ToTCOOP+i Lesson plan unit 8_final_version_en

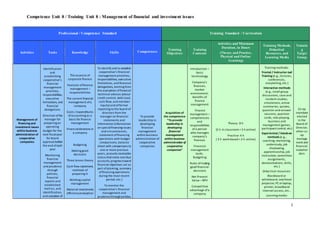

- 1. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 1 Professional / Competence Standard Training Standard / Curriculum Activities Tasks Knowledge Skills Competences Training Objectives Training Contents Activities and Minimum Duration, in Hours (Theory and Practice, Physical and Online Learning) Training Methods, Didactical Resources, and Learning Media Trainin g Target Group Management of financing and investment issues within business administration of cooperative companies Identification and establishing cooperative’s financial management priorities, responsibilities, executive limitations, and financial delegations Direction ofthe manager for preparing an operating budget for the next fiscalyear for board approvalbefore the end ofeach year Monitoring financial management and prudence through policies, financial reports and established metrics, and identification, and adoption of The essence of corporate finance Features offinance management – responsibilities The current financial management ofa company Costs / expenditures of accounting as a basis for finance management Financialdecisions in a company Budgeting Making good decisions Three lenses theory Cash flow statement, methods of preparing it Working capital management Material investments efficiencyevaluation To identify and to establish cooperative’s financial management priorities, responsibilities, executive limitations, and financial delegations, starting from the evaluation offinancial technical advices (about credit control, debt load, cash-flow, and member equity) and offormal reporting to the board of directors from the manager on financial statements and information (information on specialfinancing issues and circumstances, statement offinancing operations with budget comparisons, balance sheet with comparisons to one or more previous years, accounts receivable status thatnotes overdue accounts,progress toward financial objectives set as part ofplanning, summary offinancing operations during the most recent period, etc.) To monitor the cooperative’s financial management and prudencethroughpolicies, To provide leadership in developing financial management within business administration of cooperative companies Acquisition of the competence “To provide leadership in developing financial management within business administration of cooperative companies” Introduction – basic terminology Company’s finances, market environment, benefits of finance management Finance management – competencies and responsibilities ofa person who manages company’s finances Financial management tasks. Budgeting Rules ofmaking good financial decisions Net Present Value –NPV Competitive advantage ofa company Theory: 8 h (5 h in classroom + 3 h online) Practice: 4 h ( 2 h work-based +2 h online) Training methods: Frontal / Instructor-Led Training (e.g., lectures, conferences, storytelling, etc.) Interactive methods (e.g., small group discussions, case and incident studies, simulations, active summaries, quizzes, question-and-answer sessions, question cards, role-playing, business and management games, participantcontrol, etc.) Experiential / Hands-on methods(e.g., coaching, mentoring, understudy, job shadowing, apprenticeship, job instruction, committee assignments, demonstrations, drills, etc.) Didactical resources: Blackboard or whiteboard, overhead projector, PC orlaptop, printer, broadband internet access, etc.. Learning media: Co-op members elected in the Board of Director, other co- op manage ment and financial stakehol ders

- 2. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 2 Professional / Competence Standard Training Standard / Curriculum Activities Tasks Knowledge Skills Competences Training Objectives Training Contents Activities and Minimum Duration, in Hours (Theory and Practice, Physical and Online Learning) Training Methods, Didactical Resources, and Learning Media Trainin g Target Group necessary adjustments Investment and financing approaches during downturn in economic activity within economic recession and depression periods Methods, techniques,andtools for establishing cooperative’s financial management priorities, responsibilities, executive limitations, and financial delegations Methods, techniques,andtools for monitoring financial management and prudence through policies, financial reports and established metrics, and for identifying and adopting needed corrections financial reports and established metrics, identifying and adopting the necessary adjustments To set and update cooperative’s investment management objectives and strategies to be implemented by the managerfor achieving the investment objectives To monitor theprocess of achievement of cooperative’s investment objectives and implementation ofrelated strategies, and to identify and adopt the necessary adjustments Three lenses theory Making long – term decisions Where to look for money for development? Making short – term decision Working capital and cash General principles of accountancy – bookkeeping and financial documents circulation Questions. Evaluation. Summary and closure Printed and digital texts Learning Management Systems (e.g., discussion pages, threaded discussions, chat rooms, group pages, gradebook, etc.) Social Media Applicationsand Peer- to-Peer Platforms (e.g., Facebook, Edmodo, Classroom 2.0, Peer2Peer University, etc.) Web Conference Software (e.g., Online Meeting/Conferencing Applications, Two-Way Audio, etc.)

- 3. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 3 Learning Activities List. 1. Activity 1: Message of welcome, participants introduction, explanation of the rules and program of the training. Participants’ needs and expectations. Introduction – basic terminology. Company’s finances, market environment, benefits of finance management (90 minutes). 2. Activity 2: Finance management – competencies and responsibilities of a person who manages company’s finances (90 minutes). 3. Activity 3: Financial management tasks. Budgeting (60 minutes). 4. Activity 4: Rules of making good financial decisions. Making good financial decisions (60 minutes). 5. Activity 5: Net Present Value – NPV. Competitive advantage of a company (90 minutes). 6. Activity 6: Three lenses theory (60 minutes). 7. Activity 7: Making long – term decisions (90 minutes). 8. Activity 8: Where to look for money for development? (60 minutes). 9. Activity 9: Making short – term decision. Working capital and cash. General principles of accountancy – bookkeeping and financial documents circulation (90 minutes). 10. Activity 10: Questions. Evaluation. Summary and closure (30 minutes).

- 4. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 4 Learning Activities Description. Activity 1: Message of welcome, participants introduction, explanation of the rules and program of the training. Participants’ needs and expectations. Introduction – basic terminology. Company’s finances, market environment, benefits of finance management Duration: 90 min. Short description: Slides 1 - 13 Message of welcome. Ask students what their expectations are. Trainer discusses aims & objectives. Outline workshop structure. learning activities: Explain basic terminology in relation to company’s financial issues. Explain, why financial management is crucially important when it comes to the company’s development. Explain the benefits of a thought through financial management for the following stakeholders: 1. Social cooperative members 2. Management personnel 3. Employees 4. Contractors 5. Requirements of financial authorities self-assessment and peer-evaluation: Ask students what benefits of financial management they can recognize in their own company? Ask students what problems they can recognize in their own company in relation to financial management? Group Discussions

- 5. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 5 Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links: Economics for Everyone: A Short Guide to the Economics of Capitalism, Jim Stanford, 2008

- 6. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 6 Activity 2: Finance management – competencies and responsibilities of a person who manages company’s finances Duration: 90 min. Short description: Slides 14 - 21 learning activities: Ask students, what the purpose of financial management in their own company is. What is the efficiency? Ask students if they are aware who makes financial decisions in their company. Are the competencies and responsibilities of the above mentioned person clearly defined? Explain the benefits of systematic and well organized finance management. Ask students what the basic and additional competencies of a person responsible for finances management should be. Do they know such a person? Ask students to imagine their company in five years’ time. Should the competencies of people responsible for finance management change? If so, ask them to elaborate. self-assessment and peer-evaluation: Group Discussions Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation

- 7. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 7 on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links: Video: http://study.com/academy/lesson/the-role-and-responsibilities-of-financial-managers.html

- 8. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 8 Activity 3: Financial managements task. Budgeting. Duration: 60 min. Short description: Slides 22 - 27 learning activities: Explain the tasks and goals of good finance management. Show the most popular forms of budgeting and discuss it with the students which form will be best suitable in their own company. Carry out the training in accordance with the following rules: 1. Divide all the students into groups of 3 to 4 people 2. Every group is tasked with preparing an example of a budget for a manufacturing plant in accordance with one of the following types: continuous budgeting incremental budgeting up – high budgeting participative budgeting self-assessment and peer-evaluation: Group Discussions. Discuss the results of the exercise with the students. Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what

- 9. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 9 could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links http://www.ruralfinanceandinvestment.org/node/363 http://www.ruralfinanceandinvestment.org/sites/default/files/1146140660614_coop_budg et_en.pdf

- 10. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 10 Activity 4: Rules of making good financial decisions. Making good financial decisions Duration: 60 min. Short description: Slides 28 – 33 learning activities: What are the principles of making good financial decisions? Present an example of every of the above mentioned principles. Ask students to explain what principles they have been taking into consideration recently. Did they do it with full awareness or subconsciously? self-assessment and peer-evaluation: Group Discussions. Discuss the results of the exercise with the students. Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer.

- 11. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 11 Documentation/Internet Links https://2012books.lardbucket.org/books/business-accounting/s04-01-making-good-financial- decision.html https://www.eiuperspectives.economist.com/financial-services/supporting-good-financial- decision-making

- 12. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 12 Activity 5: Net Present Value – NPV. Competitive advantage of a company Duration: 90 min. Short description: Slides 34 - 39 learning activities: Ask students whether they know what NPV is. Explain to the students the Net Present Value. (The net present value rule, a logical outgrowth of net present value theory, refers to the idea that company managers or investors should only invest in projects or engage in transactions which have a positive net present value (NPV), and should avoid investing in projects which have negative net present values. According to the net present value rule theory, investing in something that has a net present value greater than zero should logically increase a company's earnings; or in the case of an investor, increase a shareholders’ wealth. Net present value is a commonly used metric in capital budgeting that accounts for the time value of money, which is the idea that future dollars have less value than presently held dollars. It is a discounted cash flow calculation that reflects the potential change in wealth resulting from an undertaking, factoring in the time value of money by discounting projected cash flows back to the present, using a company's weighted average cost of capital (WACC). A project or investment's NPV equals the present value of net cash inflows that the project is expected to generate, minus the initial required investment for the project. Based on a selected example explain to the student how to calculate NPV. Exercise: Based on their own company’s recent year’s selected investment every student is tasked with evaluating whether it was profitable in accordance with NPV formula and NPV principles of management. Explain why the competitive advantage of a company is crucial when it comes to the development. Based on examples, show the types of competitive advantage. self-assessment and peer-evaluation:

- 13. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 13 Group Discussions. Discuss the results of the exercise with the students. Ask students what competitive advantages of their company they can recognize. Discuss what can be changed in terms of the form in order to build or improve competitive advantage of their companies. Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links https://www.youtube.com/watch?v=HFFkFMfotT0

- 14. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 14 Activity 6: Three lenses theory Duration: 60 min. Short description: Slides 40 - 45 learning activities: Ask students whether they have heard of three lenses theory. Explain the three lenses theory – there are three aspects of analyses – the way one should look at a company: economics, finance and assets. Every lense shows a partial information concerning a company and all three give the complete and reliable evaluation as for the company’s situation. Based on a selected example explain how students can make such analyses in accordance with the above mentioned method. When explaining assets lense, show basic strategies of financing company assets: dynamic conservative moderate self-assessment and peer-evaluation: Group Discussions. Discuss it with the students which strategy could be best for their Cooperative. Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-

- 15. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 15 assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links https://ocw.mit.edu/courses/sloan-school-of-management/15-301-managerial-psychology- fall-2006/lecture-notes/lec2.pdf

- 16. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 16 Activity 7: Making long – term decisions Duration: 90 min. Short description: Slides 46 - 51 learning activities: Ask students how long – term financial decisions influence their company’s development. Are the above mentioned decisions monitored, controlled? If so, ask students to elaborate on this topic. Explain the conditions under which good long – term decisions can be made. Discuss it with the students, who should make decisions related to investments and how would these investments influence company’s development. What is the company’s dividend policy? Is it clear? Should it be changed? self-assessment and peer-evaluation: Group Discussions. Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what

- 17. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 17 could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links https://www.youtube.com/watch?v=7grqqbSgiWc

- 18. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 18 Activity 8: Where to look for money for development? Duration: 60 min. Short description: Slides 52 - 57 learning activities: Ask students where from they take money for development in their companies. Explain the traditional methods of obtaining capital for development from outside. Explain the alternative methods of obtaining capital for development from outside: Factoring Financial transaction and a type of debtor finance in which a business sells its accounts receivable to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable. Franchasing is the practice of the right to use a firm's business model and brand for a prescribed period of time. The word "franchise" is of Anglo-French derivation— from franc, meaning free—and is used both as a noun and as a (transitive) verb. For the franchisor, the franchise is an alternative to building "chain stores" to distribute goods that avoids the investments and liability of a chain. The franchisor's success depends on the success of the franchisees. The franchisee is said to have a greater incentive than a direct employee because they have a direct stake in the business Forfaiting Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter Leasing

- 19. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 19 A lease is a contractual arrangement calling for the lessee (user) to pay the lessor (owner) for use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment is also leased Give examples. Show possibilities of obtaining EU grants for development purposes. self-assessment and peer-evaluation: Group Discussions. Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links http://www.investopedia.com/terms/f/franchised-monopoly.asp http://www.investopedia.com/terms/f/forfaiting.asp http://www.investopedia.com/terms/o/operatinglease.asp http://www.investopedia.com/terms/f/franchise.asp https://www.youtube.com/watch?v=D3UoRhdtR1w

- 20. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 20 Activity 9: Making long – term decisions. Working capital and cash. General principles of accountancy – bookkeeping and financial documents circulation Duration: 90 min. Short description: Slides 58 - 69 learning activities: How to make good short – term decisions? What is the purpose of short – term decisions? What are the principles of good short – term decision making? Give examples. How does working capital circulate in an economy? How does my company manage working capital? What is the role that reserves play in your company? How does my company manage cash? What are the proper ways of managing cash? What can I do to improve my company in terms of working capital and cash management? Present and explain the following principles: Accountancy in a company. Production process of accounting books. Marking accounting books (short descriptions). Proper circulation of accounting books. Explain why proper and good accounting and accounting books management has a fundamental impact on proper evaluation of financial flows. self-assessment and peer-evaluation: Group Discussions.

- 21. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 21 Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer. Documentation/Internet Links http://study.com/academy/lesson/what-is-accounting-purpose-importance-relationship-to- business.html

- 22. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 22 Activity 10: Questions. Evaluation. Summary and closure. Duration: 30 min. Short description: Slide 70 learning activities: Invite students to ask questions. Ask students for their evaluation of the training – feedback. Deliver the summary and close the training. self-assessment and peer-evaluation: Group Discussions. Self-reflection of understanding Material: didactics equipments (flipchart with markers, PC with projector), material for students such as: sheets of paper, pens, marker pens. Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about good interpersonal communication, ensuring both the required scientific support in communication learning, and the non-formal learning facilitation (e.g. effective communication with them, learner orientated and empathic approaches, consideration of the individual experiences of the learners, etc.). For evaluation of learning outcomes, self- assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give their personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback from other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involved learners and the trainer.

- 23. Competence Unit 8 / Training Unit 8 : Management of financial and investment issues 23 Documentation/Internet Links None