (mn)1Q2014 % Change YoY Operating Profit (mn) 1Q2014 % Change YoY Net Profit (mn) 1Q2014 % Change YoY Emirates Integrated Telecommunications Co. (Du) UAE AED 2,955.3 12.5% 867.1 14.5% 490.3 4.8% Abu Dhabi Ship Building (ADSB) Abu Dhabi AED 193.7 -49.2% – – -6.5 NA Ras Al Khaimah Ceramics (RAK Ceramics) Abu Dhabi AED 792.7 -1.6% – – 58.0 14.0% Oman Oil Marketing Co. (OOMS) Oman OMR 76.6 9.0% – – 2.4 15.9% Oman Orix Leasing Co. (ORXL) Oman OMR – – – – 1.0 15.9% A'Saffa Foods Co. Oman OMR 7.5 5.8% – – 1.8 6.5% Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/01 US IPSOS Public Affairs RBC Consumer Outlook Index May 50.1 – 50.0 05/01 US Department of Labor Initial Jobless Claims 26 April 344K 320K 330K 05/01 US Bloomberg Bloomberg Consumer Comfort 27 April 37.9 – 37.3 05/01 US ISM ISM Manufacturing April 54.9 54.3 53.7 05/01 US ISM ISM Prices Paid April 56.5 59.5 59 05/01 US US Census Bureau Construction Spending MoM March 0.20% 0.50% -0.20% 05/02 US BLS Unemployment Rate April 6.30% 6.60% 6.70% 05/02 US BLS Average Hourly Earnings YoY April 1.90% 2.10% 2.10% 05/02 US BLS Average Weekly Hours All Employees April 34.5 34.5 34.5 05/02 US BLS Change in Household Employment April -73.0 250.0 476.0 05/02 US BLS Underemployment Rate April 12.30% – 12.70% 05/02 US BLS Labor Force Participation Rate April 62.80% – 63.20% 05/01 US Markit Markit US Manufacturing PMI April 55.5 55.4 55.4 05/02 EU Eurostat Unemployment Rate March 11.80% 11.90% 11.80% 05/01 UK Bank of England Net Consumer Credit March 1.1B 0.6B 0.6B 05/01 UK Bank of England Net Lending Sec. on Dwellings March 1.8B 1.7B 1.6B 05/01 UK Bank of England Mortgage Approvals March 67.1K 72.0K 69.6K 05/01 UK Bank of England Money Supply M4 MoM March -2.30% – 0.70% 05/01 UK Bank of England M4 Money Supply YoY March -0.30% – 0.90% 05/01 UK Bank of England M4 Ex IOFCs 3M Annualised March 2.90% – 3.20% 05/02 Italy Italian Treasury Budget Balance April -10.1B – -18.4B Overall Activity Buy %* Sell %* Net (QR) Qatari 66.43% 68.85% (19,482,132.01) Non-Qatari 33.58% 31.14% 19,482,132.01

- 3. Page 3 of 7 05/01 China CFLP Manufacturing PMI April 50.4 50.5 50.3 05/03 China CFLP Non-manufacturing PMI April 54.8 – 54.5 05/02 Japan MIC Jobless Rate March 3.60% 3.60% 3.60% 05/02 Japan MHLW Job-To-Applicant Ratio March 1.07 1.06 1.05 05/02 Japan MIC Overall Household Spending YoY March 7.20% 2.00% -2.50% 05/02 Japan Bank of Japan Monetary Base YoY April 48.50% – 54.80% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QGMD obtains QFMA approval to postpone 1Q2014 results to May 12 – The Qatari German Company for Medical Devices (QGMD) has obtained an approval from the QFMA to postpone the date of disclosing its 1Q2014 financial results to May 12, 2014. The company has made this request due to technical failures in its ERP system, which led to errors in the profit & loss statement for 1Q2014. The company’s revenue and cost of goods sold during 1Q2014 stood at QR5.3mn and QR5.2mn, respectively. Moreover, QGMD posted a loss of QR3.3mn in 1Q2014. After the internal review of the financials it was noted that the cost of goods sold was not accurate due to systematic mistakes that affected the allocation of direct and indirect expenses to the products. (QE) QE expects 9 firms to be on MSCI EM list – The international index compiler MSCI will announce the names of Qatari companies that have qualified for its Emerging Market list on May 14, 2014. Qatar Exchange’s (QE) CEO Rashid bin Ali Al Mansoori said the Qatari bourse expects at least nine local companies to be eligible for the list. He noted that the MSCI upgrade will help accelerate the inflow of international investors into the Qatari market and will enhance market liquidity and the value of many companies. Al Mansoori said the importance of joining the global index stems from the fact that MSCI is one of the pioneer companies in Global Equity Index. This new reclassification allows Qatar to be in line with Brazil, Russia, India, China and Turkey in attracting foreign investments. (Peninsula Qatar) Al-Ahli Hospital signs national health insurance provider network agreement for Stage-II – Medicare Group (MCGS) announced that Al-Ahli Hospital has signed the national health insurance provider network agreement for Stage-II of the NHIS, which is formed by the Supreme Council of Health (SCH). The second stage of the NHIS has been implemented from May 1, 2014. (QE) DIA for Qatar Aeronautical College, Gulf Helicopters use – The Civil Aviation Authority’s (CAA) Chairman Abdulaziz Mohamed al-Noaimi said Doha International Airport (DIA) will be used for the services of Qatar Aeronautical College and Gulf Helicopters once all airlines move their operations to Hamad International Airport (HIA). For many years, DIA was Qatar's gateway to the world and home to Qatar's national airline, Qatar Airways (QA). The airport is also home to the world's first Premium Terminal dedicated to QA’s first class and business class passengers. Around 10 airlines, some of which are budget carriers, have moved their operations to HIA, following its soft launch on April 30. The airline said the national carrier QA will move its entire operations to HIA on May 27. Al-Noaimi said a portion of the existing airport will be kept as a green strip. (Gulf- Times.com) MoJ: 29% rise in Doha property transactions – According to statistics released by the Ministry of Justice (MoJ), the property market in Doha has grown substantially, with a 29% increase QoQ in the number of transactions between 4Q2013 and 1Q2014, with the aggregate value of sales reflecting a 35% rise. According to the latest Asteco Qatar 1Q2014 report, land sales continue to dominate trade in Doha’s real estate sector, representing around 77% of all property transactions over the last three months, with the total value topping QR7.35bn. Qatar’s capital has also seen strong overall performance in the residential rental market, despite a second wave of apartment launches on The Pearl-Qatar easing the pressure on rental rates slightly following stabilization in 4Q2013. (Bloomberg) Al Meera Bookstore opens 3 WHSmith Stores in Doha – Al Meera Bookstore Company, a subsidiary of Al Meera Consumer Goods Company, opened three WHSmith Stores in Doha. The stores were opened at Hayat Plaza at Al Aziziya, Ezdan Mall at Gharrafah District, and Nuaija Mall at Al Hilal. Al Meera Bookstore is the exclusive franchise of the WHSmith brand in Qatar, which is one of the largest bookstores in the UK. These stores offer an array of new and popular releases of classic and bestselling books. (QE) International The US economy remains balanced on a tight rope between higher growth and tighter policies – This was reflected in the GDP figures for the first quarter of 2014, which were released last week. While the headline number showed the US economy growing by 0.1% in Q1 on an annualized basis, well below consensus expectation of 1.2% possibly owing to temporary factors such as bad weather, a deeper look at the numbers helps reveal the underlying drivers of growth. Overall, we expect growth to remain below 2.0% in 2014 as tighter macroeconomic policies are likely to outweigh the recovery in the private sector. An important factor in US GDP growth for the last couple of years has been the stance of macroeconomic policy. Following the 2008 crisis, US policymakers responded aggressively on the monetary side by slashing interest rates to near zero and embarking on an unprecedented program of Quantitative Easing (QE); and on the fiscal side introducing a stimulus package. However, fiscal policy began to tighten in 2012-13, leaving monetary policy to do the heavy-lifting on its own. This introduced a fiscal drag on growth as the government spent less and introduced more taxes. Overall, the US economy is walking on a tight rope between an incipient recovery and a tightening of macroeconomic policies. If private sector activity continues to grow rapidly, despite the fiscal drag and tighter monetary policy, real GDP growth could reach 2.0%-2.5% in 2014. However, the risk that QE tapering derails this momentum is significant, suggesting a lower growth rate is likely to materialize. (QNB Group) US job growth jumps, but shrinking labor force a blemish – Employers in the US hired workers at the fastest clip in more than two years in April 2014, pointing to a rebound in economic growth after a dreadful winter and keeping the Federal Reserve on track to end bond purchases this year. The central bank on April 30 pushed ahead with its plan to gradually wind down its asset-purchase program by another $10bn a month, to $45bn. However, the brightening outlook was tempered somewhat by a sharp rise in the number of people dropping out of the labor

- 4. Page 4 of 7 force, which pushed the unemployment rate to a 5-1/2-year low of 6.3%. Wage growth was also stagnant. The Labor Department said non-farm payrolls surged 288,000 last month, which was largest gain since January 2012 and beat economists' expectations for a 210,000 rise. (Reuters) Eurozone factory recovery broadens, except for France – A business survey showed the recovery in the Eurozone manufacturing sector accelerated at the start of 2Q2014 with solid growth across most of the bloc, though French factories struggled to maintain momentum. Growth was again led by Germany, Europe's largest economy, and companies in Spain and Italy reported better business last month. It was the first time since November 2007 that all PMIs in the region indicated growth – coming in above the 50 break-even level. However, another data showed that unemployment in the Eurozone fell only slightly to 11.8% in March 2014, a sign that European households are yet to feel much of the corporate economic recovery. Another concern to the ECB's Governing Council, which meets shortly to set monetary policy, is that factories have cut goods prices for the second straight month. Official flash data showed Eurozone inflation rose to only 0.7% last month from 0.5% the month before, still well below the ECB's 2% target. (Reuters) Japan considers tax breaks to promote investment, help companies – According to sources, Japan is considering expanding tax breaks and loosening some rules to promote investment in start-ups as part of the government's economic growth strategy. Prime Minister Shinzo Abe's government is set to announce the second part of its growth strategy next month, in which it is likely to lower the effective corporate tax rate to 20% next month from around 35% currently, for encouraging firms to boost much-needed capital expenditure in Japan. Investor disappointment with the first installment of the strategy last year contributed to a decline in Japanese shares. One proposal is to expand the value of an investment that a so-called ‘angel investors’ can deduct from their taxable income from the current limit of 10mn yen ($97,800) to several times as much. The government may also expand the scheme to companies started within the past five years from the current limit of companies that have been founded in the past three years. (Reuters) China services PMI rises amid slowdown concern – A services-industry index in China rose in April as Chinese Premier Li Keqiang grapples with a slowdown in the world’s second-biggest economy, while avoiding another large-scale stimulus. The National Bureau of Statistics and the Federation of Logistics & Purchasing said the non-manufacturing Purchasing Managers’ Index (PMI) stood at 54.8 last month as compared to 54.5 in March, indicating a steady expansion. Property construction plunged in the first quarter and economic growth slowed as China’s leaders faced increasing challenges in maintaining the rate of expansion while reining in debt. Li Keqiang stated that the government stood firm last year against short-term stimulus that could have added to difficulties in the years ahead. Economists have projected China’s GDP to expand 7.3% this year as the government controls credit, slightly less than the government target of about 7.5%. meanwhile, a manufacturing gauge released last week was below analysts’ forecasts. (Bloomberg) Regional Bloomberg: OPEC April crude output drops to three-year low – A Bloomberg survey showed that the OPEC’s crude oil production dropped to the lowest level in almost three years in April 2014, led by declines in Saudi Arabian and Iraqi output. Production by the 12-member group slipped by 302,000 bpd to an average of 29.863mn bpd, which is the lowest level since June 2011. Last month’s total was revised by 128,000 bpd lower to 30.165mn bpd due to changes to the Saudi Arabian, Iranian and Ecuadorean estimates. OPEC members were forced to reduce their production because of unplanned and planned maintenance to pipelines, fields and refineries. The group is also seeing demand for its crude drop just as the US output surges. (Gulf-Times.com) Mowasalat, OIF sign $160mn deal for bus assembly – Mowasalat, the national transport company of Qatar and the Oman Investment Fund (OIF) have entered into an agreement to establish a bus assembly unit in Oman. Once ready, the unit will assemble 2,000 buses every year. The unit will be constructed on 1mn square meters of land in Al Mudhaibi in the Al Sharqiyah region with an investment of $160mn. Under the agreement, OIF will invest $48mn for a 30% stake, while the remaining 70% stake will be held by Mowasalat for $112mn. (GulfBase.com) GIB sets guidance on SR2bn private placement FRN – Bahrain-based Gulf International Bank has set a guidance of 72.5 basis points over the three-month Saudi interbank lending rate on its new SR2bn, five-year private placement floating rate note (FRN). GIB has completed investor meetings for the deal on May 5, 2014 and the settlement is scheduled for May 11, 2014. The placement will be managed by GIB Capital, NCB Capital, Samba Capital and Saudi Fransi Capital. The company intends to use the proceeds for general financing requirements. (GulfBase.com) Mobily declares SR962.5mn cash dividend – Etihad Etisalat Company’s (Mobily) board of directors has approved the distribution of 12.5% cash dividends (SR1.25 per share), amounting to SR962.5mn for 1Q2014. (Tadawul) Saptco alliance secures SR7.855bn bus deal for Riyadh Metro – The Saudi Public Transport Company’s (Saptco) alliance with France-based RATP Dev has jointly secured a SR7.855bn contract to operate and maintain buses in the Kingdom's capital Riyadh. The 10-year deal will be linked to the city's metro railway project, the King Abdulaziz Project for Public Transport, and will handle the procurement, operation and maintenance of the buses. (GulfBase.com) SFD enhances urea credit line by $25mn – The Saudi Fund for Development (SFD) has enhanced Pakistan’s credit line for urea import by $25mn to $125mn to facilitate an improved commodity supply for 2014. Saudi Basic Industries Corporation (SABIC) will supply around 0.33mn tons urea under this credit facility to avoid shortage in the domestic market. The committed amount is 25% higher than 2013, when SABIC supplied some 267,000 tons urea against $100mn credit facility from SFD. (GulfBase.com) SEC signs four deals worth SR2.3bn – The Saudi Electricity Company (SEC) has signed four contracts for carrying out electricity projects worth over SR2.3bn. The first project is for setting up an electricity transformer station located near Tabarjal in the Northern Frontier Region with a voltage of 33/132/380 kilovolts with 600 megawatts capacity. The second project is to set up an electricity transformer station with a voltage of 115/380 kilovolts in Al-Oqair in the Eastern Province. The third contract is for the construction of a double line with a voltage of 380 kilovolts to link the generating plants in Tabuk and Tabarjal. These three projects will be completed within 29 months from the date of signing the contracts. Meanwhile, the fourth project is for purchasing thermal exchanges for the two projects for setting

- 5. Page 5 of 7 up the 13th and 14th generating plants in Riyadh region. (GulfBase.com) EBRD, ICD to launch $120mn SME fund – The Islamic Development Bank through its private sector arm ICD, along with the European Bank for Reconstruction & Development (EBRD) will launch a $120mn fund to support small & medium- sized enterprises (SMEs) in the southern and eastern Mediterranean region. The fund is a part of an agreement signed between the EBRD and the Islamic Corporation for the Development of the Private Sector (ICD) to help develop SMEs in Egypt, Jordan, Morocco and Tunisia. (GulfBase.com) ICD, BTMUM sign MoU to expand Islamic finance activities – Islamic Corporation for the Development of the Private Sector (ICD) and Bank of Tokyo-Mitsubishi UFJ (Malaysia) Berhad (BTMUM) have signed a MoU to form a joint strategic collaboration to tap opportunities in the Islamic finance industry. The alliance will strengthen and ICD's relationship with its non- traditional partners in the Pacific region such as BTMUM, especially to promote cross-border investment in ICD member states and sharing of Islamic finance knowledge. (GulfBase.com) Boehringer Ingelheim partners with Cigalah and Tabouk in Kingdom – German pharmaceutical company Boehringer Ingelheim GmbH has entered into a tripartite agreement with Cigalah Group and Tabouk to set up production facilities in Saudi Arabia. Under the agreement, the partners will combine their technical expertise and local infrastructure to serve Saudi patients. With this contract, Cigalah and Tabuk will manage complex secondary packaging projects of 26 medicinal products for Boehringer Ingelheim. The agreement enables Boehringer to expand its range of medicines in Kingdom. (GulfBase.com) HFZA attracts FDI over $10bn – Hamriyah Free Zone Authority (HFZA), the second largest industrial free zone in the UAE has attracted over $10bn FDI. HFZA has 7 different zones catering to different sectors such as oil & gas, petrochemicals, steel, construction, timber, maritime and perfume, complimented by e- office packages. (GulfBase.com) Emirates NBD issues AUD400mn FRN due 2019 – Emirates NBD has issued AUD400mn Fixed Rate Notes (FRN), maturing in 2019, from its AUD1.5bn Debt Issuance Program. These notes are rated Baa1 by Moody’s and A+ by Fitch and pay a fixed rate coupon of 5.75%. ANZ, BNP Paribas, HSBC and Emirates NBD Capital were joint lead managers on the transaction. (Bloomberg) Ithmar to hire banks for AED5bn placement, IPO – According to sources, a group of investors led by Ithmar Capital are seeking to raise AED5bn to invest in healthcare and education sectors in the GCC region. These investors led by Ithmar have hired the National Bank of Abu Dhabi, Credit Suisse Group, Deutsche Bank and NCB Capital to advice on the plan. The financing plan includes raising AED2.25bn in a placement and AED2.75bn through an IPO on the Abu Dhabi stock exchange. Sources added that subscribers to the placement will not be able to buy shares in the IPO. Accelerating economic growth and a rally in Dubai and Abu Dhabi stocks are encouraging companies in the UAE to end a five-year drought in IPOs. (Gulf- Times.com) DIB’s 1Q2014 profits surge by 111% – Dubai Islamic Bank (DIB) has reported a 111% increase in its 1Q2014 net profits, which reached AED636.6 from AED301.7mn in 1Q2013. Net operating income for 1Q2014 amounted to AED1.3bn as compared to AED1.07bn in 1Q2013. Total revenue has increased to AED1.5bn, with a rise of 7.4% from 1Q2013. Total assets grew by 6.9% to AED121.2bn as on March 31, 2014 as compared to AED113.3bn as on December 31, 2013. EPS amounted to AED0.12 in 1Q2014 from AED0.07 in 1Q2013. Customer deposits increased by 8.9% to AED86.1bn from AED79.1bn. Further, DIB’s CEO said that the bank is in talks with a publicly-listed Islamic bank in Indonesia to take a 40% stake. (DFM, GulfBase.com) Arabtec declares 40% bonus shares – Arabtec Holding’s AGM has approved the distribution of 40% bonus shares for the year ended December 31, 2013. (DFM) Dentons advises Emirates NBD on $90.5mn loan facility – Dentons has advised Emirates NBD on a $90.5mn term-loan facility provided to Abu Dhabi-based investment company, Centurion Investments. The loan was to finance Centurion's acquisition of CSH Investment. (GulfBase.com) DWC records growth in passenger, freight volumes – Dubai World Central (DWC) has reported strong growth in passenger and freight volumes in 1Q2014 as more airlines commenced operations at Dubai's second airport. Freight volumes rose to 76,816 tons in 1Q2014, up 42.3% from 53,974 tons in 1Q2013. As a result of the increased activity, aircraft movements climbed sharply in 1Q2014 to 9,965 movements, up 142.8% from 4,104 movements in 1Q2013. The growth trend is expected to escalate in 2Q2014 with more than 600 flights per week temporarily moving over from Dubai International where both runways will be refurbished and upgraded between May 1, 2014 and July, 20, 2014. (GulfBase.com) Al Ahli Bank appoints new CEO – Al Ahli Bank has appointed Michel Accad as the Chief Executive Officer (CEO). Formerly, Accad was the CEO at Gulf Bank. (GulfBase.com) Abu Dhabi's Senaat shelves IPO plans – According to sources, Abu Dhabi government-owned General Holding Corporation (Senaat) has shelved its IPO plans. Senaat had mandated JP Morgan and HSBC for an IPO to be launched on the Abu Dhabi bourse by the summer of 2014. (Reuters) Omani commercial banks’ assets rise 10% to OMR23.2bn in February 2014 – The combined balance sheet of all commercial banks in Oman indicated positive growth in all major banking aggregates. Growth in the Omani banking sector has been aided by the sustained high crude oil prices, increased domestic demand, large public expenditure and accommodative monetary policy pursued by the Central Bank of Oman (CBO). Total assets of all commercial banks rose by 10% to OMR23.2bn in February 2014 as compared to OMR21.1bn a year ago. Of this, credit disbursement accounted for 66%, which increased by 8.5% YoY to OMR15.4bn at the end of February 2014. While credit to the government declined by 40%, credit to the private sector and public enterprises increased by 8.6% and 7.4%, respectively. (Bloomberg) Bank Muscat's Islamic unit plans $300mn sukuk – Bank Muscat's Islamic unit is planning to issue $300mn dual-currency sukuk. The issue could carry tenors of between three and five years, and would be a part of a OMR500mn sukuk program approved by the bank’s shareholders. (GulfBase.com) NCSI: Omani inflation up by 0.73% in March 2014 – According to the National Centre for Statistics & Information (NCSI), Oman's inflation has increased to 0.73% in March 2014 as compared to 0.06% in March 2013. However, on a MoM basis, the March rate witnessed a decline of 0.06% against the February figure. The NCSI report further revealed that 1Q2014 recorded an overall rise of 0.82% in inflation rate. This increase was due to the rise in food & non-alcoholic beverage prices by 2.78%, while housing, water, electricity, gas and other fuel costs

- 6. Page 6 of 7 grew by 1.38%. Furnishings, household equipment and routine household maintenance grew by 1.43%, health costs by 3.51%, education costs by 6.24%, clothing & footwear by 0.6%, and hotels & restaurant costs by 1.22%. Meanwhile, communication costs declined by 4.62%, transport costs also fell by 1.24%, recreation & culture group declined 0.16%, and services & goods dropped by 0.15%. (GulfBase.com) FCC exploring $3.5bn contract offers in Oman, Bahrain – The FCC, a citizen services company, is evaluating contract offers worth $3.5bn in Oman and Bahrain. In Oman, the FCC has already pre-qualified for the Diba-Lima-Khasab highway project, valued at $694mn, in the Straits of Hormuz zone. In addition, the FCC has just formed a consortium with an Indian company and an Omani firm to file an expression of interest for the construction of a railway project. The first 250km section of the project is valued at $999mn. FCC Aqualia, the company's water division, is bidding for three projects, which are currently in the prequalification phase. Two of these projects are in Bahrain and one in Oman. (Bloomberg)

- 7. Contacts Saugata Sarkar Keith Whitney Sahbi Kasraoui Head of Research Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (* Market closed on May 01, 2014) Source: Bloomberg (* Market closed on May 02, 2014) Source: Bloomberg (* Market closed on May 02, 2014) 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 Jun-10 Jan-11 Aug-11 Mar-12 Oct-12 May-13 Dec-13 QE Index S&P Pan Arab S&P GCC 0.8% 0.4% 0.3% 0.0% 0.3% 0.3% 0.4% 0.0% 0.4% 0.8% 1.2% SaudiArabia Qatar Kuwait Bahrain* Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,299.62 1.2 (0.3) 7.8 DJ Industrial 16,512.89 (0.3) 0.9 (0.4) Silver/Ounce 19.50 2.4 (1.0) 0.1 S&P 500 1,881.14 (0.1) 1.0 1.8 Crude Oil (Brent)/Barrel (FM Future) 108.59 0.8 (0.9) (2.0) NASDAQ 100 4,123.90 (0.1) 1.2 (1.3) Natural Gas (Henry Hub)/MMBtu 4.71 (1.3) 0.3 8.5 STOXX 600 337.76 (0.2) 1.3 2.9 LPG Propane (Arab Gulf)/Ton* 107.00 0.0 (3.4) (15.2) DAX 9,556.02 (0.5) 1.6 0.0 LPG Butane (Arab Gulf)/Ton 120.37 0.0 (1.8) (11.8) FTSE 100 6,822.42 0.2 2.0 1.1 Euro 1.39 (0.0) 0.3 0.9 CAC 40 4,458.17 (0.7) 0.3 3.8 Yen 102.20 (0.1) 0.0 (3.0) Nikkei 14,457.51 (0.2) 0.2 (11.3) GBP 1.69 (0.1) 0.4 1.9 MSCI EM 1,003.39 0.7 1.0 0.1 CHF 1.14 0.1 0.4 1.7 SHANGHAI SE Composite* 2,026.36 0.0 (0.5) (4.2) AUD 0.93 0.0 (0.0) 4.0 HANG SENG 22,260.67 0.6 0.2 (4.5) USD Index 79.52 (0.0) (0.3) (0.6) BSE SENSEX 22,403.89 (0.1) (1.3) 5.8 RUB 35.84 0.6 (0.6) 9.0 Bovespa 52,980.31 2.6 3.1 2.9 BRL 0.45 0.5 0.9 6.4 RTS 1,148.96 (0.6) 2.6 (20.4) 182.9 152.9 139.4