Financial Reporting Balance Sheet

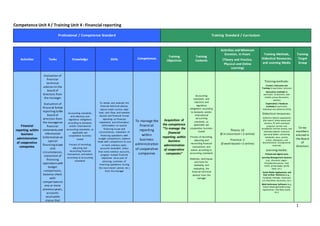

- 1. 1 Competence Unit 4 / Training Unit 4 : Financial reporting Professional / Competence Standard Training Standard / Curriculum Activities Tasks Knowledge Skills Competences Training Objectives Training Contents Activities and Minimum Duration, in Hours (Theory and Practice, Physical and Online Learning) Training Methods, Didactical Resources, and Learning Media Training Target Group Financial reporting within business administration of cooperative companies Evaluation of financial technical advices to the board of directors from the manager Evaluation of financial formal reporting tothe board of directors from the manageron financial statements and information (information on special financing issues and circumstances, statement of financing operations with budget comparisons, balance sheet with comparisons to one or more previous years, accounts receivable status that Accounting standards, and statutory and regulatory obligations according to domestic and/or international accounting standards, as applicable per cooperative business model Process of recording, adjusting and reconciling financial transactions and events according to accounting standards To review and evaluate the financial technical advices (about credit control, debt load, cash-flow, and member equity) and financial formal reporting on financial statements and information (information on special financing issues and circumstances, statement of financing operations with budget comparisons, balance sheet with comparisons to one or more previous years, accounts receivable status that notes overdue accounts, progress toward financial objectives set as part of planning, summary of financing operations during the most recent period, etc.) from the manager To manage the financial reporting within business administration of cooperative companies Acquisition of the competence “To manage the financial reporting within business administration of cooperative companies” Accounting standards, and statutory and regulatory obligations according to domestic and/or international accounting standards, as applicable per cooperative business model Process of recording, adjusting and reconciling financial transactions and events according to accounting standards Methods, techniques and tools for reviewing and evaluating the financial technical advices from the manager Theory: 10 (8 in classroom +2 online) Practice: 2 (0 work-based +2 online) Training methods: Frontal / Instructor-Led Training (in particular, lectures) Interactive methods (in particular, simulations, case studies, group discussions, quizzes) Experiential / Hands-on methods (in particular, individual and collective drills) Didactical resources: Collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containing notebooks, pens, pencils, eraser, sharpeners, and documentation of programme material) Learning media: Printed and digital texts Learning Management Systems (e.g., discussion pages, threaded discussions, chat rooms, group pages, grade book, etc.) Social Media Applications and Peer-to-Peer Platforms (e.g., Facebook, Edmodo, Classroom 2.0, Peer2Peer University, etc.) Web Conference Software (e.g., Online Meeting/Conferencing Applications, Two-Way Audio, etc.) Co-op members elected in the Board of Directors

- 2. 2 Activities Tasks Knowledge Skills Competences Training Objectives Training Contents Activities and Minimum Duration, in Hours (Theory and Practice, Physical and Online Learning) Training Methods, Didactical Resources, and Learning Media Training Target Group notes overdue accounts, progress toward financial objectives set as part of planning, summary of financing operations during the most recent period, etc.)

- 3. 3 Training Unit 4: Financial reporting Learning Activities List Activity 1: Approaching main financial statements within international financial reporting standards applied in EU : balance sheet (90 min.) Activity 2: Approaching main financial statements within international financial reporting standards applied in EU : income statement (90 min.) Activity 3: Approaching main financial statements within international financial reporting standards applied in EU : equity statement (90 min.) Activity 4: Approaching main financial statements within international financial reporting standards applied in EU : cash flow statement (90 min.) Activity 5: Approaching main financial statements within international financial reporting standards applied in EU : management discussion and analysis - MD&A (90 min.) Activity 6: Application to cooperatives in EU of international financial reporting standards : the case of the IAS 32 (90 min.) Activity 7: Approaching international financial reporting standards specific for agriculture applied in EU : the IAS 41 Agriculture (90 min.) Activity 8: Approaching financial statement analysis (90 min.)

- 4. 4 Activity 1: Approaching main financial statements within international financial reporting standards applied in EU : balance sheet Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience for the comprehension, review and evaluation of financial reportsof the cooperative enterprise,startingfromthe balance sheetorstatementof financialposition. The purpose is to develop the skills for reviewing and evaluating the financial statement reporting on the cooperative’s assets, liabilities, and owners equity at a given point in time, i.e. the balance sheet, also referredtoas a statementof financial position. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to financial statement reporting, in particular for reviewing and evaluating the balance sheet: the trainer explains to the group of learners the main features of the statement of financial position (parts of a standard company balance sheet: assets, liabilities, and ownership equity; relationship between the assets, liabilities, and owner's equity of a business: basic accounting equation, or balance sheet equation, and double-entry bookkeeping system and process of recording financial effects of transactions), and shows examples of its application in small and largerbusinesses,particularlyincooperative enterprises; - applying the accounting equation as a tool for detecting an error in the balance sheet: each learner inserts the here below listed accounts in the fitting positions within the following small business balance sheet sample, ensuring that sum of debits and sum of credits are equal in value, and that owners'equityequalsassetsminus liabilities: List of accounts: a) Cash € 5,500 b) Accounts Receivable € 5,100 c) Notes Payable € 4,000 d) Tools and equipment € 22,000 e) Capital Stock € 6,000 f) Accounts Payable € 22,000 g) Retained Earnings € 600 Sample Small Business Balance Sheet Assets (current) Liabilities and Owners' Equity ……… € … Liabilities ……… € … ……… € … Assets (non-current) ……… € … ……… € … Total liabilities € … Owners' equity ……… € … ……… € … Total owners' equity € …

- 5. 5 Sample Small Business Balance Sheet Assets (current) Liabilities and Owners' Equity Total € … Total € … self-assessmentandpeer-evaluation: - drafting the annual balance sheet of an agri-food cooperative: each learner, using the here below annual balance sheet scheme, fills in with indicative debit and credit accounts of the own agri-food cooperative, or of a hypothetical one, ensuring respect of balance sheet equation. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for reviewing and evaluating the balance sheet that the learningexperience hasresulted,receivingacollective feedbackfromthe otherlearners. Annual balance sheet scheme for agri-food cooperatives CURRENT ASSETS Current Assets (Cash oritems expectedto beconverted intocash within 12months:cash, checking, liquidfunds) € … Accounts Receivable (Amounts owedto theco-op frompatrons) € … Inventories (Products on handavailablefor sale:batteries,fertilizer, tires, fuel, etc.) € … OTHER ASSETS Investments in Cooperatives (Investments oneco-ophas in another) € … FIXED ASSETS Land, Buildings & Equipment (Accounts thatincludeland,buildings,vehicles andotherequipment- Less Accumulated Depreciation =Net Fixed Assets) € … Total € … LIABILITIES & MEMBER EQUITIES Current Liabilities (What the co-op has to pay within12 months, i.e.in short-term: payments to suppliers, employees, payments made morefrequently thenon anannualbasis; accounts payable,accrual taxes, accrualexpenses, patronage refunds payable,loans payable, financial claims against theorganization) € … Long-Term Liabilities (Amounts notduein thenext 12months: mortgageloans onbuilding &equipmentarelisted in this section; long-term portion, i.e. what a co-op owes) € … Total € … MEMBERS’ EQUITY ACCOUNTS Common Stock (Commonstock can bepurchased or earned through patronagerefund,i.e. right tovote) € … Allocated Equity Credits (Yearlyadditions ofretainedpatronage refund / co-op members share that is reinvested minus theamount ofdividend paid out) € … Retained Earnings (Money from business donewithnon-members) € … Total € … This outline is based on the annual balance sheet scheme for agri-food cooperatives published on website of North Dakota Farmers Union (http://www.ndfu.org/4866-2/understanding-a-co-op-financial-statement/) Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about balance sheet, ensuring both the required scientific support

- 6. 6 in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involvedlearnersandthe trainer. Documentation: Consolidatedversionof International Financial ReportingStandardsasadoptedbythe EU Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 Exposure DraftConceptual FrameworkforFinancial Reporting,IFRSFoundation,2015 InterpretationandApplicationof International Financial ReportingStandards,BarryJ.Epstein,EvaK. Jermakowicz,2007 Financial &Managerial Accounting,JanWilliams,Sue Haka,MarkS. Bettner,JosephV. Carcello,2008

- 7. 7 Activity 2:Approaching main financial statements within international financial reporting standards applied in EU: income statement Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience for the comprehension, review and evaluation of financial reportsof the cooperative enterprise,focusingonthe income statementorprofitandlossaccount. The purpose is to develop the skills for reviewing and evaluating the financial statement reporting on cooperative’s income, expenses, and profits over a period of time, i.e. income statement or profit and loss account, also referred to as profit and loss statement (P&L), statement of profit or loss, revenue statement, statementof financial performance,earningsstatement,operatingstatement,statementof operations. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to financial statement reporting, in particular for reviewing and evaluating the income statement: the trainer explains to the group of learners the main features of the profit and loss account (parts of a standard company profit and loss statement: income or revenues, i.e. money received from sale of products and services, interests payments, rents, and other forms of earnings received in a given period of time before expenses are taken out, or more precisely increases in economic benefits during accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants; expenses, i.e. outflows of cash or other valuable assets charged against these revenues, including write-offs like depreciation and amortization of various assets, and taxes, or more precisely decreases in economic benefits during accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants; and profits, i.e. the result after all revenues and expenses have been accounted for, coinciding with income distributed to owners, in co-op also named net savings or net margins), and shows examples of its application in small and larger businesses,particularlyincooperative enterprises; - identifying the items of a profit and loss account: : each learner inserts the here below listed accounts in the fitting positions within the following income statement brief example, ensuring the correctnessof calculationsaccordingtoalreadyinserted items: List of accounts (in millions): a) Selling, general and administrative expenses € (4,142.1) b) Revenue € 36,525.9 c) Interest income € 25.3 d) Depreciation € (602.4) e) Profit (or loss) from associates, net of tax € (20.08) f) Interest expense € (718.9) g) Amortization € (209.9) h) Profit (or loss) from non-controlling interest, net of tax € (5.1) i) Income tax expense € (1,678.6) j) Cost of sales € (18,545.8) k) Profit (or loss) from discontinued operations, net of tax € (1,090.3) l) Impairment loss € (17,997.1) m) Profit (or loss) from continuing operations before tax, share of profit (or loss) from associates and non-controlling interest € (5,665.0)

- 8. 8 self-assessmentandpeer-evaluation: - drafting the income statement of an agri-food cooperative: each learner, using the here below statement of operations scheme, fills in with indicative accounts of the own agri-food cooperative, or of a hypothetical one, reporting the business results of the last year and trying to avoid loss in net income. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for reviewing and evaluating the income statement that the learning experience has resulted, receiving a collective feedback fromthe otherlearners. Statement of operations scheme for agri-food cooperatives Agri-food European Cooperative Society INCOME STATEMENT (in millions) Year Ended December 31, 2015 2015 2014 ……… € … € 29,827.6 ……… € … € (15,858.8) Gross profit € 17,980.1 € 13,968.8 Operating Expenses: ……… € … € (3,732.3) ……… € … € (584.5) ……… € … € (141.9) ……… € … - Total operating expenses € 22,951.5 € (4,458.7) Operating profit (or loss) € 4,971.4 € 9,510.1 ……… € … € 11.7 ……… € … € (742.9) ……… € … € 8,778.9 ……… € … € (3,510.5) ……… € … € 0.1 ……… € … € (4.7) Profit (or loss)from continuing operations € 7,369.5 € 5,263.8 ……… € … € (802.4) Profit (or loss)for theyear € 8,459.8 € 4,461.4 2015 2014 Sales (€ amount received for products sold by thecooperative) € … € … Cost ofsales (€ amount thecooperative pays for products it sells: e.g., for paying fertilizer supplier) € … € … Gross margins on sales (differencebetween “sales”and “cost ofsales”) € … € … Other operating income (incomenotfrom selling products but fromproviding a service: e.g.,grain storage, fertilizerservice, grinding,mixing, drying,finance charges) € … € … Total gross margins (Sales +Serviceincome =Totalgross margin) € … € … Operating Expenses (costofgoods and services used ina year of operation): Salaries € … € … Utilities € … € … Taxes € … € … Depreciation € … € …

- 9. 9 This outline is based on the statement of operations scheme for agri-food cooperatives published on website of North Dakota Farmers Union (http://www.ndfu.org/4866-2/understanding-a-co-op-financial-statement/) Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about income statement, ensuring both the required scientific support in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience throughdialogue amongthe involvedlearnersandthe trainer. Documentation: Consolidatedversionof International Financial ReportingStandards asadoptedbythe EU Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 Exposure DraftConceptual FrameworkforFinancial Reporting,IFRSFoundation,2015 InterpretationandApplicationof International Financial ReportingStandards,BarryJ.Epstein,EvaK. Jermakowicz,2007 Financial &Managerial Accounting,JanWilliams,Sue Haka,MarkS. Bettner,JosephV. Carcello,2008 Insurance € … € … Truck operating expense € … € … Reservefor baddebts € … € … Investments € … € … ………. € … € … Total operating expenses € … € … Net incomefrom operations (Gross margins –Total operating expenses =Net incomefrom operations) € … € … Other Income: Patronage refund(funds from one co-op toanother) € … € … Net incomebeforetaxes (Net incomefrom operations +Otherincome =Net incomebeforetaxes) € … € … Income tax € … € … Net incomeafter incometax (Netincome beforeincometaxes –Incometax =Net incomeafterincome tax) € … € …

- 10. 10

- 11. 11 Activity 3:Approaching main financial statements within international financial reporting standards applied in EU : equity statement Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience for the comprehension, review and evaluation of financial reports of the cooperative enterprise, focusing on the equity statement, also known as statement of changesinequityorstatementof retainedearnings. The purpose is to develop the skills for reviewing and evaluating the financial statement reporting on the changesin equity (share capital, accumulated reserves and retained earnings) of the cooperative during the reporting period, i.e. the equity statement, also referred to as statement of changes in equity or statement of retainedearnings. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to financial statement reporting, in particular for reviewing and evaluating the equity statement: the trainer explains to the group of learners the main features of the statement of changesin equity (typical line items of a standard company equity statement: profits or losses from operations, dividends paid, issue or redemption of shares, revaluation reserve and any other items charged or credited to accumulated other comprehensive income, as well as non-controlling interest attribuable to other individuals and organisations; way in which the equity statement explain the owners’ equity shown on the balance sheet, breaking down changes in the owners’ interest in the organization, and in the application of retained profit or surplus from one accounting period to the next), and shows examples of its application in small and larger businesses, particularlyincooperative enterprises; - identifying the sense of the items of an equity statement: each learner reads the here below listed usual items within a company’s statement of changes in equity, trying to identify the correct significance of eachitem withinthe listedrelatingmeanings : ITEMS MEANINGS Share capital / Capital stock Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash

- 12. 12 Share premium / Capital surplus Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash Treasury share / Treasury stock Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash Retained earnings Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash Revaluation of fixed assets Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash

- 13. 13 Other comprehensive income Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash Minority interest Portion of a subsidiary corporation's stock that is not owned by the parent corporation Estimate of market value of a property, based on what a willing, knowledgeable and unpressured buyer would probably pay to a willing, knowledgeable and unpressured seller in the market Difference between net income as in the income statement and comprehensive income (total non-owner change in equity for a reporting period), representing certain gains and losses not recognized in the income statement account Accumulated net income retained by the corporation and transferred, at the end of reporting period, from the income statement to the retained earnings account Stock which is also bought back by the issuing company, reducing the amount of outstanding stock on the open market including insiders' holdings Component of shareholders' equity, representing the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of shares (common stock) Portion of a corporation's equity that has been obtained by the issue of shares in the corporation to a shareholder, usually for cash self-assessmentandpeer-evaluation: - identifying the items of a an equity statement: each learner inserts the here below listed accounts in the fitting positions within the following statement of changes in equity brief example, completing it ensuring the correctness of calculations according to already inserted items. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for reviewing and evaluating the equity statement that the learning experience has resulted, receiving a collective feedback from the other learners. List of accounts (in thousands): a) Purchase of own shares € (250) b) Foreign exchange reserves € 40 c) Profit/(loss) for the year € 400 d) Pensions Reserve € 30 e) Dividends to Shareholders @50% € (200) f) Revaluation Reserve € (10)

- 14. 14 Statement ofChangesin Equity Sample Asof 31 December 2015 (in thousands of €) Share Capital Share Premium Treasury Shares Retained Earnings Accumulated Other Comprehensive Income Total shareholders funds Minority interest Total ………… ………… ………… At 1 January 2014 1,000 100 0 2,500 750 800 56 5,206 600 5,806 Profit/(loss) for the year 300 300 30 330 Other Comprehensive Income 10 35 45 90 9 99 Dividends to Shareholders @50% (150) (150) (15) (165) …………………. …… - (250) At 1 January 2015 1,000 100 (250) 2,650 760 835 101 5,196 624 5,820 …………………. …… 40 440 Other Comprehensive Income 60 6 66 …………………. …… (20) (220) Issue of Shares 150 87 220 (50) 407 - 407 At 31 December 2015 1,150 187 (30) 2,800 800 865 91 5,863 650 6,513 Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about statement of changes in equity, ensuring both the required scientific support in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience throughdialogue amongthe involvedlearnersandthe trainer. Documentation: Consolidatedversionof International Financial ReportingStandardsasadoptedbythe EU Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 Exposure DraftConceptual FrameworkforFinancial Reporting,IFRSFoundation,2015 Interpretation andApplicationof International Financial ReportingStandards,BarryJ.Epstein,EvaK. Jermakowicz,2007

- 15. 15 Financial &Managerial Accounting,JanWilliams,Sue Haka,MarkS. Bettner,JosephV. Carcello,2008

- 16. 16 Activity 4:Approaching main financial statements within international financial reporting standards applied in EU : cashflow statement Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience for the comprehension, review and evaluation of financial reports of the cooperative enterprise, focusing on the cash flow statement, also known as statement of cash flows. The purpose is to develop the skills for reviewing and evaluating the financial statement reporting on cooperative’s operating, investing and financing activities, i.e. the cash flow statement or statement of cash flows. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to financial statement reporting, in particular for reviewing and evaluating the cash flow statement: the trainer explains to the group of learners the main features of the statement of cash flows (usefulness in order to determine the short-term viability of a company, particularly its liquidity and ability to pay bills, showing how changes in balance sheet accounts and income affect cash and cash equivalents, breaking the analysis down to operating, investing and financing activities, capturing both the current operating results and the accompanying changes in the balance sheet concerned with the flow of cash in and out of the business; main cash flow items from operating activities: receipts for the sale of loans or debt or equity instruments in a trading portfolio, interest received on loans, payments to suppliers for goods and services, payments to employees or on behalf of employees, interest payments, buying merchandise, depreciation, deferred tax, amortization, and dividends received; main cash flow items from investing activities: purchase or sale of assets like land, building, equipment, marketable securities, etc., loans made to suppliers or received from customers, and payments related to mergers and acquisition; main cash flow items from financing activities: payments of dividends, payments for repurchase of company shares, net borrowings, repayment of debt principal including capital leases, and for non-profit organizations, receipts of donor-restricted cash that is limited to long-term purposes), and shows examplesof its applicationinsmall andlargerbusinesses,particularlyincooperative enterprises; - identifying the items of a cash flow statement: each learner inserts the here below listed accounts in the fitting positions within the following statement of cash flows brief example, ensuring the correctnessof calculationsaccordingtoalreadyinserteditems: List of accounts: a) Cash paid to suppliers and employees € (2,500) b) Dividends paid € (2,000) c) Interest paid € (1,600) d) Cash receipts from customers € 8,500 e) Income taxes paid € (2,400) f) Dividends received € 2,500 g) Cash and cash equivalents, beginning of year € 500 h) Proceeds from the sale of equipment € 7,000

- 17. 17 Sample cash flow statement Cash flows from (used in) operating activities ………………… € … ………………… € … Cash generated from operations (sum) € 6,000 ………………… € … ………………… € … Net cash flows from operating activities € 2,000 Cash flows from (used in) investing activities ………………… € … ………………… € … Net cash flows from investing activities € 10,000 Cash flows from (used in) financing activities ………………… € … Net cash flows used in financing activities € (2,000) Net increase in cash and cash equivalents € 10,000 ………………… € … Cash and cash equivalents, end of year € 10,500 self-assessmentandpeer-evaluation: - classifying the items of a cash flow statement: each learner reads the here below listed usual items within a statement of cash flows, trying to classify them under operating, investing or financing activities. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for reviewing and evaluating the cash flow statement that the learning experience has resulted, receiving a collective feedback fromthe otherlearners. CASH FLOW ITEMS TYPEOF ACTIVITY Sale (repurchase) ofstock Operating Activities Investing Activities Financing Activities Dividends received Operating Activities Investing Activities Financing Activities Depreciation and amortization Operating Activities Investing Activities Financing Activities Decrease(increase) in accounts receivable Operating Activities Investing Activities Financing Activities Decrease(increase) in inventories Operating Activities Investing Activities Financing Activities Proceeds fromthesale ofequipment Operating Activities Investing Activities Financing Activities Dividends paid Operating Activities Investing Activities Financing Activities Increase(decrease) in liabilities (A/P, taxes payable) Operating Activities Investing Activities Financing Activities Increase(decrease) in debt Operating Activities Investing Activities Financing Activities

- 18. 18 Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentation of programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about cash flow statement, ensuring both the required scientific support in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience throughdialogue amongthe involvedlearnersandthe trainer. Documentation: Consolidatedversionof International Financial ReportingStandardsasadoptedbythe EU Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 Exposure DraftConceptual FrameworkforFinancial Reporting,IFRSFoundation,2015 InterpretationandApplicationof International Financial ReportingStandards,BarryJ.Epstein,EvaK. Jermakowicz,2007 Financial &Managerial Accounting,JanWilliams,Sue Haka,MarkS. Bettner,JosephV. Carcello,2008

- 19. 19 Activity 5:Approaching main financial statements within international financial reporting standards : management discussionandanalysis - MD&A Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience for the comprehension, review and evaluation of financial reportsof the cooperative enterprise,focusingonthe managementdiscussionandanalysisorMD&A. The purpose is to develop the skills for reviewing and evaluating the financial statement providing the narrative explanation by the management of how the cooperative has performed in the past, its financial condition, and its future prospects, i.e. the management discussion and analysis or MD&A, which is an integratedpartof a company'sannual financial statements. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to financial statement reporting, in particular for reviewing and evaluating the management discussion and analysis: the trainer explains to the group of learners the main features (description of the year gone by and some of the key factors that influenced the business of the companyin that year, as well as a fair and unbiased overview of the company's past, present, and future, with description of company's liquidity position, capital resources, results of its operations, underlying causes of material changes in financial statement items, such as asset impairment and restructuring charges, events of unusual or infrequent nature, such as mergers and acquisitions or share buybacks, positive and negative trends, effects of inflation, domestic and international market risks, and significant uncertainties, etc.), and elements (core businesses, objectives and strategy, capability to deliver results - resources, relationships and risk, results and outlook, external and internal key performance measures and indicators) of the MD&A disclosure framework, also showing examples of its application in small and larger businesses, particularly in cooperative enterprises; - identifying MD&A single items within MD&A elements: each learner reads the here below listed usual items within a company’s management discussion and analysis, trying to identify the MD&A elementtowhicheachitemrelates: MD&A ITEMS MD&A ELEMENTS Core businesses Objectivesand strategy Capability to deliver results -resources, relationshipsand risk Terms ofand changes incredit facilities, debtcovenants and debt repayments, including the effects ofany non- compliance oranticipated non-compliancewith terms YES NO YES NO YES NO Significant long-termbusiness objectives, strategy,goals or targets andshorter-term priorities for eachcorebusiness, including eachsignificant segment,andfor thecompany, as appropriate YES NO YES NO YES NO Description ofthe company structure YES NO YES NO YES NO Description ofeach corebusiness inwhich the company operates, including the totalsizeofthebusiness,its growth, and other relevant features YES NO YES NO YES NO Description ofthose aspects ofeach corebusiness thatare distinctive tothecompany, including principal products YES NO YES NO YES NO

- 20. 20 produced and/or services rendered, principal markets served and methods ofdistribution,market share, major competitors andtheir market share, and appropriate business segment information Risks associated withfinancialinstruments and other sources ofliquidity, including any terms thatcouldtrigger an additional funding requirementor early payment to counterparties; and circumstances that couldimpairthe company’s ability toundertaketransactions considered essentialto operations YES NO YES NO YES NO Attitude toandtolerancefor risk YES NO YES NO YES NO Extent to which each corebusiness is managed at the local level or throughcentraloversight YES NO YES NO YES NO Strategy for developing, maintaining or reducing productive capacity YES NO YES NO YES NO Financing strategy, including considerations in determining the optimalcapitalstructure,targeted debt-to-equity ratios and hedging strategies YES NO YES NO YES NO Strategicdirectionandfinancing implications behind acquisitions and dispositions YES NO YES NO YES NO Outsourcing practices, strategic business relationships and related financeimplications YES NO YES NO YES NO Company’s focus regarding researchand new product development YES NO YES NO YES NO Marketing,distribution, pricing andcustomer credit arrangements YES NO YES NO YES NO Description ofeach corebusiness inwhich the company operates, including the totalsizeofthebusiness,its growth, and other relevant features YES NO YES NO YES NO Trends andrisks thathave impacted the financial statements, andtrends andrisks that arereasonably likely to affect the financial statements inthefuture YES NO YES NO YES NO Any legal restrictions ontheability ofsubsidiaries to transferfunds to the company and the impact onthe company tomeet obligations YES NO YES NO YES NO Discussionaboutkey aspects ofthe legal,regulatory and economicenvironment that affecthow the business segment orcompany operates YES NO YES NO YES NO Nature, magnitudeand reliability oftheextendedentity relationships, including strategic, operational, and financing relationships YES NO YES NO YES NO Degree ofmanagement orboard ofdirector involvementin the extended entity relationships YES NO YES NO YES NO Relationships consideredto be“relatedparties”, andextent of economicdependency ofthecompany onsuch relationships YES NO YES NO YES NO Information about the quality andpotentialvariability of profit or loss and cashflow YES NO YES NO YES NO self-assessmentandpeer-evaluation: - distinguishing among external and internal performance areas and measures identified and defined within a MD&A: each learner reads the here below listed examples of performance areas and measures usual within a MD&A, trying to classify them under external or internal performance areas and measures. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for reviewing and evaluating the management discussion and analysis that the learning experience has resulted, receivingacollectivefeedbackfromthe otherlearners. Examplesofperformance areasand measuresidentified and defined within aMD&A External performance areasand measures Internal performance areasand measures Sales pricing YES NO YES NO Raw materialprices YES NO YES NO Overheads YES NO YES NO Working capital YES NO YES NO

- 21. 21 Foreign exchangerates YES NO YES NO Research anddevelopmentandnewproduct development YES NO YES NO Supply chain management YES NO YES NO Market share YES NO YES NO Cost containment and operating efficiency YES NO YES NO Workforce — retentionandturnover YES NO YES NO Customersatisfaction YES NO YES NO Leadershipandgovernance YES NO YES NO Capacity and utilization YES NO YES NO Interest rates YES NO YES NO Innovation YES NO YES NO Technology YES NO YES NO Reputationand brand equity YES NO YES NO Financing YES NO YES NO Safety YES NO YES NO Key performancemetrics on environmental, economicand social issues YES NO YES NO Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about management discussion and analysis – MD&A, ensuring both the required scientific support in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience throughdialogue amongthe involvedlearnersandthe trainer. Documentation: Consolidatedversionof International Financial ReportingStandardsasadoptedbythe EU Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 Exposure DraftConceptual FrameworkforFinancial Reporting,IFRSFoundation,2015 InterpretationandApplicationof International Financial ReportingStandards,BarryJ.Epstein,EvaK. Jermakowicz,2007 Financial &Managerial Accounting,JanWilliams,Sue Haka,MarkS. Bettner,JosephV. Carcello,2008

- 22. 22 Management’sDiscussionandAnalysis - Guidance onpreparationanddisclosure, CharteredProfessional Accountantsof Canada, 2014

- 23. 23 Activity 6: Application to cooperatives in EU of international financial reporting standards : the case of the IAS 32 Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience about the specificities of cooperatives to be considered in the process of definition and application of international accounting standards, focusing on the case of the International AccountingStandard IAS32. The purpose is to develop the skills for understanding and evaluating the relation among international accounting standards and cooperative enterprise specificities - especially in relation to equity classification - and the negative impact on cooperatives - particularly in terms of securing financing- that the application of international accountingstandardsnotconsideringthese specificities mayproduce. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to the case of the International Accounting Standard IAS 32: the trainer introduces the group of learners to the concern of the 2002-2004 amendment process of the accounting standard IAS 32 “Financial instruments: disclosure and presentation,” focusing on its iconicity about relevance in international financial reporting standards of cooperatives business model differences compared to investor-oriented incorporations, especially in relation to equity classification (main characteristics and contents of the process, from 2002 initial terms of the IAS 32 amendment proposal, accordingly to which - paragraph 22B - shares in cooperatives would not be treated as part of the cooperative’s equity but rather as debt, till final terms adopted in 2004 - IFRIC D8 “Members’ shares in cooperative entities” - establishing that members’ shares in cooperatives can be treated as capital under certain conditions, included the contextualisation of this process within the wider revision process of the existing IFRS Conceptual Framework, and the related proposals from cooperative movement for ensuring that international financial reporting standards respect the characteristicsof cooperatives); - identifying the conditions allowing, within current international financial reporting standards, to treat members’ shares in cooperatives as capital: each learners tries to identify the correct IFRS conditions (cfr., IFRIC D8 “Members’ shares in cooperative entities”) allowing that shares in a cooperative are accounted as part of the cooperative’s capital instead of as part of its debts, filling inthe followingscheme: Conditions Included or not inIFRS conditionsfor treating members’ sharesin cooperativesascapital Cooperative’s members’ shares arecoveredby a financial guarantee YES NO Cooperative’s constitution, or law,specifies the levelbelow which capitalcannotfall, and this minimum amountwill be considered as capital YES NO The cooperativehas theunconditional obligation torefuse redemptionofmembers’ shares YES NO The cooperativehas theunconditional rightto refuse redemptionofmembers’ shares YES NO

- 24. 24 self-assessmentandpeer-evaluation: - identifying the main targets of cooperative movement for ensuring that the process of definition and application of international financial reporting standards respect the characteristics of cooperatives enterprises: each learner reads the here below listed targets for ensuring that international financial reporting standards respect the characteristics of cooperatives enterprises, trying to identify those actually recommended by Cooperatives Europe withinits 2013 “Contribution to IASB consultation on Conceptual Framework for Financial Reporting”. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge - for understanding and evaluating the relation among international accounting standards and cooperative enterprise specificities and the negative impact on cooperatives that the application of international accounting standards not considering these specificities may produce - that the learning experience has resulted, receiving a collective feedback fromthe otherlearners. Targets for ensuring that international financial reporting standardsrespect the characteristicsofcooperativesenterprises Actually recommended by European cooperative movement To establish relevant accounting characteristics matters ofcooperative entities ona firm basis within the revisedConceptual Framework YES NO To considera revisionofthe equitydefinition inIAS 32 YES NO To grandfather reliable practises ofequity classification for cooperatives following current requirements in IFRIC 2 YES NO Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about specificities of cooperatives to be considered in the process of definition and application of international accounting standards, ensuring both the required scientific support in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience throughdialogue amongthe involvedlearnersand the trainer. Documentation: CooperativesandInternationalAccountingStandards:The case of IAS32, Jean-Claude Detilleux and Caroline Naett,Recma- Revue Internationalede l’Economie Sociale,no.295,February2005

- 25. 25 Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 ContributiontoIASBconsultationonConceptual FrameworkforFinancialReporting,CooperativesEurope,2013 Exposure DraftConceptual FrameworkforFinancial Reporting,IFRSFoundation,2015 Consolidatedversionof International Financial Reporting Standardsasadoptedbythe EU

- 26. 26 Activity 7: Approaching international financial reporting standards specific for agriculture applied in EU : the IAS 41 Agriculture Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements within international financial reporting standards applied in the European Union, supporting them in a collective formal and non-formal learning experience about those specific for agriculture, focusing on the International AccountingStandardIAS 41 Agriculture. The purpose is to develop the skills for reviewing and evaluating the accounting treatment and disclosures relatedtoagricultural activityof the cooperative enterprise. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to the International Accounting Standard IAS 41 Agriculture: the trainer introduces the group of learners to the main features of the international financial reporting standard IAS 41 Agriculture prescribing the accounting treatment and disclosures related to agricultural activity (definition of agricultural activity and produce; accounting treatment for biological assets during the period of growth, degeneration, production, and procreation, and for the initial measurement - at fair value less costs to sell - of agricultural produce at the point of harvest; etc.), also showing examples of its application in small and larger businesses in agriculture sector, particularly in cooperative enterprises; - applying IAS 41 Agriculture to accounting treatment and disclosures related to agricultural activity: each learners tries to identify the correct answers to questions relating to the application field and modalitiesof IAS41 Agriculture,fillinginthe followingscheme: IAS 41 Agriculture application field and modalities Questions Possible answers The IAS 41 Agriculture deals with the whole processing ofagriculturalproduce,included after harvest (for example, theprocessing of grapes into wineby a vintner whohas grown the grapes). Yes, it deals with processing ofagriculturalproduce both before andafter harvest No, it deals only withprocessing ofagriculturalproducebefore harvest When measuring biological assets at fair value costs to sell, these latter include commissions to brokers anddealers, levies by regulatory agencies andcommodity exchanges,transfer taxes and duties,transportandothercosts necessary toget assets toa market. Yes, according to IAS 41Agriculture all thesekindofcosts areto beconsidered No, according toIAS 41 Agriculture transportandothercosts necessary to get assets to a market areexcluded,and deducted in determining fair value The IAS 41 Agriculture establishes new principles for land related toagricultural activity. Yes No The IAS 41 Agriculture requires thatan unconditional governmentgrant relatedto a biologicalasset measured at its fair valueless costs to sellto berecognisedin profitor loss. Yes, in any case Yes, when, andonly when, thegovernment grantbecomes receivable No This outline is based on the contents of the “Technical Summary” of the IAS 41 “Agriculture” issued in 2014 by IFRS Foundation (http://www.ifrs.org/IFRSs/Documents/Technical-summaries-2014/IAS%2041.pdf)

- 27. 27 self-assessmentandpeer-evaluation: - evaluating accounting treatment and disclosures related to government grant in agricultural activity: each learners tries to identify the correct answers to questions relating to unconditional and conditional government grants according to IAS 41 Agriculture, filling in the following scheme. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for reviewing and evaluating the management discussion and analysis that the learning experience has resulted, receiving a collective feedbackfromthe otherlearners. IAS 41 Agriculture application about unconditional and conditional government grants Questions Possible answers The IAS 41 Agriculture requires thatan unconditional governmentgrant relatedto a biologicalasset measured at its fair valueless costs to sellto be recognisedin profitor loss. Yes, in any case Yes, when, andonly when, thegovernment grantbecomes receivable No The IAS 41 Agriculture establishes that a conditional governmentgrant should be recognisedin profitor loss. Yes, in any case Yes, excepted incase the conditional governmentgrant requires notto engage in specified agriculturalactivity Yes, when, andonly when, theconditions attaching to governmentgrant aremet No This outline is based on the contents of the “Technical Summary” of the IAS 41 “Agriculture” issued in 2014 by IFRS Foundation (http://www.ifrs.org/IFRSs/Documents/Technical-summaries-2014/IAS%2041.pdf) Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specifictargetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks, pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about accounting treatment and disclosures related to agricultural activity accordingly to International Accounting Standard IAS 41 Agriculture, ensuring both the required scientific support in financial statement reporting, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience throughdialogue amongthe involvedlearnersandthe trainer. Documentation:

- 28. 28 Conceptual FrameworkforFinancial Reporting2010, IFRS Foundation,2010 Technical Summary - IAS41 Agriculture,IFRSFoundation,2014 Consolidatedversionof International Financial ReportingStandardsasadoptedbythe EU

- 29. 29 Activity 8: Approaching financial statement analysis Duration: 90 min. Short description: In this activity, the trainer introduces the learners to financial statements analysis, supporting them in a collective formal and non-formal learning experience for the comprehension, review and evaluation of financial reports of the cooperative enterprise, focusing on the whole process of reviewingandanalyzingacompany'sfinancial statementstomake bettereconomicdecisions. The purpose is to develop the skills for applying specific techniques and tools aimed to evaluate risks, performance, financial health, and future prospects of the cooperative enterprise, by reviewing and analyzingthe company'sfinancial statements. Specifictasksandexercisesof the learnersonfieldrelatedtopics,within: learningactivities: - introduction to financial statement analysis: the trainer explains to the group of learners the main features of the financial statement analysis process (common methodological approaches, e.g. horizontal and vertical analysis, fundamental analysis, DuPont analisys, etc., and financial ratios analysis: profitability ratios for measuring the firm's use of its assets and control of its expenses to generate an acceptable rate of return, e.g. Gross Profit Rate, Return On Sales, Net Profit Margin, Return On Equity, Return On Assets, Return on Net Assets, Return On Capital, Cash Flow Return On Investments, etc.; liquidity ratios for measuring the availability of cash to pay debt, e.g. Working Capital Ratio, Quick Ratio, Cash Ratio, Operating Cash Flow, etc.; activity or efficiency ratios for measuring how quickly a firm converts non-cash assets to cash assets, e.g. Average Collection Period, Degree of Operating Leverage, Days Sales Outstanding Ratio, Average Payment Period, Asset Turnover, Stock Turnover Ratio, Receivables Turnover Ratio, Inventory Conversion Ratio, Receivables Conversion Period, Payables Conversion Period, Cash Conversion Cycle, etc.; leverage of debt ratios for measuring the firm's ability to repay long-term debt, e.g. Debt Ratio, Debt to Equity Ratio, Long-Term Debt to Equity, Interest Coverage Ratio, Debt Service Coverage Ratio, etc.; and market ratios for measuring investor response to owning a company's stock and also the cost of issuing stock, e.g. Earning Per Share, Payout Ratio and its inverse Dividend Cover, Price/Earnings Ratio, Dividend Yield, Price/Cash Flow ratio, Price to Book Value Ratio, Prices/Sales Ratio, Price/Earnings to Growth Ratio, etc.), and shows examples of its application in small and larger businesses,particularlyincooperative enterprises; - identifying financial ratios: each learner tries to identify the financial ratios corresponding to the formulas listed here below, also classifying each of them within the appropriate category, filling in the followingscheme: Financial ratio formulas Financial ratios Financial ratio categories Net Income ---------------- Total Assets Asset turnover Return on assets Interestcoverageratio Earnings pershare Working capitalratio Return on net assets Profitability ratios Liquidity ratios Activity ratios Leverage ratios Market ratios

- 30. 30 Net Sales ---------------- Total Assets Asset turnover Return on assets Interestcoverageratio Earnings pershare Working capitalratio Return on net assets Profitability ratios Liquidity ratios Activity ratios Leverage ratios Market ratios Net Income ---------------- Annual Interest Expense Asset turnover Return on assets Interestcoverageratio Earnings pershare Working capitalratio Return on net assets Profitability ratios Liquidity ratios Activity ratios Leverage ratios Market ratios Net Income ---------------- Fixed Assets +Working Capital Asset turnover Return on assets Interestcoverageratio Earnings pershare Working capitalratio Return on net assets Profitability ratios Liquidity ratios Activity ratios Leverage ratios Market ratios Net Earnings ---------------- Number ofShares Asset turnover Return on assets Interestcoverageratio Earnings pershare Working capitalratio Return on net assets Profitability ratios Liquidity ratios Activity ratios Leverage ratios Market ratios Current Assets ---------------- Current Liabilities Asset turnover Return on assets Interestcoverageratio Earnings pershare Working capitalratio Return on net assets Profitability ratios Liquidity ratios Activity ratios Leverage ratios Market ratios self-assessmentandpeer-evaluation: - identifying financial statement analysis approaches: each learner, tries to identify the financial statement analysis approaches corresponding to the definitions listed here below, filling in the following scheme. Then the learner presents to the other learners the results of the activity, also trying to give a personal evaluation on the maturation of skills and knowledge for financial statements analysis that the learning experience has resulted, receiving a collective feedback from the otherlearners. Definitions Possible answers Financialstatementanalysis approach basedon percentageanalysis offinancialstatements, referring each itemlistedin the financial statement as thepercentageofanother lineitem Horizontalanalysis Verticalanalysis Fundamentalanalysis Financialstatementanalysis approach basedon historicaland presentdata with thegoalof making financial forecasts Horizontalanalysis Verticalanalysis Fundamentalanalysis Financialstatementanalysis approach basedon comparing financialstatements data over time, looking for variations such as higher or lower earnings Horizontalanalysis Verticalanalysis Fundamentalanalysis

- 31. 31 Learningactivities,inparticularthose havingpractical character, will be supportedbythe utilization inthe classroom,forabout30 minutes,of specific targetedtrainingmaterial(cfr.PowerPointfilerelatingto Training Unit 4 - Financialreporting, alsopreparedwithinthe ToTCoop+i project). Material: collective didactic equipments (flip board / white-board and markers, PC with overhead projector, printer and broadband internet access), and individual didactic resources (personal folders containingnotebooks,pens,pencils,eraser,sharpeners,anddocumentationof programme material). Methodological recommendation for implementation and evaluation: The trainer should support the learners in the collective formal and non-formal learning experience about financial reports of the cooperative enterprise and particularly about the whole process of reviewing and analyzing a company's financial statements to make better economic decisions, ensuring both the required scientific support in financial statement analysis, and the non-formal learning facilitation (e.g., effective communication with them, learner orientated and empathic approaches, consideration of to the individual experiences of the learners, etc.). For evaluation of learning outcomes, self-assessment and collective peer evaluation are suggested: each participant, in the presence of all participants serving as true partners in learning, tries to give a personal evaluation on the learning outcomes that the experience has resulted, and on what was good and what could be improved, then the learner receives feedback of the other participants about the same issues, facilitating the participant's reflection on the learning experience through dialogue among the involvedlearnersandthe trainer. Documentation: Finance,AngelicoA. Groppelli, EhsanNikbakht,2000 Financial &Managerial Accounting,JanWilliams,Sue Haka,MarkS. Bettner,JosephV.Carcello,2008