Auditingpresentation

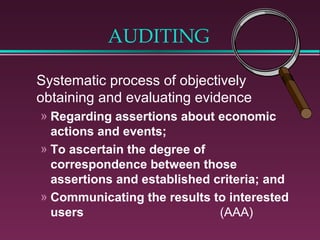

- 1. AUDITING Systematic process of objectively obtaining and evaluating evidence » Regarding assertions about economic actions and events; » To ascertain the degree of correspondence between those assertions and established criteria; and » Communicating the results to interested users (AAA)

- 2. Purpose of an Audit To provide certain degree of assurance that the activities reviewed (financial statements, operations, management practices, etc.) have been performed in accordance with applicable standards or practices.

- 3. Standards on Auditing Either: International Standards on Auditing, issued by IFAC (International Federation of Accountants) or: Standards for Government Auditors, issued by INTOSAI (International Organization of Supreme Audit Institutions)

- 4. AUDIT COMPLIANCE TYPES OF AUDITS Financial Compliance Operational

- 5. FINANCIAL AUDITS The Implementing Organization’s Financial Statements Project Financial Statements Statements of Expenditures (SOEs) Special Bank Account (SA)

- 6. Implementing Organization’s Financial Statements Overall objective is to express an opinion on fairness of statements Phases: Understanding the Organization Evaluating Internal Controls Testing Financial Statement Balances

- 7. Understanding the Organization Nature of the Organization’s Activities Organization’s Background Significant Trends and Relationships Staff Appraisal Report (SAR) Loan Agreement Other Documents Pertaining to the Project

- 8. Evaluating Internal Controls Purpose: To determine the audit tests required for forming an opinion How much Reliance on internal controls? Extent of Validation? » Tests of Compliance » Tests of Transactions Not an endorsement of the overall adequacy of the internal control system

- 9. Testing the Balances Purpose: To determine if information is fairly presented Examples: » Observation of Inventory-taking » Verification of Fixed Assets » Direct Verification with Third Parties Level of Testing Might Depend on Results from Prior Phases

- 10. Audit of Project Financial Statements Overall Objectives » Statements fairly presented? – For the period – Cumulatively Disbursements made in accordance with: » Loan agreement » SAR Fair presentation of balance sheets, especially assets

- 11. Audit of Project F/S (cont.) Similar to the audit process for the entity’s financial statements, except: » Greater emphasis on inspection of valid supporting documentation » Additional steps, such as physical observation of significant items, to substantiate the validity of expenditures reported.

- 12. Audits of SOEs Primary objective is to ascertain that individual expenditures reported in the SOEs are: Fully supported by proper documentation in files Properly authorized and eligible Appropriately accounted for

- 13. Audits of SOEs ...Continued Why? » Because withdrawal requests are not supported by documentation submitted to the Bank Effect? » Results of audit are basis for determining whether to continue use of SOEs, or if adjustment must be made on subsequent claims

- 14. Audits of Special Accounts Primary objectives are to verify that: SA financial statements are fairly presented, and disbursements from SAs are proper and in accordance with the respective loan agreements

- 15. Audits of Special Accounts (cont.) Auditors should: » Review the SA records maintained by the Implementing Institution » Review the SA bank statements » Reconcile (including tracking of in- transit items) » Directly confirm balances with Bank » Examine treatment and disclosure of interest earned on SA

- 16. Audits of Adjustment Loans Primary focus is on the adequacy of procedures used to prepare customs or similar certificates. Limited to examining certificates on which SOEs have been based and determining reliability of the procedures applied in verifying or issuing such certificates

- 17. Audits of Adjustment Loans (cont.) Important issues: » TOR must satisfy financial covenants » Documentation must not have been used to justify another adjustment loan » Claims must be properly documented » Negative list items must be verified » Cut-off dates must be verified

- 18. Requirements for Auditors Adherence to principles of integrity, objectivity, independence and confidentially Adequate and Competent Staff Work performed by personnel who have technical training and proficiency Proper direction and supervision of work (includes quality control)

- 19. Selection of Auditors Preferably independent auditors who meet ISA criteria and are members of bodies affiliated with IFAC Government audit institutions should subcontract with audit firms until equivalent independence and technical competence is achieved. The Bank can help them to meet this goal

- 20. Determining Auditor Acceptability TM should consult with an accounting professional and consider the following: » Evidence of independence » Qualifications and experience of key personnel » Time and personnel reqs. of the audit » Experience with: – Bank projects – Operations similar to the project » Peer review, quality control, CPE

- 21. Government Auditors Usually the “Supreme Audit Institution (SAI)” Contralor Should: General » Report to legislature, rather than executive branch of government » Have statutory authority » Preferably be a member of INTOSAI, and meet corresponding standards

- 22. Private Sector Auditors Independent auditors who meet ISA criteria and are members of bodies affiliated with IFAC Duly licensed to practice the profession Competent staff and adequate facilities Preferably affiliated with an international firm that provides adequate guidance and quality control

- 23. Appointing the Auditor The borrower appoints the auditor, but only after the Bank has expressed the acceptability of the auditor proposed. The auditor should be appointed well before the beginning of the fiscal year. Preferably there should be a multi-year contract.

- 24. Terms of Reference (TOR) Provide guidance for the audit and format of the audit report Should not restrict the auditor’s obligations with respect to legislation, regulation, and auditing standards » In the event of poor performance, auditors should not be able to claim that TOR requirements prevented them from doing professional work Guidelines & Sample: Annexes 18-19

- 25. Additional Guidance “Suggested Minimum Guidelines and Terms of Reference for the Planning and Execution of External Audits of Borrowers, Executing Agencies and Operations Financed by the World Bank” FM-600 Summarizes Requirements stated in FM-100, FM-200 and FM-300

- 26. Contract or Engagement Letter All engagements with audit firms should be supported by a contract Contract should specifically incorporate the TORs Engagement letters are prepared by auditors and should not substitute either the TORs or the contract Audits by Government Auditors should at least be supported by acceptable TORs

- 27. Auditors’ Opinions Written upon completion of the audit of the institution/project financial statements » Should contain separate SOE paragraph if they are used in the project Types of Audit Opinions » Unqualified » Qualified » Adverse » Disclaimer of opinion Samples: Annex XXI

- 28. Opinions Required (Project) Project Financial Statements (Sources and Applications of Funds, Accumulated Investments, Supplementary Information) Certificates of Expenditures for period audited Special Account Compliance Internal Control Structure Disclosure of Audit Procedures

- 29. Management Letter Is a report on the internal controls and operating procedures of the institution Must address: » Any subjects which the project managers and the auditor had previously agreed should be discussed » All other matters that the auditor judges to be worthy of management’s attention

- 30. Financing of Audit Costs Normally financed by Borrower if part of its normal operating expenditures » Exceptions must be approved by the RVP May be included in project budget if costs are incremental because of project nature Audits performed by government auditors should not be financed by the Bank

- 31. Report Submission Audited financial statements should be submitted within six months from the end of implementing institution’s fiscal year » Or sooner if agreed upon by the Bank and the borrower