Accounts Payable Automation: Preparing Your Organization for a Digital Future

•

3 recomendaciones•3,344 vistas

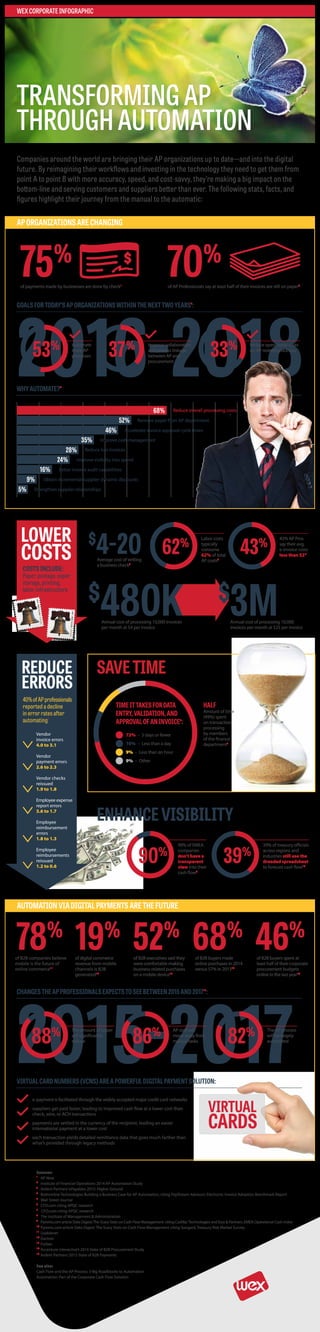

The accounts payable function at organizations is evolving, and as companies bring their AP processes into the digital future, they need technological advances to keep up, bringing them from point A to point B with more accuracy, speed, and cost-savvy. All of this and more can be done with planning and automation. The following infographic shares statistics, facts, and tips on AP automation and modernizing your business processes for improved customer and supplier relationships, better discount capture, and enhanced visibility into business processes.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (19)

Accounts Payable Trends 2017: The Process and Technology of AP Invoices | Sep...

Accounts Payable Trends 2017: The Process and Technology of AP Invoices | Sep...

Accounts Payable Killer Application for SharePoint

Accounts Payable Killer Application for SharePoint

Case Study on Driving Procure to Pay (Purchase to Pay) Quick Wins

Case Study on Driving Procure to Pay (Purchase to Pay) Quick Wins

Accounts Payable Trends 2017: The Process and Technology of AP Invoice | Octo...

Accounts Payable Trends 2017: The Process and Technology of AP Invoice | Octo...

Tradeshift, Hackett Group & sharedserviceslink - P2P Webinar

Tradeshift, Hackett Group & sharedserviceslink - P2P Webinar

Acounts Payable Trends 2017: The Process and Technology of AP Invoice (ACAP)

Acounts Payable Trends 2017: The Process and Technology of AP Invoice (ACAP)

“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]![“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]

Destacado

Destacado (11)

How Payments Have Evolved Since the Stone Age: Conch Shells to Credit Cards a...

How Payments Have Evolved Since the Stone Age: Conch Shells to Credit Cards a...

AP Automation and Invoice Processing: Removing Paper Pain

AP Automation and Invoice Processing: Removing Paper Pain

Visa inc. q4 2016 financial results conference call presentation

Visa inc. q4 2016 financial results conference call presentation

Invoice & AP Automation: Improving Cash Flow Management

Invoice & AP Automation: Improving Cash Flow Management

Visa inc. q1 2017 financial results conference call presentation

Visa inc. q1 2017 financial results conference call presentation

105 accounts payable interview questions and answers

105 accounts payable interview questions and answers

Similar a Accounts Payable Automation: Preparing Your Organization for a Digital Future

Watch the recording of this session and learn how to structure a winning AP automation strategy from beginning to end. We will show demos of Intelligent Data Capture and RPA in action for invoice processing.10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP Automation

10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP AutomationAuxis Consulting & Outsourcing

Similar a Accounts Payable Automation: Preparing Your Organization for a Digital Future (20)

MnCCC 2016- Account payable trends for local government

MnCCC 2016- Account payable trends for local government

Electronic Payments and the Last Mile of the Procure-to-Pay Transformation

Electronic Payments and the Last Mile of the Procure-to-Pay Transformation

Accelerate cash flow and reduce costs with digital payments

Accelerate cash flow and reduce costs with digital payments

Working Capital Management: The Missing Link in Payables and P2P

Working Capital Management: The Missing Link in Payables and P2P

Digital Onboarding Made Easy with the Inception of AI-Based Algorithms

Digital Onboarding Made Easy with the Inception of AI-Based Algorithms

CSI-globalVCard-Whitepaper-Whats-holding-your-business-back

CSI-globalVCard-Whitepaper-Whats-holding-your-business-back

How to take Procure-to-Pay (P2P) from tactical to value-adding

How to take Procure-to-Pay (P2P) from tactical to value-adding

10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP Automation

10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP Automation

Último

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

VIP Call Girls Napur Anamika Call Now: 8617697112 Napur Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Napur Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Napur understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS Live

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(07-May-2024(PSS)VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Último (20)

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Value Proposition canvas- Customer needs and pains

Value Proposition canvas- Customer needs and pains

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Accounts Payable Automation: Preparing Your Organization for a Digital Future

- 1. 2016-2018 WEXCORPORATEINFOGRAPHIC APORGANIZATIONSARECHANGING WHYAUTOMATE?4 Companies around the world are bringing their AP organizations up to date—and into the digital future. By reimagining their workflows and investing in the technology they need to get them from point A to point B with more accuracy, speed, and cost-savvy, they’re making a big impact on the bottom-line and serving customers and suppliers better than ever. The following stats, facts, and figures highlight their journey from the manual to the automatic: 68% Reduce overall processing costs Remove paper from AP department Accelerate invoice approval cycle times Improve cash management Reduce lost invoices Improve visibility into spend 52% 46% 35% 28% 24% Better invoice audit capabilities16% Obtain incremental supplier dynamic discounts9% Strengthen supplier relationships5% GOALSFORTODAY’SAPORGANIZATIONSWITHINTHENEXTTWOYEARS3 : 75% 70% of payments made by businesses are done by check1 of AP Professionals say at least half of their invoices are still on paper2 53% 37% 33%Improve collaboration and process linkage between AP and procurement Reduce operational costs on AP-related processes Automate more AP processes AUTOMATIONVIADIGITALPAYMENTSARETHEFUTURE LOWER COSTS LOWER COSTS REDUCE ERRORS SAVETIME ENHANCEVISIBILITY COSTSINCLUDE: Paper, postage, paper storage, printing, labor, infrastructure 40%ofAPprofessionals reported a decline in error rates after automating2 $ 4-20Average cost of writing a business check5 $ 3MAnnual cost of processing 10,000 invoices per month at $25 per invoice $ 480KAnnual cost of processing 10,000 invoices per month at $4 per invoice 62% 2015-2017 CHANGESTHEAPPROFESSIONALSEXPECTSTOSEEBETWEEN2015AND201715 : VIRTUALCARDNUMBERS(VCNS)AREAPOWERFULDIGITALPAYMENTSOLUTION: 78% 19% 52% 68% 46% 88% 86% 82%AP staff will move away from manual tasks The AP process will be largely automated The amount of paper will significantly reduce Labor costs typically consume 62% of total AP costs6 43% 43% AP Pros say their avg. e-invoice costs less than $22 90% 90% of EMEA companies don’t have a transparent view into their cash flow6 39% 39% of treasury officials across regions and industries still use the dreaded spreadsheet to forecast cash flow10 TIMEITTAKESFORDATA ENTRY,VALIDATION,AND APPROVALOFANINVOICE2 : 72% – 5 days or fewer 10% – Less than a day 9% – Less than an hour 9% – Other HALF Amount of time (49%) spent on transaction processing by members of the finance department7 Vendor invoice errors 4.0 to 3.1 Vendor payment errors 2.6 to 2.3 Vendor checks reissued 1.9 to 1.8 Employee expense report errors 3.6 to 1.7 Employee reimbursement errors 1.8 to 1.3 Employee reimbursements reissued 1.2 to 0.6 of B2B companies believe mobile is the future of online commerce11 of digital commerce revenue from mobile channels is B2B generated12 of B2B executives said they were comfortable making business-related purchases on a mobile device13 of B2B buyers made online purchases in 2014 versus 57% in 201314 of B2B buyers spent at least half of their corporate procurement budgets online in the last year14 e-payment is facilitated through the widely accepted major credit card networks suppliers get paid faster, leading to improved cash flow at a lower cost than check, wire, or ACH transactions payments are settled in the currency of the recipient, leading an easier international payment at a lower cost each transaction yields detailed remittance data that goes much farther than what’s provided through legacy methods VIRTUAL CARDS Sources: 1 AP Now 2 Institute of Financial Operations 2014 AP Automation Study 3 Ardent Partners’ePayables 2015: Higher Ground 4 Bottomline Technologies Building a Business Case for AP Automation, citing PayStream Advisors; Electronic Invoice Adoption Benchmark Report 5 Wall Street Journal 6 CFO.com citing APQC research 7 CFO.com citing APQC research 8 The Institute of Management & Administration 9 Pymnts.com article Data Digest:The Scary Stats on Cash Flow Management: citing CashfacTechnologies and East & Partners, EMEA Operational Cash Index 10 Pymnts.com article Data Digest: The Scary Stats on Cash Flow Management citing Sungard, Treasury Risk Market Survey 11 Usablenet 12 Gartner 13 Forbes 14 Accenture Interactive’s 2014 State of B2B Procurement Study 15 Ardent Partners’2015 State of B2B Payments See also: Cash Flow and the AP Process: 3 Big Roadblocks to Automation Automation: Part of the Corporate Cash Flow Solution TRANSFORMINGAP THROUGHAUTOMATION