Understanding business customers' financing needs

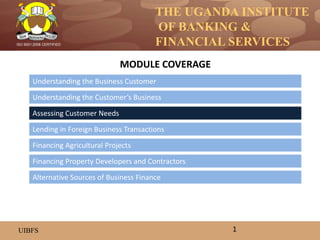

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Understanding the Business Customer Understanding the Customer’s Business Assessing Customer Needs Lending in Foreign Business Transactions Financing Property Developers and Contractors Financing Agricultural Projects MODULE COVERAGE 1 Alternative Sources of Business Finance

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Assessing the business customer’s need for financing As a rule of the thumb (but by no means exhaustive guide), the customer genuinely needs financing and the transaction is likely to be viable if: • The need is triggered by increases in the volume of business. • Sales figures (monthly, weekly or annually) are increasing in a considerable way. • The business remains profitable or gets more profitable, yet cash flow is a challenge (because of volume growth). (NB: It is not profits that pay loans but cash!) • The financing need is to expand capacity, in response to sustainable increased market demand. • Management of the finances in the business is prudent, and personal finance of the owners/shareholders is distinct from that of the business. • The customer, who is successful and remains profitable, wants to diversify into a new area. • The size of the customer’s balance sheet and business volume justifies/relates to the loan request. 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Assessing non-financial needs of business customers There are times when customers seek for bank advances honestly but mistakenly. The problem could be in an area that will not be solved by borrowing more money to put into the business. In several businesses, mistakes or inadequacies in non-financial areas can result into persistent cash flow challenges. Because the customer is unwilling or unaware of the real issues, he/she prefers to borrow money to address the symptom rather than the problem. Typical areas to consider in assessing the customer’s non-financial needs which might cause financial difficulties are; a. Customer’s life style: Is the customer financially prudent? Frugal? Careful? Wasteful? Does he keep up to date records of his own drawings from the business and are these replenished back? 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED b. Business and financial management skills: Is the customer good at managing the business overall? Are the right people in the right places? Are there good systems for safety and soundness in the conduct of daily business transactions? Is the money well managed and accounted for on a daily basis? c. Profitability assessment: Does the customer assess and calculate/track profits regularly? (unprofitable businesses eventually result into cash flow shortages and if the customer is unable to detect this, they might prefer to borrow to cover the cash flow shortfalls) d. Internal controls and safety: Are the stocks, money, business assets, procurement processes, cash receipts and other transactions completely safe from possible pilferage? e. Management of inventory and debtors: Are the stocks of raw materials, finished goods, merchandize and other things at suitable levels/ (overstocking means to much money is always tied up in inventory). Is the customer managing the debts/ accounts payable effectively? Giving lots of time to debtors while borrowing to finance working capital can be very costly, eventually reducing margins and cash flows. 4

Notas del editor

- At the end of this unit, the students should be able to: Determine the cause and suitability of the business customer’s need for financing. Relate the customer’s business size to financing needs. Explain how to assess non-financial needs of business customers.

- It can sometimes be difficult to tell whether the customer really needs financing, and to what extent. In some cases customers mismanage the business, it becomes illiquid and then they come to the bank for a loan to revamp the financial position of the business. This mismanagement-triggered need is not good ground for the bank to lend. The customer could just do the same thing – mismanage and later come back or go somewhere else for another loan. (Note however that much as diversification mitigates risk, some businesses may collapse as a result. A customer who focuses and remains efficient in a business may perform better. If you chase two rabbits, you catch none!)